Answered step by step

Verified Expert Solution

Question

1 Approved Answer

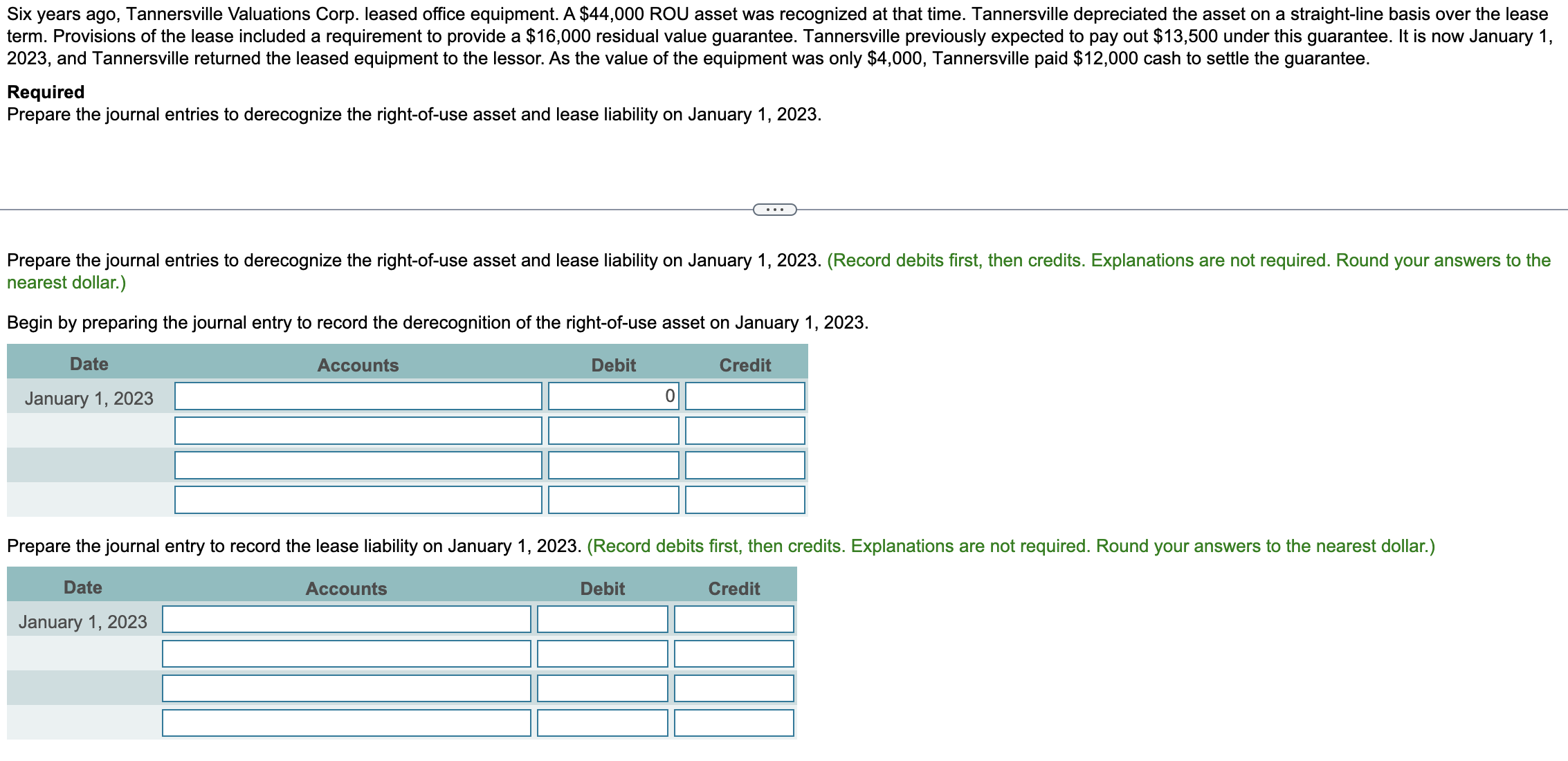

Six years ago, Tannersville Valuations Corp. leased office equipment. A $ 4 4 , 0 0 0 ROU asset was recognized at that time. Tannersville

Six years ago, Tannersville Valuations Corp. leased office equipment. A $ ROU asset was recognized at that time. Tannersville depreciated the asset on a straightline basis over the lease

term. Provisions of the lease included a requirement to provide a $ residual value guarantee. Tannersville previously expected to pay out $ under this guarantee. It is now January

and Tannersville returned the leased equipment to the lessor. As the value of the equipment was only $ Tannersville paid $ cash to settle the guarantee.

Required

Prepare the journal entries to derecognize the rightofuse asset and lease liability on January

Prepare the journal entries to derecognize the rightofuse asset and lease liability on January Record debits first, then credits. Explanations are not required. Round your answers to the

nearest dollar.

Begin by preparing the journal entry to record the derecognition of the rightofuse asset on January

Prepare the journal entry to record the lease liability on January Record debits first, then credits. Explanations are not required. Round your answers to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started