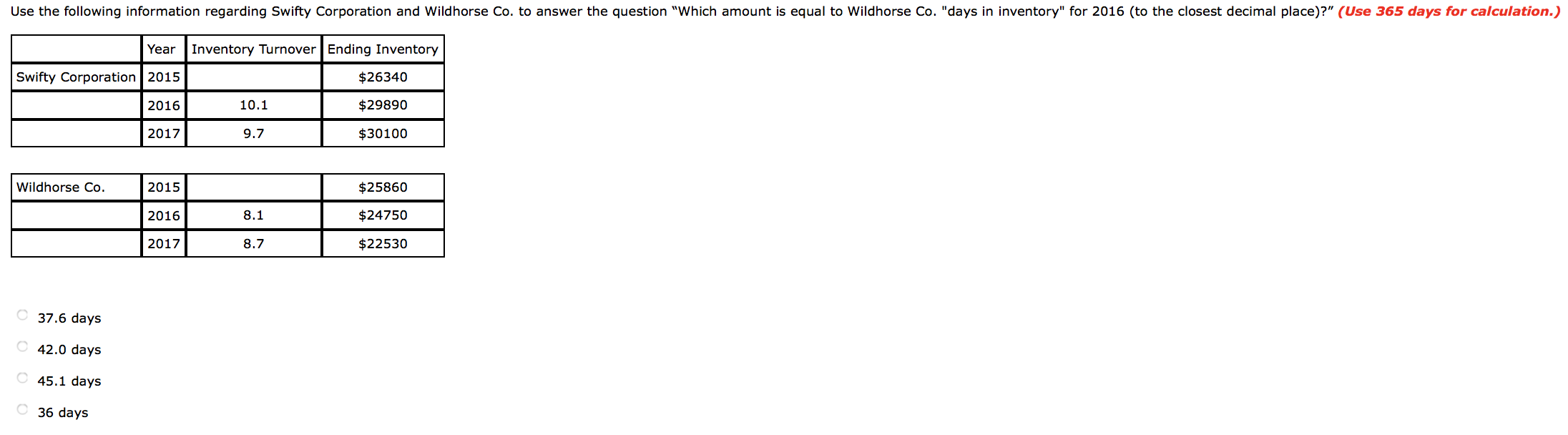

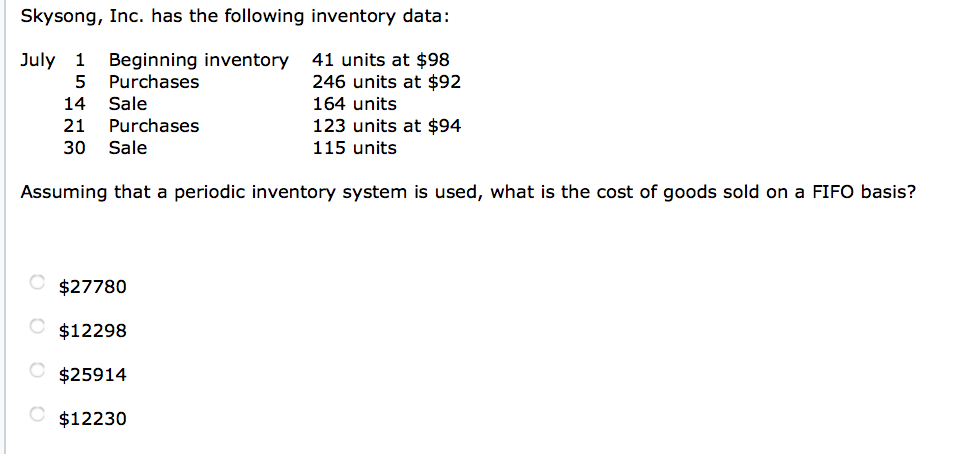

