Answered step by step

Verified Expert Solution

Question

1 Approved Answer

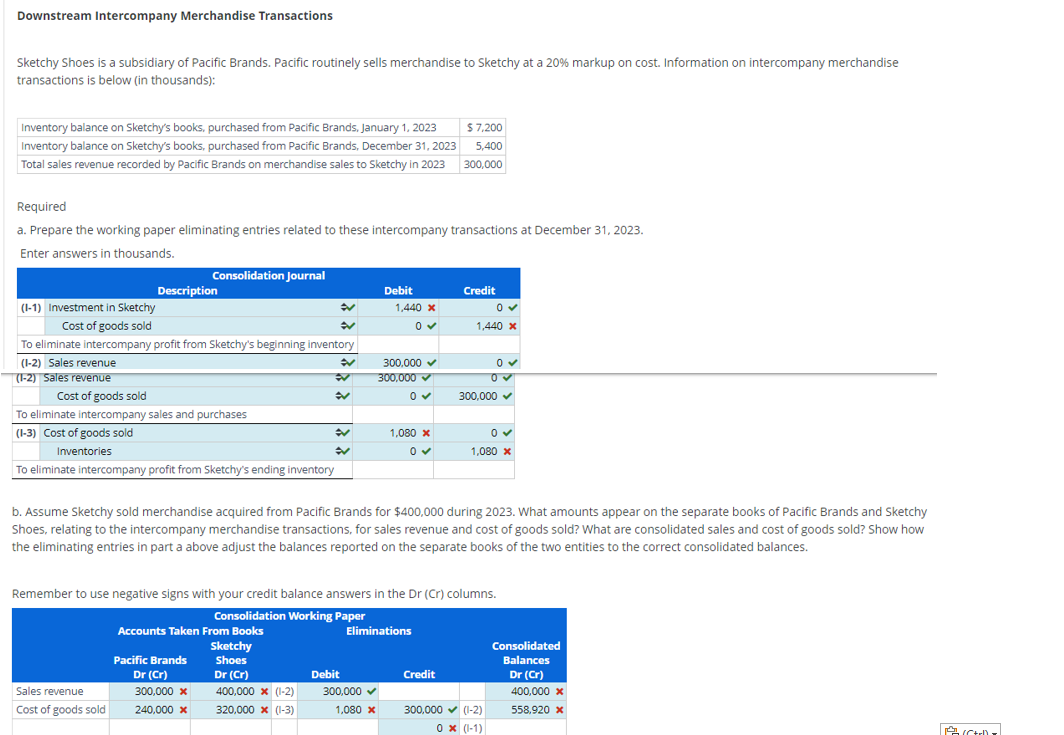

Sketchy Shoes is a subsidiary of Pacific Brands. Pacific routinely sells merchandise to Sketchy at a 2 0 % markup on cost . Information on

Sketchy Shoes is a subsidiary of Pacific Brands. Pacific routinely sells merchandise to Sketchy at a markup on cost Information on intercompany merchandise transactions is below in thousands:

Inventory balance on Sketchys books, purchased from Pacific Brands, January $ Inventory balance on Sketchys books, purchased from Pacific Brands, December Total sales revenue recorded by Pacific Brands on merchandise sales to Sketchy in

Required

a Prepare the working paper eliminating entries related to these intercompany transactions at December

Enter answers in thousands. Downstream Intercompany Merchandise Transactions

Sketchy Shoes is a subsidiary of Pacific Brands. Pacific routinely sells merchandise to Sketchy at a markup on cost Information on intercompany merchandise transactions is below in thousands:

Required

a Prepare the working paper eliminating entries related to these intercompany transactions at December

Enter answers in thousands.

b Assume Sketchy sold merchandise acquired from Pacific Brands for $ during What amounts appear on the separate books of Pacific Brands and Sketchy Shoes, relating to the intercompany merchandise transactions, for sales revenue and cost of goods sold? What are consolidated sales and cost of goods sold? Show how the eliminating entries in part a above adjust the balances reported on the separate books of the two entities to the correct consolidated balances.

Remember to use negative signs with your credit balance answers in the mathrmDrmathrmCr columns.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started