Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Situation: (a) On January 15, a cattle feeder puts 500 feeder cattle on feed at an average weight o 650lbs. The feeder plans to feed

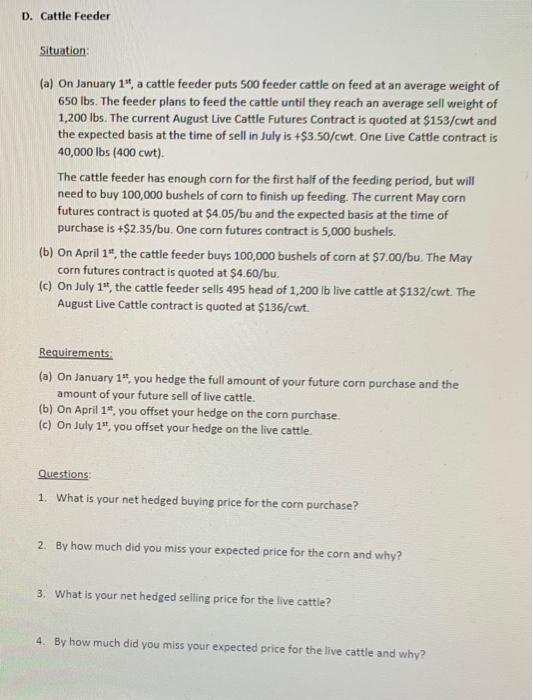

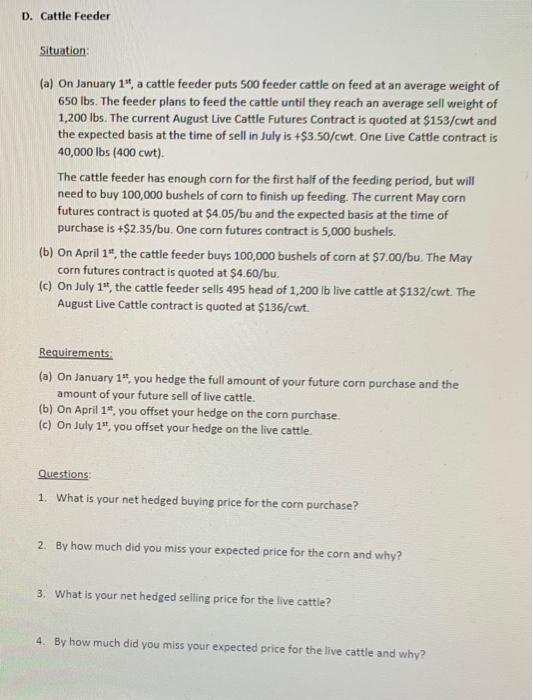

Situation: (a) On January 15, a cattle feeder puts 500 feeder cattle on feed at an average weight o 650lbs. The feeder plans to feed the cattle until they reach an average sell weight of 1,200lbs. The current August Live Cattle Futures Contract is quoted at $153/ cwt and the expected basis at the time of sell in July is +$3.50/cwt. One live Cattle contract is 40,000lbs ( 400cwt). The cattle feeder has enough corn for the first half of the feeding period, but will need to buy 100,000 bushels of corn to finish up feeding. The current May corn futures contract is quoted at $4.05/bu and the expected basis at the time of purchase is +$2.35/bu. One corn futures contract is 5,000 bushels. (b) On April 1", the cattle feeder buys 100,000 bushels of corn at $7.00/bu. The May corn futures contract is quoted at $4.60/ bu. (c) On July 1tt, the cattle feeder sells 495 head of 1,200lb live cattle at $132/cw. The August Live Cattle contract is quoted at $136/cwt. Requirements: (a) On January 1:t, you hedge the full amount of your future corn purchase and the amount of your future sell of live cattle. (b) On April 1", you offset your hedge on the corn purchase. (c) On July 1nt, you offset your hedge on the live cattle. Questions: 1. What is your net hedged buying price for the corn purchase? 2. By how much did you miss your expected price for the corn and why? 3. What is your net hedsed selling price for the live cattle? 4. By how much did you miss your expected price for the live cattle and why? Situation: (a) On January 15, a cattle feeder puts 500 feeder cattle on feed at an average weight o 650lbs. The feeder plans to feed the cattle until they reach an average sell weight of 1,200lbs. The current August Live Cattle Futures Contract is quoted at $153/ cwt and the expected basis at the time of sell in July is +$3.50/cwt. One live Cattle contract is 40,000lbs ( 400cwt). The cattle feeder has enough corn for the first half of the feeding period, but will need to buy 100,000 bushels of corn to finish up feeding. The current May corn futures contract is quoted at $4.05/bu and the expected basis at the time of purchase is +$2.35/bu. One corn futures contract is 5,000 bushels. (b) On April 1", the cattle feeder buys 100,000 bushels of corn at $7.00/bu. The May corn futures contract is quoted at $4.60/ bu. (c) On July 1tt, the cattle feeder sells 495 head of 1,200lb live cattle at $132/cw. The August Live Cattle contract is quoted at $136/cwt. Requirements: (a) On January 1:t, you hedge the full amount of your future corn purchase and the amount of your future sell of live cattle. (b) On April 1", you offset your hedge on the corn purchase. (c) On July 1nt, you offset your hedge on the live cattle. Questions: 1. What is your net hedged buying price for the corn purchase? 2. By how much did you miss your expected price for the corn and why? 3. What is your net hedsed selling price for the live cattle? 4. By how much did you miss your expected price for the live cattle and why