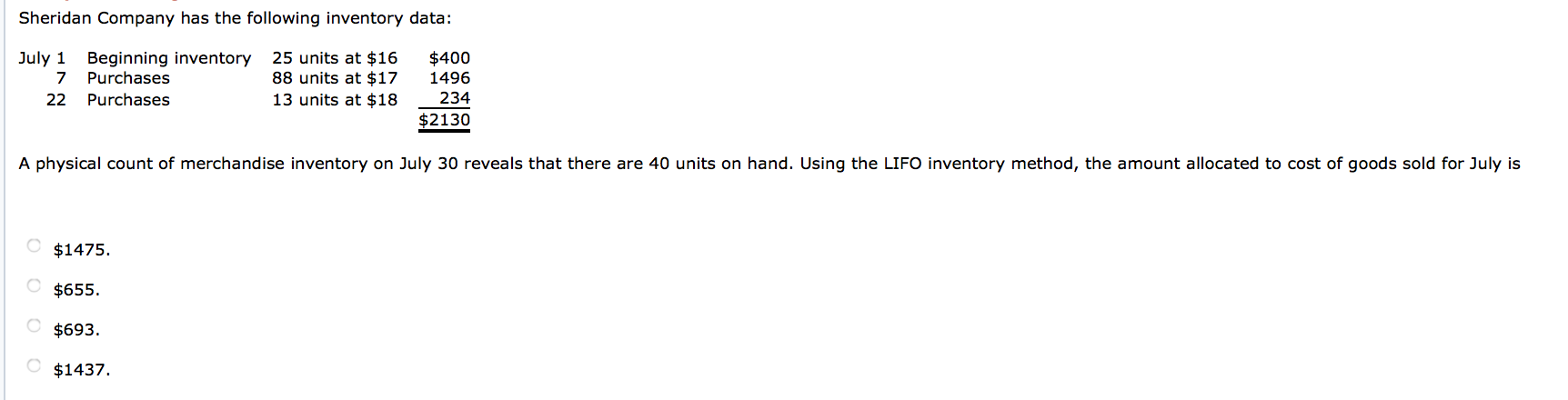

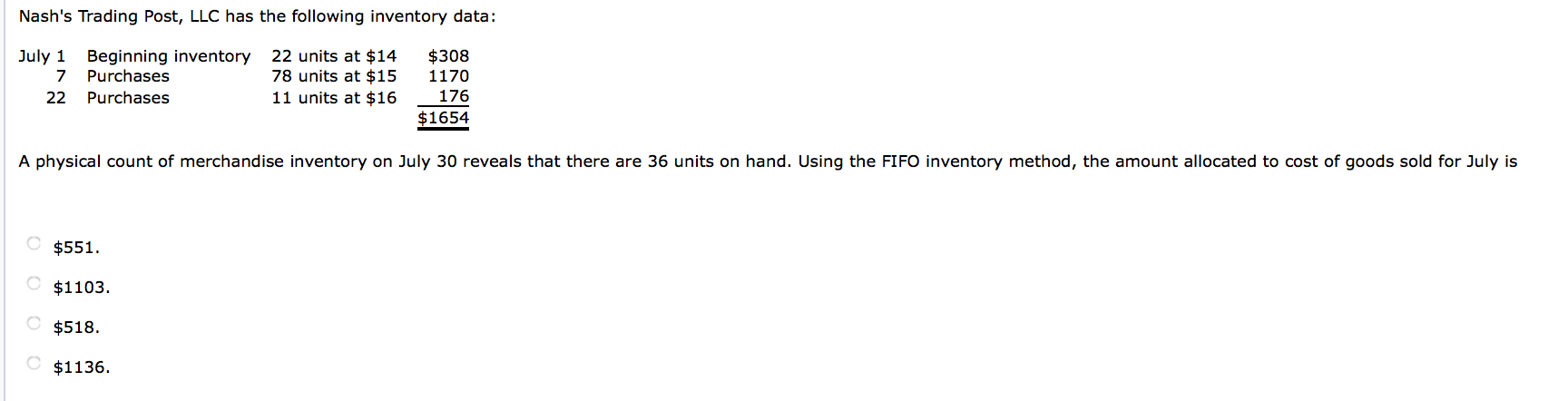

