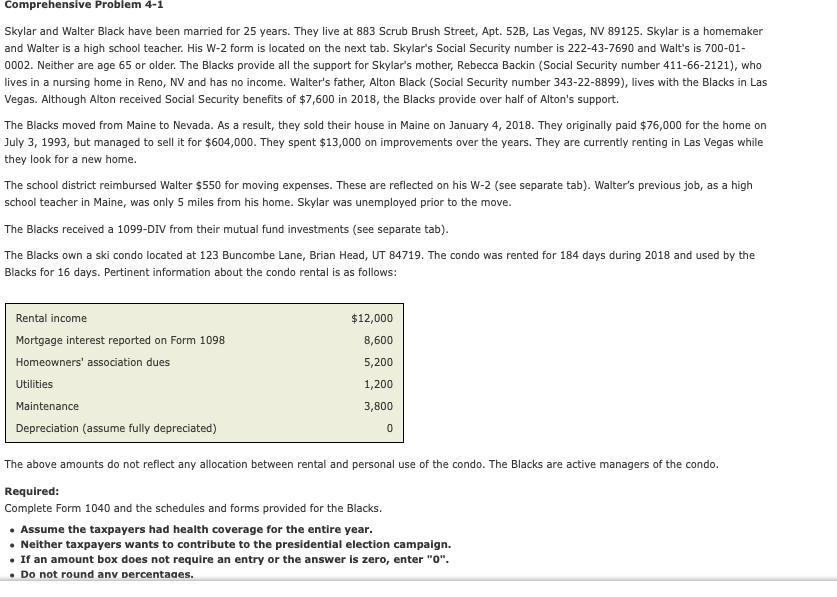

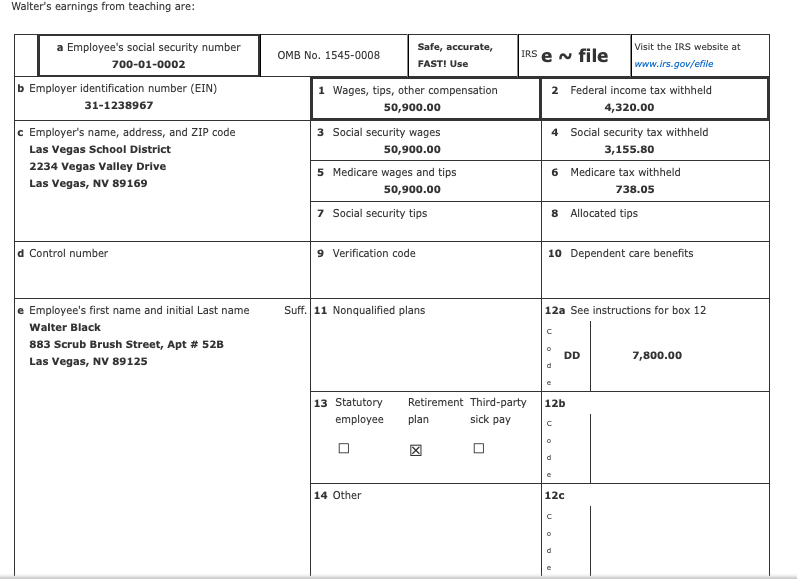

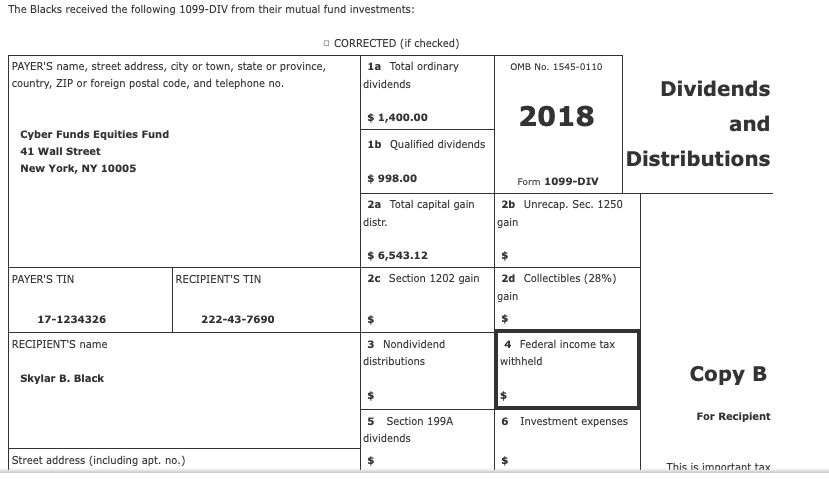

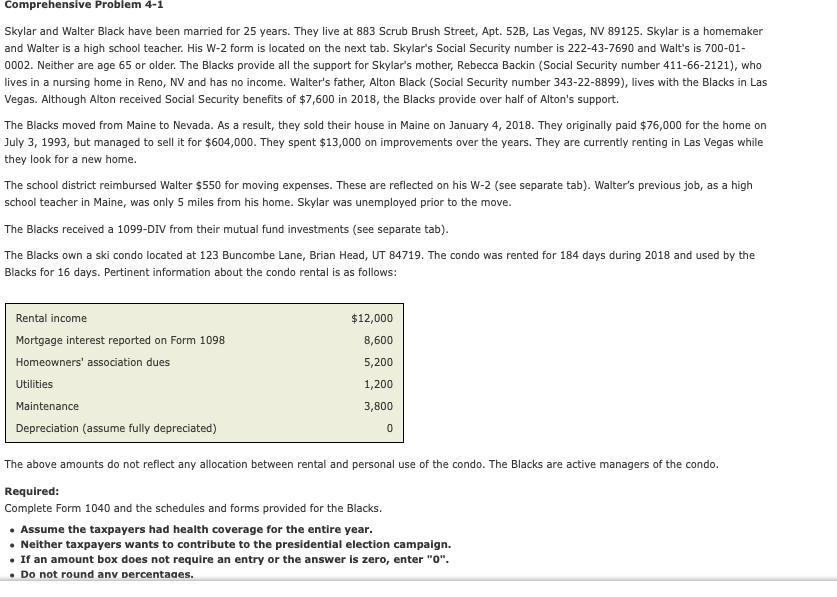

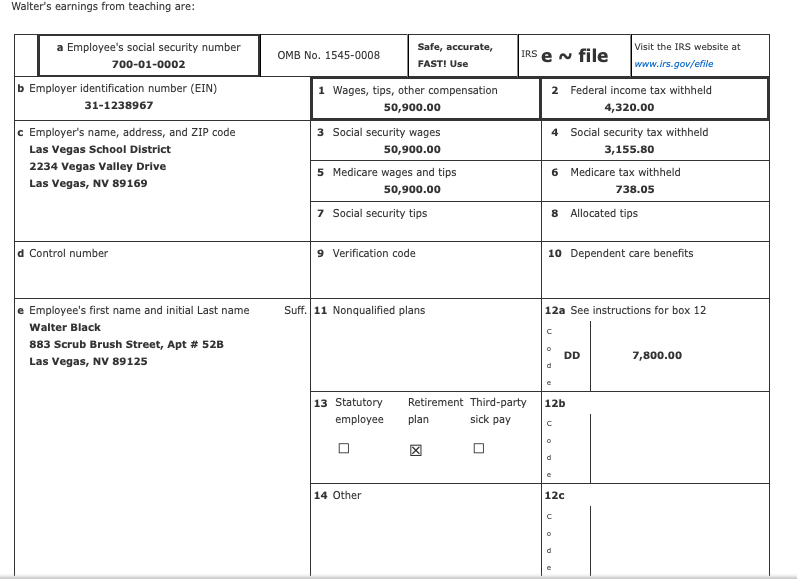

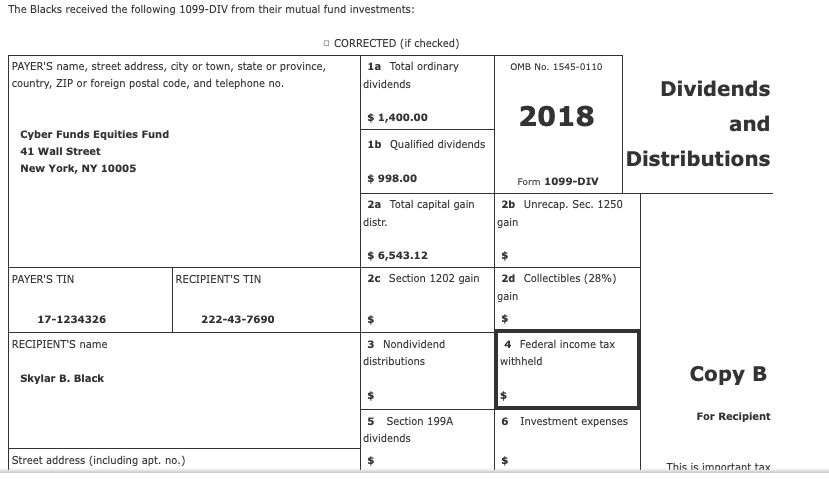

Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a homemaker and Walter is a high school teacher. His W-2 form is located on the next tab. Skylar's Social Security number is 222-43-7690 and Walt's is 700-01-0002. Neither are age 65 or older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411-66-2121), who lives in a nursing home in Reno, NV and has no income. Walter's father, Alton Black (Social Security number 343-22-8899), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of $7,600 in 2018, the Blacks provide over half of Alton's support. The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4, 2018. They originally paid $76,000 for the home on July 3, 1993, but managed to sell it for $604,000. They spent $13,000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home. The school district reimbursed Walter $550 for moving expenses. These are reflected on his W-2 (see separate tab). Walters previous job, as a high school teacher in Maine, was only 5 miles from his home. Skylar was unemployed prior to the move. The Blacks received a 1099-DIV from their mutual fund investments (see separate tab). The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 184 days during 2018 and used by the Blacks for 16 days. Pertinent information about the condo rental is as follows:

