Answered step by step

Verified Expert Solution

Question

1 Approved Answer

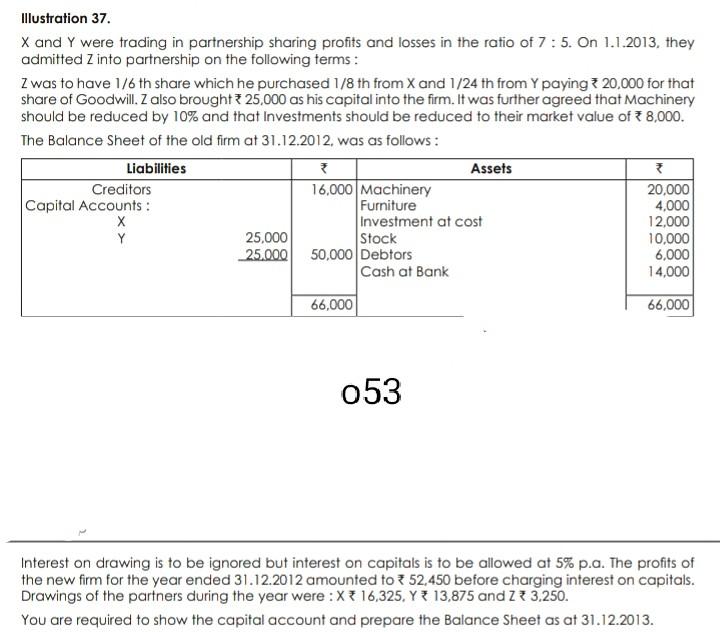

sjj Illustration 37. X and Y were trading in partnership sharing profits and losses in the ratio of 7:5. On 1.1.2013, they admitted Z into

sjj

Illustration 37. X and Y were trading in partnership sharing profits and losses in the ratio of 7:5. On 1.1.2013, they admitted Z into partnership on the following terms: Z was to have 1/6th share which he purchased 1/8 th from X and 1/24 th from Y paying #20,000 for that share of Goodwill. Z also brought 325,000 as his capital into the firm. It was further agreed that Machinery should be reduced by 10% and that investments should be reduced to their market value of 8,000. The Balance sheet of the old firm at 31.12.2012. was as follows: Liabilities Assets Creditors 16,000 Machinery 20,000 Capital Accounts: Furniture 4,000 Investment at cost 12,000 Y 25,000 Stock 10,000 25.000 50,000 Debtors 6,000 Cash at Bank 14,000 66,000 66,000 053 Interest on drawing is to be ignored but interest on capitals is to be allowed at 5% p.a. The profits of the new firm for the year ended 31.12.2012 amounted to 52,450 before charging interest on capitals. Drawings of the partners during the year were :X + 16,325, Y 13,875 and 273,250. You are required to show the capital account and prepare the Balance Sheet as at 31.12.2013Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started