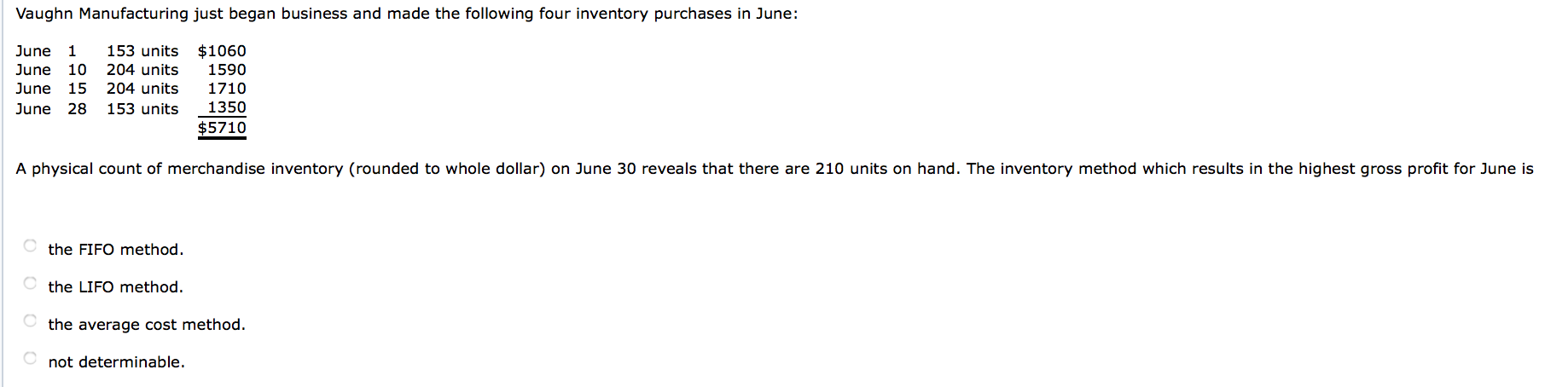

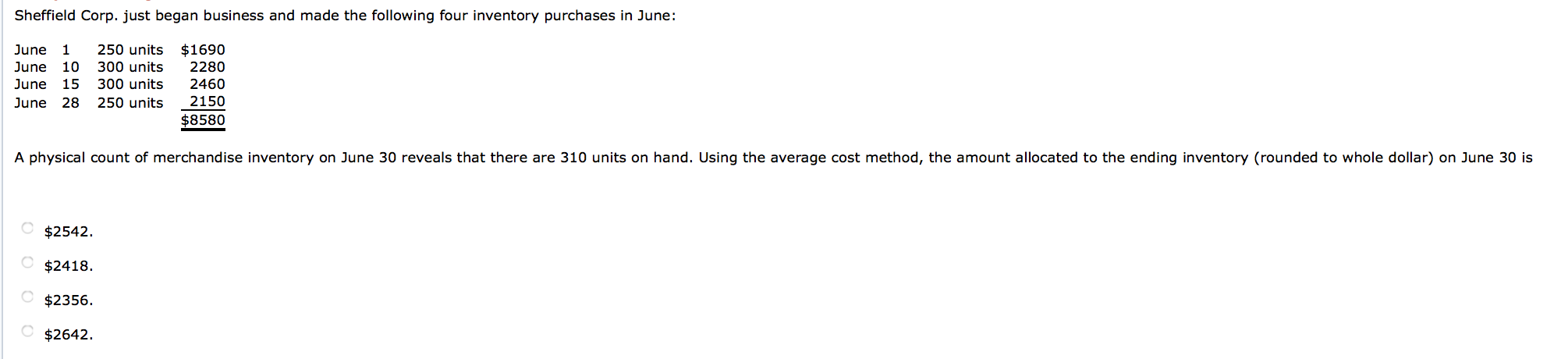

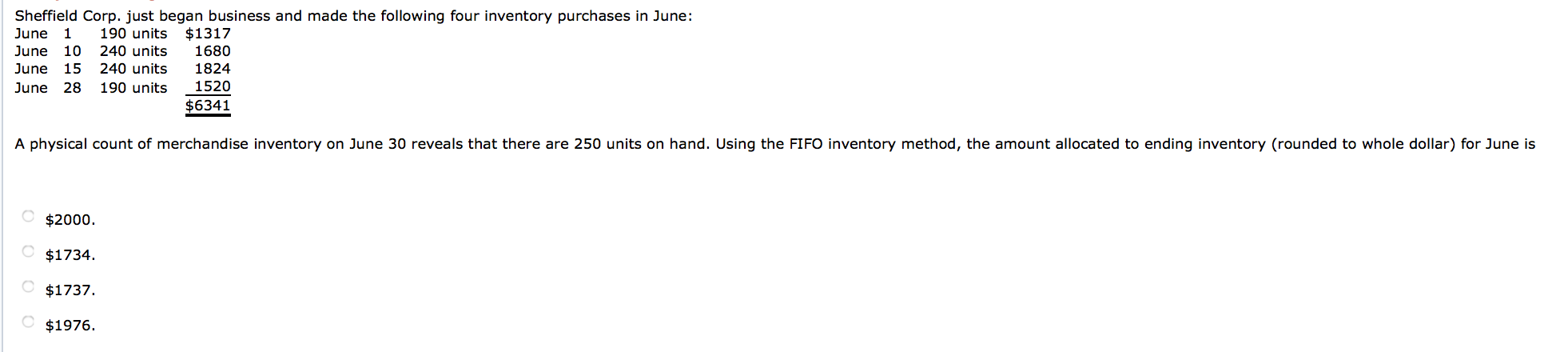