Situation: (a) On January 15, a cattle feeder puts 500 feeder cattle on feed at an average weight o 650lbs. The feeder plans to feed the cattle until they reach an average sell weight of 1,200lbs. The current August Live Cattle Futures Contract is quoted at $153/ cwt and the expected basis at the time of sell in July is +$3.50/cwt. One live Cattle contract is 40,000lbs ( 400cwt). The cattle feeder has enough corn for the first half of the feeding period, but will need to buy 100,000 bushels of corn to finish up feeding. The current May corn futures contract is quoted at $4.05/bu and the expected basis at the time of purchase is +$2.35/bu. One corn futures contract is 5,000 bushels. (b) On April 1", the cattle feeder buys 100,000 bushels of corn at $7.00/bu. The May corn futures contract is quoted at $4.60/ bu. (c) On July 1tt, the cattle feeder sells 495 head of 1,200lb live cattle at $132/cw. The August Live Cattle contract is quoted at $136/cwt. Requirements: (a) On January 1:t, you hedge the full amount of your future corn purchase and the amount of your future sell of live cattle. (b) On April 1", you offset your hedge on the corn purchase. (c) On July 1nt, you offset your hedge on the live cattle. Questions: 1. What is your net hedged buying price for the corn purchase? 2. By how much did you miss your expected price for the corn and why? 3. What is your net hedsed selling price for the live cattle? 4. By how much did you miss your expected price for the live cattle and why? Situation: (a) On January 15, a cattle feeder puts 500 feeder cattle on feed at an average weight o 650lbs. The feeder plans to feed the cattle until they reach an average sell weight of 1,200lbs. The current August Live Cattle Futures Contract is quoted at $153/ cwt and the expected basis at the time of sell in July is +$3.50/cwt. One live Cattle contract is 40,000lbs ( 400cwt). The cattle feeder has enough corn for the first half of the feeding period, but will need to buy 100,000 bushels of corn to finish up feeding. The current May corn futures contract is quoted at $4.05/bu and the expected basis at the time of purchase is +$2.35/bu. One corn futures contract is 5,000 bushels. (b) On April 1", the cattle feeder buys 100,000 bushels of corn at $7.00/bu. The May corn futures contract is quoted at $4.60/ bu. (c) On July 1tt, the cattle feeder sells 495 head of 1,200lb live cattle at $132/cw. The August Live Cattle contract is quoted at $136/cwt. Requirements: (a) On January 1:t, you hedge the full amount of your future corn purchase and the amount of your future sell of live cattle. (b) On April 1", you offset your hedge on the corn purchase. (c) On July 1nt, you offset your hedge on the live cattle. Questions: 1. What is your net hedged buying price for the corn purchase? 2. By how much did you miss your expected price for the corn and why? 3. What is your net hedsed selling price for the live cattle? 4. By how much did you miss your expected price for the live cattle and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started