Question

Six months have passed since the gathering of information in Exhibit 1. As a result of negative returns on the Pension Plans investment portfolio, the

Six months have passed since the gathering of information in Exhibit 1. As a result of negative returns on the Pension Plans investment portfolio, the Pension Plan is now underfunded by R20 million. The pension plan's investment committee, seeking to raise expected returns, increases the investment portfolios equity allocation to 77%. Immediately after this decision is implemented, Rusere Investments equity price volatility and beta increase. Assume Rusere Investments operational assets and its debt/equity ratio (market value) remained constant during the six-month period.

B) Discuss why Rusere Investments equity beta increases in response to the Pension Plans change in the asset allocation?

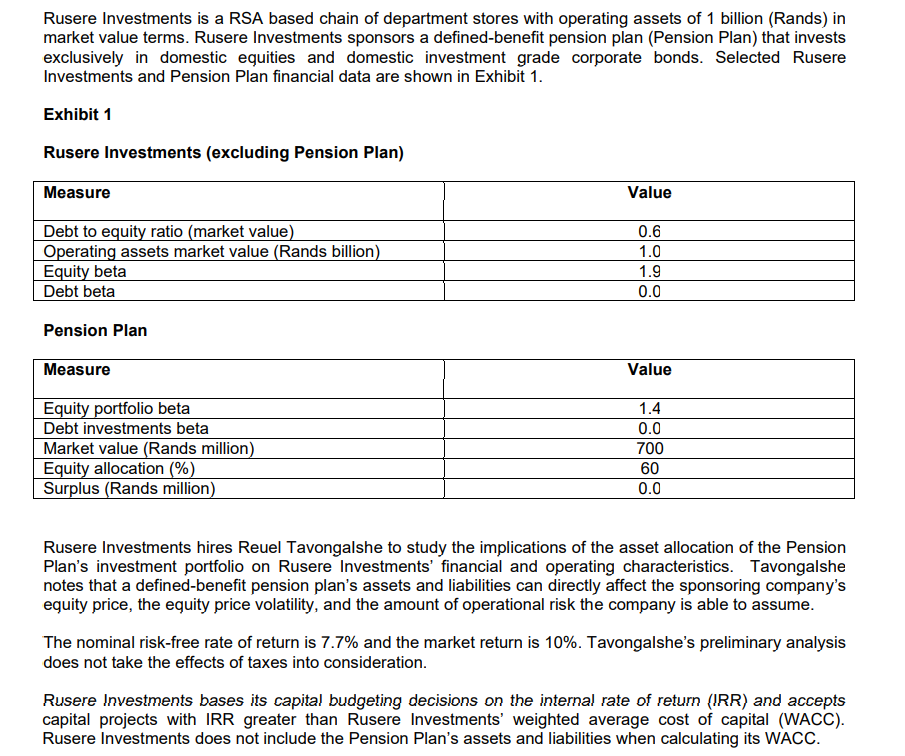

Rusere Investments is a RSA based chain of department stores with operating assets of 1 billion (Rands) in market value terms. Rusere Investments sponsors a defined-benefit pension plan (Pension Plan) that invests exclusively in domestic equities and domestic investment grade corporate bonds. Selected Rusere Investments and Pension Plan financial data are shown in Exhibit 1. Exhibit 1 Rusere Investments (excluding Pension Plan) Measure Value Debt to equity ratio (market value) Operating assets market value (Rands billion) Equity beta Debt beta 0.6 1.0 1.9 0.0 Pension Plan Measure Value Equity portfolio beta Debt investments beta Market value (Rands million) Equity allocation (%) Surplus (Rands million) 1.4 0.0 700 60 0.0 Rusere Investments hires Reuel Tavongalshe to study the implications of the asset allocation of the Pension Plan's investment portfolio on Rusere Investments' financial and operating characteristics. Tavongalshe notes that a defined-benefit pension plan's assets and liabilities can directly affect the sponsoring company's equity price, the equity price volatility, and the amount of operational risk the company is able to assume. The nominal risk-free rate of return is 7.7% and the market return is 10%. Tavongalshe's preliminary analysis does not take the effects of taxes into consideration. Rusere Investments bases its capital budgeting decisions on the internal rate of return (IRR) and accepts capital projects with IRR greater than Rusere Investments' weighted average cost of capital (WACC). Rusere Investments does not include the Pension Plan's assets and liabilities when calculating its WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started