Answered step by step

Verified Expert Solution

Question

1 Approved Answer

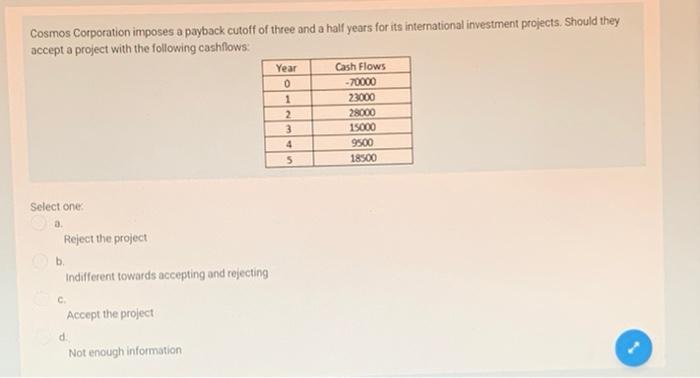

skip question 2 Cosmos Corporation imposes a payback cutoff of three and a half years for its international investment projects. Should they accept a project

skip question 2

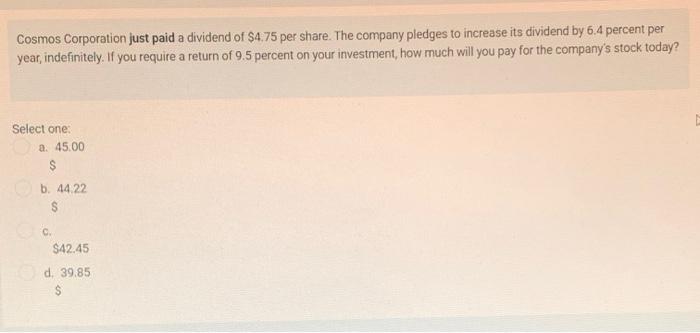

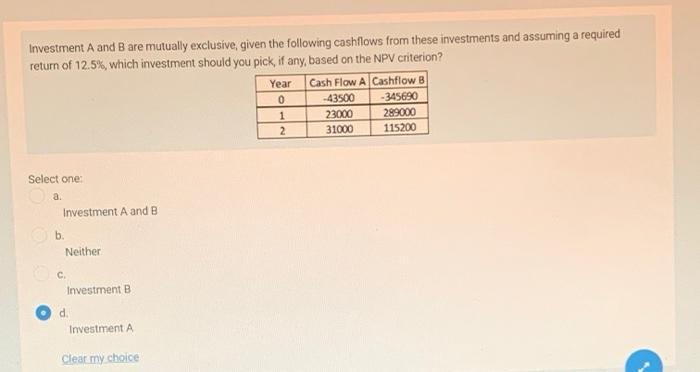

Cosmos Corporation imposes a payback cutoff of three and a half years for its international investment projects. Should they accept a project with the following cashflows. Year 0 1 2 3 Cash Flows - 70000 23000 28000 15000 4 9500 5 18500 Select one: 3 Reject the project b Indifferent towards accepting and rejecting C Accept the project d Not enough information Cosmos Corporation just paid a dividend of $4.75 per share. The company pledges to increase its dividend by 6.4 percent per year, indefinitely. If you require a return of 9.5 percent on your investment, how much will you pay for the company's stock today? Select one: a. 45.00 $ b. 44.22 $ C. $42.45 d. 39.85 Year Investment A and B are mutually exclusive, given the following cashflows from these investments and assuming a required return of 12.5%, which investment should you pick, if any, based on the NPV criterion? Cash Flow A Cashflow B 0 43500 -345690 1 23000 289000 2 31000 115200 Select one a. Investment A and B b. Neither Investment B d Investment A Clear my choice Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started