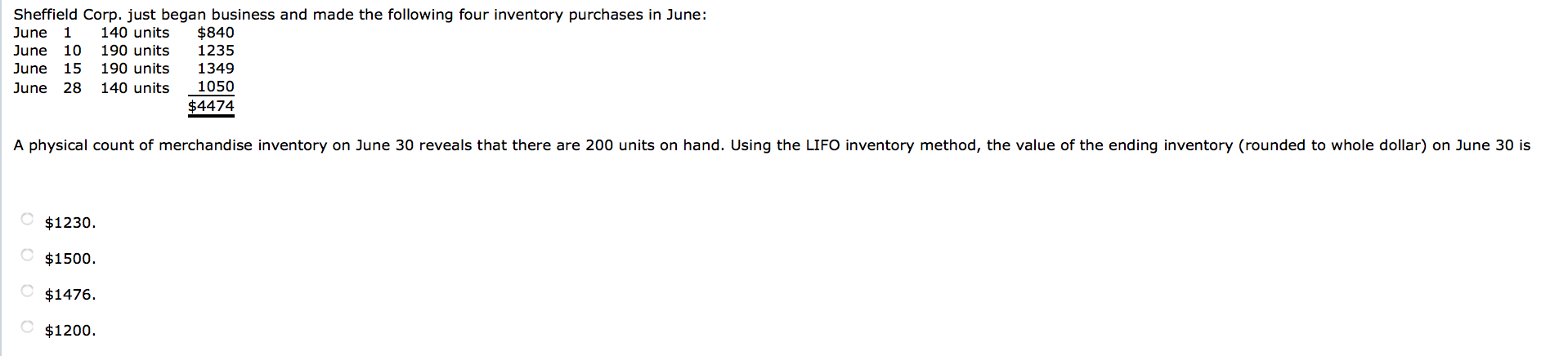

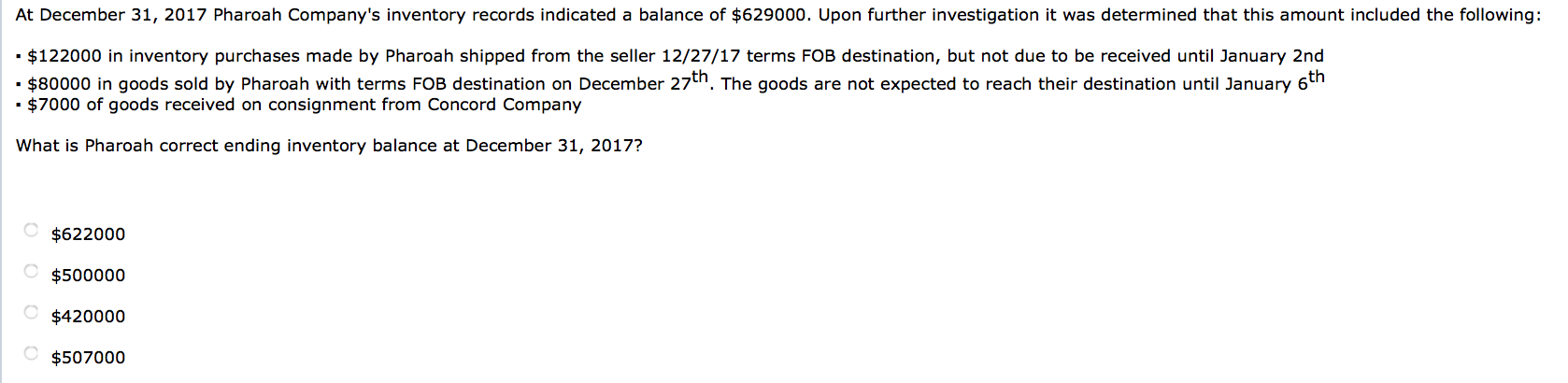

