Question

Situation: You are the audit senior engaged on the audit of Lovely Lawns Ltd. for the year ended June 30, 20X2, and will be responsible

Situation:

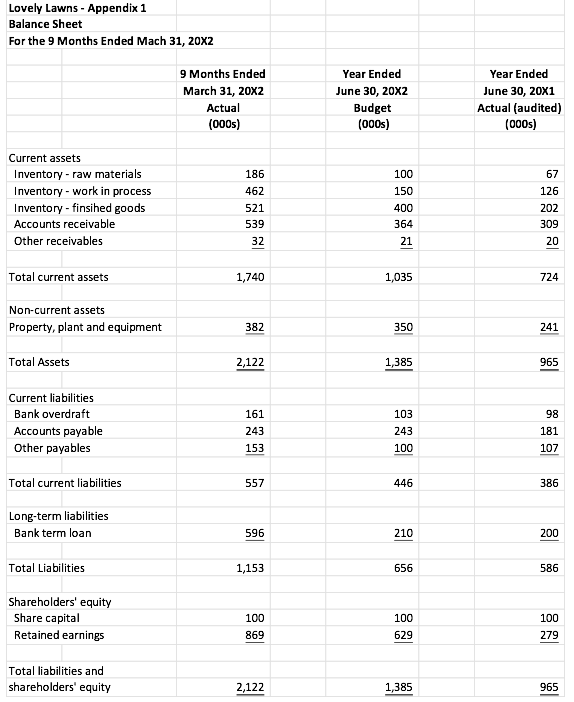

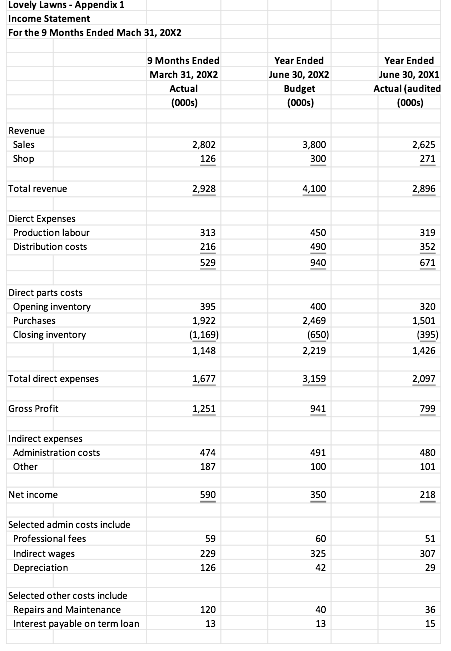

You are the audit senior engaged on the audit of Lovely Lawns Ltd. for the year ended June 30, 20X2, and will be responsible for the initial planning work. You have been provided with the most recent management financial statements for the nine months to March 31, 20X2, included in appendix 1.

Lovely Lawns specializes in the manufacturing of lawnmowers, trimmers, and other gardening accessories. The head office and factory are based in Langley, BC. All sales orders are generated by the sales team consisting of four sales representatives and a sales manager. All orders and invoices are processed by the administrative team at head office.

The main customers of Lovely Lawns are "do-it-yourself" (DIY) stores and local garden centres. It also makes cash sales over the counter from the small shop attached to the factory. Revenue from the shop accounts for approximately 10% of total sales. As the business is seasonal, 50% of annual sales are normally generated in the final quarter of the financial year.

In December 20X1, Lovely Lawns launched a new type of lawnmower, the 3X. The 3X aerates and feeds the lawn as the grass is being cut. It is designed mainly for larger lawns, as it saves time by doing three activities at once. The DIY stores showed enormous interest in this product in the initial stages, with predicted third quarter sales of $10,000. Initial sales, however, have been disappointingly low since its release, achieving only 25% of initial expectations. The directors are confident that sales will escalate once the gardening season gets underway in mid-April. The margins are currently very low on the 3X machine due to a low introductory price of $95 (the full price is $115); however, the introductory price has been advertised as a sale price ending on April 30, 20X2.

Lovely Lawns suppliers are generally reliable, and they have used the same approved suppliers successfully in the previous six years. Suppliers usually increase their prices at the beginning of August, and this year the increase was 3%. Lovely Lawns passed this increase directly to the customers through sales price increases. Neither the inflationary price increase nor the release of the new 3X product have affected sales of other products.

The sales director retired at the end of December and the board has decided that the primary responsibilities of the sales director should be passed onto the sales manager, Naeem. In addition to managing the small sales team, she will now be responsible for preparing and presenting the monthly sales report to the board of directors for their review. Naeem will attend these board meetings to explain fluctuations and plans for the following month. On a quarterly basis, Naeem will present the forward plan to the board for approval. Naeem is also responsible for controlling the operation of the monthly inventory counts. Due to work pressures and the implementation of the new computerized inventory system, inventory counts have not been conducted since November 20X1. A year-end inventory count is planned for June 30, 20X2.

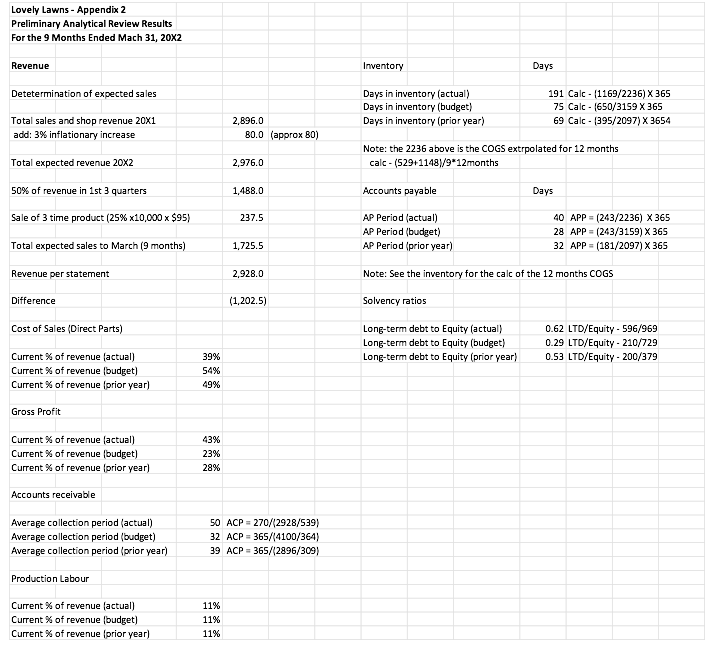

One of the audit team members has also started the analytical review, the results of which are included in appendix 2.

Required:

Evaluate the inherent risks (OFSL and account/assertion level) for Lovely Lawns arising from the above discussion and the analytical review results. Remember to identify the risk, explain why it is an audit risk, and for account level risk, indicate the assertion(s) at risk. Provide a preliminary assessment for the overall risk level for the engagement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started