Comprehensive Problem 4-1 Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a homemaker and Walter is a high school teacher. His W-2 form is located on the next tab. Skylar's Social Security number is 222-43-7690 and Walt's is 700-01 0002. Neither are age 65 or older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411-66-2121), who lives in a nursing home in Reno, NV and has no income. Walter's father, Alton Black (Social Security number 343-22-8899), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of $7,600 in 2018, the Blacks provide over half of Alton's support. The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4, 2018. They originally paid $76,000 for the home on July 3, 1993, but managed to sell it for $604,000. They spent $13,000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home The school district reimbursed Walter $550 for moving expenses. These are reflected on his W-2 (see separate tab). Walter's previous job, as a high school teacher in Maine, was only 5 miles from his home. Skylar was unemployed prior to the move The Blacks received a 1099-DIV from their mutual fund investments (see separate tab) The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 184 days during 2018 and used by the Blacks for 16 days. Pertinent information about the condo rental is as follows: Rental income Mortgage interest reported on Form 1098 Homeowners' association dues Utilities Maintenance Depreciation (assume fully depreciated) $12,000 8,600 5,200 1,200 3,800 The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo Required Complete Form 1040 and the schedules and forms provided for the Blacks. Assume the taxpayers had health coverage for the entire year Neither taxpayers wants to contribute to the presidential