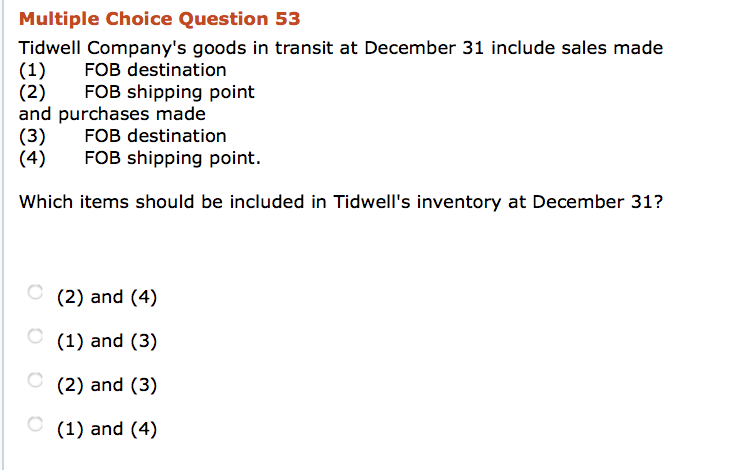

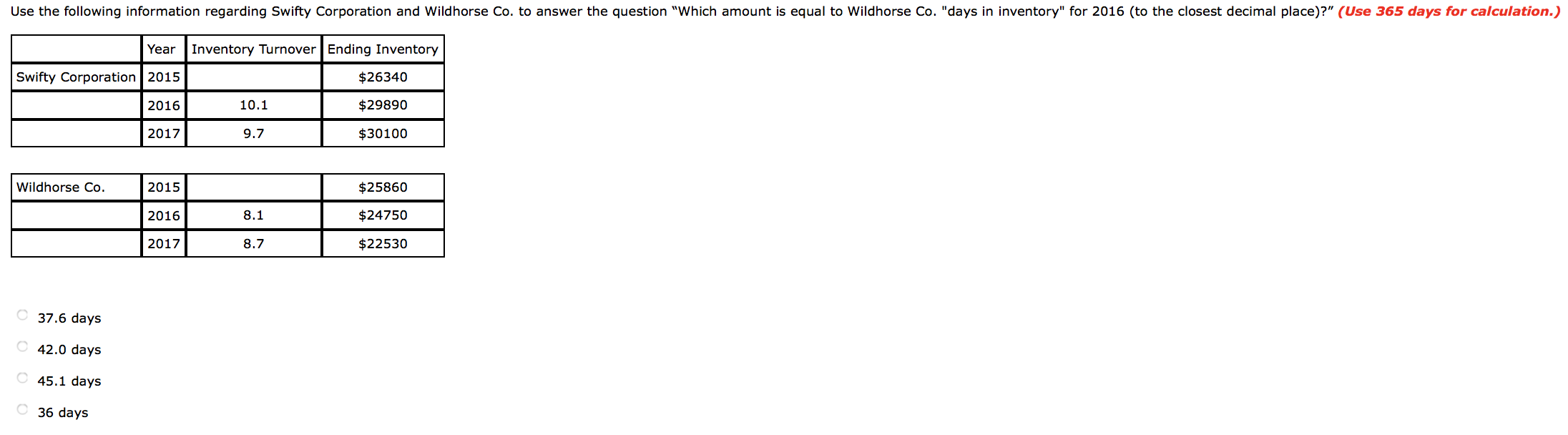

