skip question 3 and 6 and provide full explanations

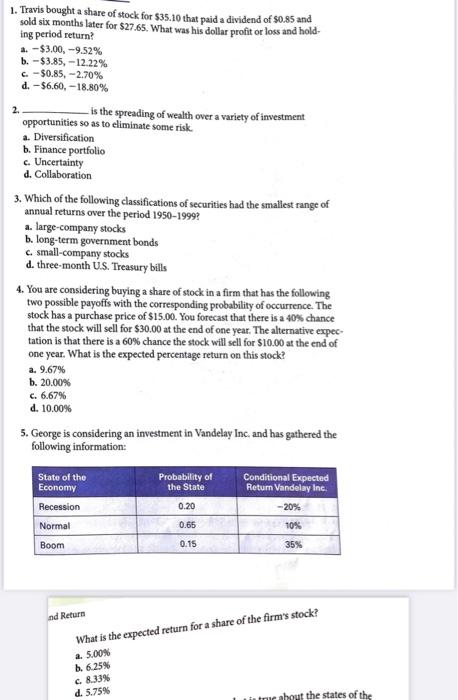

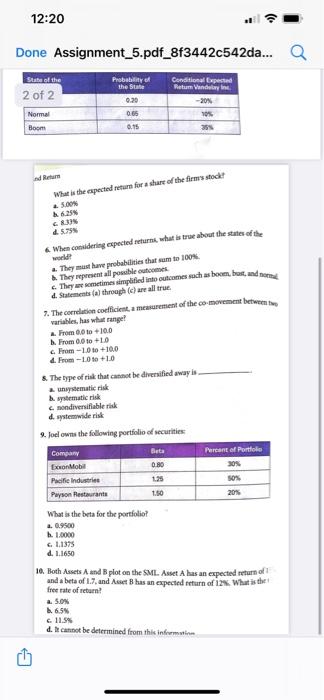

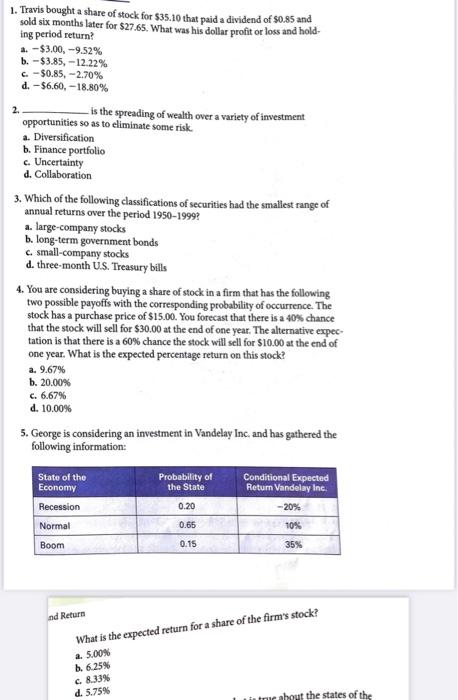

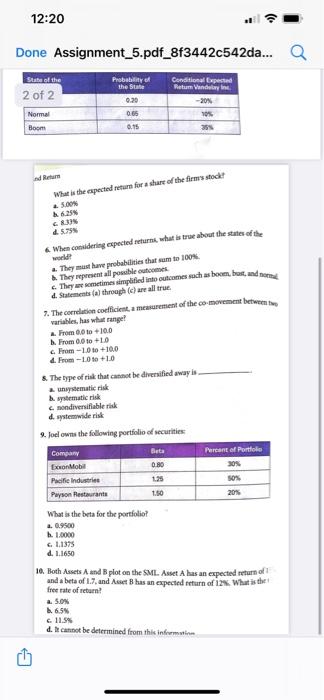

2. 1. Travis bought a share of stock for $35.10 that paid a dividend of $0.85 and sold six months later for $27.65. What was his dollar profit or loss and hold. ing period return? a. -$3.00 -9.52% b. -$3.85, -12.22% C.-$0.85,-2.70% d. -$6.60.-18.80% is the spreading of wealth over a variety of investment opportunities so as to eliminate some risk a. Diversification b. Finance portfolio c. Uncertainty d. Collaboration 3. Which of the following classifications of securities had the smallest range of annual returns over the period 1950-1999? a large company stocks b. long-term government bonds c. small-company stocks d. three-month U.S. Treasury bills 4. You are considering buying a share of stock in a firm that has the following two possible payoffs with the corresponding probability of occurrence. The stock has a purchase price of $15.00. You forecast that there is a 40% chance that the stock will sell for $30.00 at the end of one year. The alternative expec- tation is that there is a 60% chance the stock will sell for $10.00 at the end of one year. What is the expected percentage return on this stock? a. 9.67% b. 20.00% c. 6.67% d. 10.00% 5. George is considering an investment in Vandelay Inc. and has gathered the following information: State of the Probability of Conditional Expected Economy the State Return Vandelay Inc. Recession 0.20 -20% Normal 0.65 10% Boom 0.15 35% nd Return What is the expected return for a share of the firm's stock? a. 5.00% b. 6.25% C. 8.33% d. 5.759 in trur about the states of the 12:20 Done Assignment_5.pdf_8f3442c542da... State of the 2 of 2 Probability of the State 0.20 0.65 Conditional Expected Ratum Vandalay -20% 10% 35 Normal Boom 0.15 dRun What is the aposted return for share of the firms stock 5.000 8. 25.99 When considering expected seturi, what is true about the states of the They must have probabilities that am to 100% They al poble outcomes Thelted into outcomes such as boom, buse, and more Statements through leare all true 7. The correlation coefficienta measurement of the comovement between the variables, has whatrange! From 0 to +100 From 0.0 LO From-1.0 to +100 d. From-10 to +1.0 & The type of risk that cannot be diversified away is anystematic risk systematic risk condiversifiable risk d. system wide risk 9. Joel owns the following portfolio of securities Company Beta Exxon Mobil 0.80 Pacific Industries 15 Payson Restaurants 1.50 Percent of Porto 30 50% 20% What is the beta for the portfolio? a. 0.900 h. 1.0000 11395 d. 1.1650 10. Both Assets A and B plot on the SML Asset A has an expected return of and a beta of 1.9, and it has an expected return of ix. What is the free rate of return! a. 5.0 6.5% c 11.5% d. cannot be determined from this information