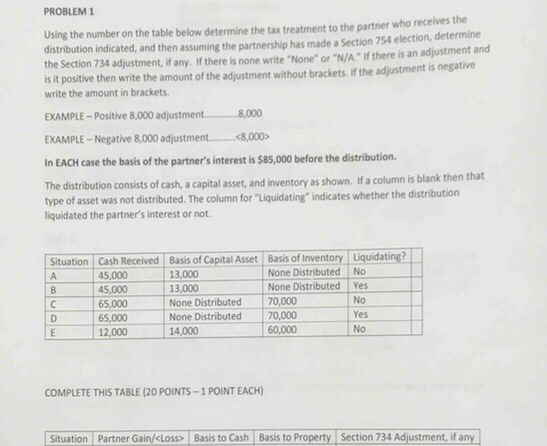

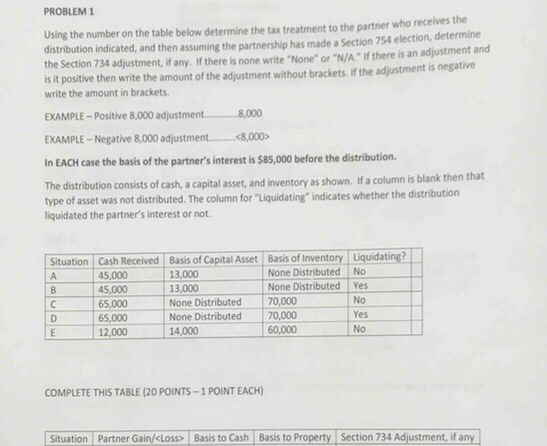

Situation A-E

PROBLEM 1 Using the number on the table below determine the tax treatment to the partner who receives the distribution indicated, and then assuming the partnership has made a Section 754 election, determine the Section 734 adjustment, if any. If there is none write "None" or "N/A. if there is an adjustment and is it positive then write the amount of the adjustment without brackets. if the adjustment is negative write the amount in brackets EXAMPLE-Positive 8,000 adjustment.8,000 EXAMPLE-Negative 8,000 adjustment.8,000> In EACH case the basis of the partner's interest is $85,000 before the distribution. The distribution consists of cash, a capital asset, and inventory as shown. If a column is blank th type of asset was not distributed. The column for "Liquidating" indicates whether the distribution liquidated the partner's interest or not. en that Situation Cash Received Basis of Capital Asset Basis of Inventory Liquidating? 45,000 45,000 65,000 None Distributed 70,000 65,000 12,000 None Distributed No 13,000 13,000 None DistributedYes No Yes No None Distributed 70,000 14,000 60,000 COMPLETE THIS TABLE (20 POINTS-1 POINT EACH) Situation Partner Gain/kLoss Basis to Cash Basis to Property Section 734 Adjustment, if any PROBLEM 1 Using the number on the table below determine the tax treatment to the partner who receives the distribution indicated, and then assuming the partnership has made a Section 754 election, determine the Section 734 adjustment, if any. If there is none write "None" or "N/A. if there is an adjustment and is it positive then write the amount of the adjustment without brackets. if the adjustment is negative write the amount in brackets EXAMPLE-Positive 8,000 adjustment.8,000 EXAMPLE-Negative 8,000 adjustment.8,000> In EACH case the basis of the partner's interest is $85,000 before the distribution. The distribution consists of cash, a capital asset, and inventory as shown. If a column is blank th type of asset was not distributed. The column for "Liquidating" indicates whether the distribution liquidated the partner's interest or not. en that Situation Cash Received Basis of Capital Asset Basis of Inventory Liquidating? 45,000 45,000 65,000 None Distributed 70,000 65,000 12,000 None Distributed No 13,000 13,000 None DistributedYes No Yes No None Distributed 70,000 14,000 60,000 COMPLETE THIS TABLE (20 POINTS-1 POINT EACH) Situation Partner Gain/kLoss Basis to Cash Basis to Property Section 734 Adjustment, if any