Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SJM Group contacts one of their largest customers, Soren Corp, because they have not yet made payment on their account (Soren Corp had previously

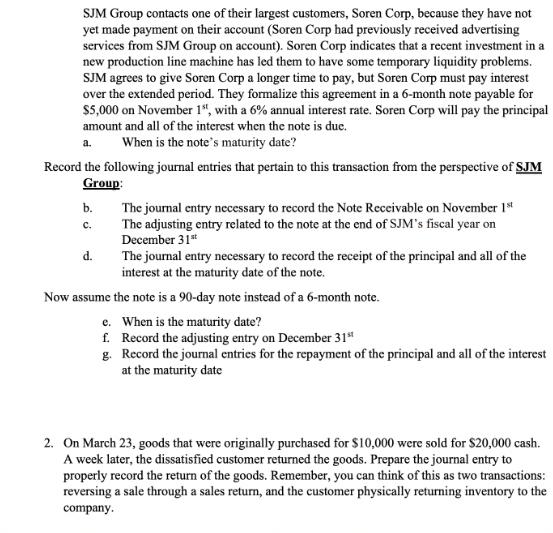

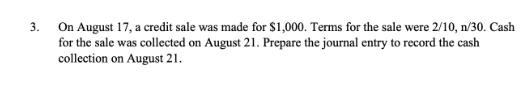

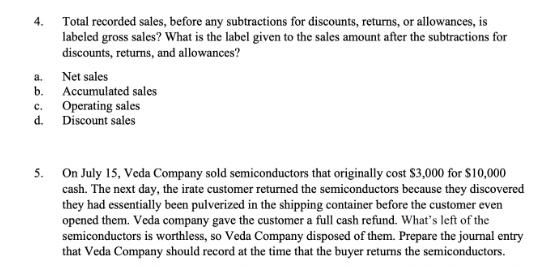

SJM Group contacts one of their largest customers, Soren Corp, because they have not yet made payment on their account (Soren Corp had previously received advertising services from SJM Group on account). Soren Corp indicates that a recent investment in a new production line machine has led them to have some temporary liquidity problems. SJM agrees to give Soren Corp a longer time to pay, but Soren Corp must pay interest over the extended period. They formalize this agreement in a 6-month note payable for $5,000 on November 1", with a 6% annual interest rate. Soren Corp will pay the principal amount and all of the interest when the note is due. When is the note's maturity date? a. Record the following journal entries that pertain to this transaction from the perspective of SJM Group: b. C. d. The journal entry necessary to record the Note Receivable on November 1st The adjusting entry related to the note at the end of SJM's fiscal year on December 31st The journal entry necessary to record the receipt of the principal and all of the interest at the maturity date of the note. Now assume the note is a 90-day note instead of a 6-month note. e. When is the maturity date? f. Record the adjusting entry on December 31st g. Record the journal entries for the repayment of the principal and all of the interest at the maturity date 2. On March 23, goods that were originally purchased for $10,000 were sold for $20,000 cash. A week later, the dissatisfied customer returned the goods. Prepare the journal entry to properly record the return of the goods. Remember, you can think of this as two transactions: reversing a sale through a sales return, and the customer physically returning inventory to the company. 3. On August 17, a credit sale was made for $1,000. Terms for the sale were 2/10, n/30. Cash for the sale was collected on August 21. Prepare the journal entry to record the cash collection on August 21. 4. Total recorded sales, before any subtractions for discounts, returns, or allowances, is labeled gross sales? What is the label given to the sales amount after the subtractions for discounts, returns, and allowances? a. Net sales b. Accumulated sales C. d. Operating sales Discount sales 5. On July 15, Veda Company sold semiconductors that originally cost $3,000 for $10,000 cash. The next day, the irate customer returned the semiconductors because they discovered they had essentially been pulverized in the shipping container before the customer even opened them. Veda company gave the customer a full cash refund. What's left of the semiconductors is worthless, so Veda Company disposed of them. Prepare the journal entry that Veda Company should record at the time that the buyer returns the semiconductors.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The maturity date of the note is May 1 b Journal entry on November 1 to record the Note Rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started