election campaign. If an amount box does not require an entry or the answer is zero, enter "o" Do not round anv Dercentaaes Walter's earnings from teaching are: Safe, accurate,fiwww.irs.gov/efile a Employee's social security number 700-01-0002 Visit the IRS website at OMB No. 1545-0008 IRS e Nfile FAST! Use b Employer identification number (EIN) 31-1238967 1 Wages, tips, other compensation 50,900.00 2 Federal income tax withheld 4,320.00 4 Social security tax withheld 3,155.80 Medicare tax withheld c Employer's name, address, and ZIP code 3 Social security wages Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 50,900.00 5 Medicare wages and tips 6 50,900.00 738.05 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 Walter Black 883 Scrub Brush Street, Apt # 52B Las Vegas, NV 89125 7,800.00 13 Statutory Retirement Third-party 12b employee plan sick pay 14 Other 12C The Blacks received the following 1099-DIV from their mutual fund investments CORRECTED (if checked) PAYER'S name, street address, city or town, state or province country, ZIP or foreign postal code, and telephone no. 1a Total ordinary OMB No. 1545-0110 dividends Dividends and Distributions 2018 1,400.00 Cyber Funds Equities Fund 41 Wall Street New York, NY 10005 ib Qualified dividends 998.00 Form 1099-DIV 2a Total capital gain 2b Unrecap. Sec. 1250 distr gain 6,543.12 2c Section 1202 gain 12d Collectibles (28%) gain PAYER'S TIN RECIPIENT'S TIN 222-43-7690 17-1234326 RECIPIENT'S name Skylar B. Black 3 Nondividend distributions 4 Federal income tax withheld Copy B For Recipient 5 Section 199A dividends 6 Investment expenses Street address (including apt. no.) mtat tax