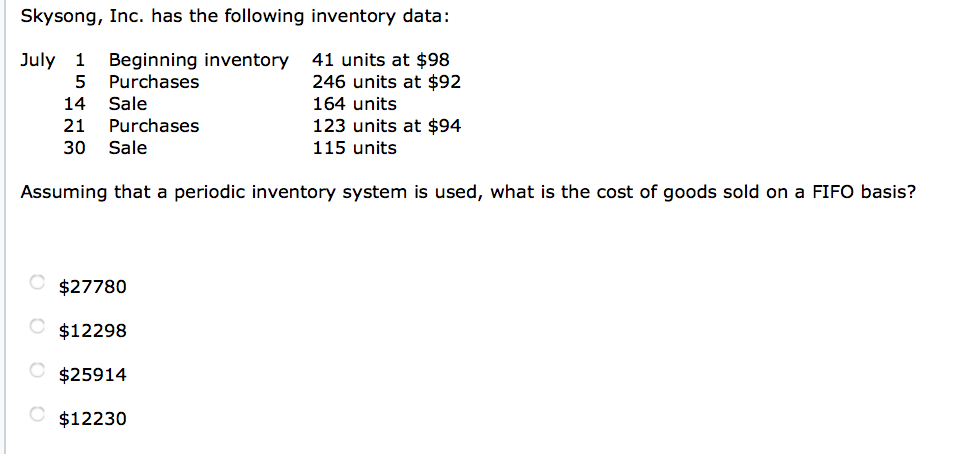

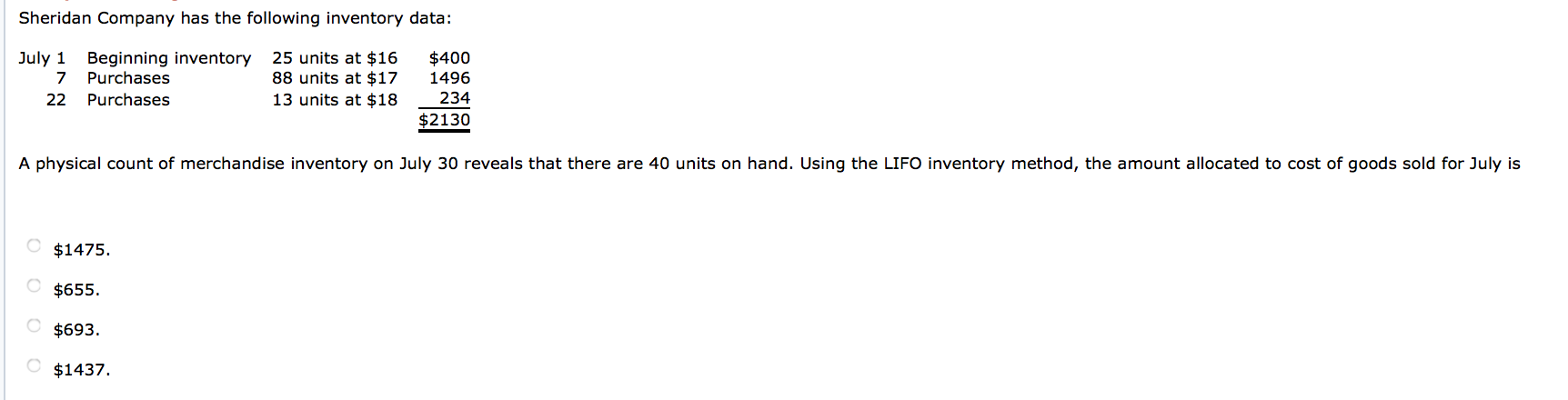

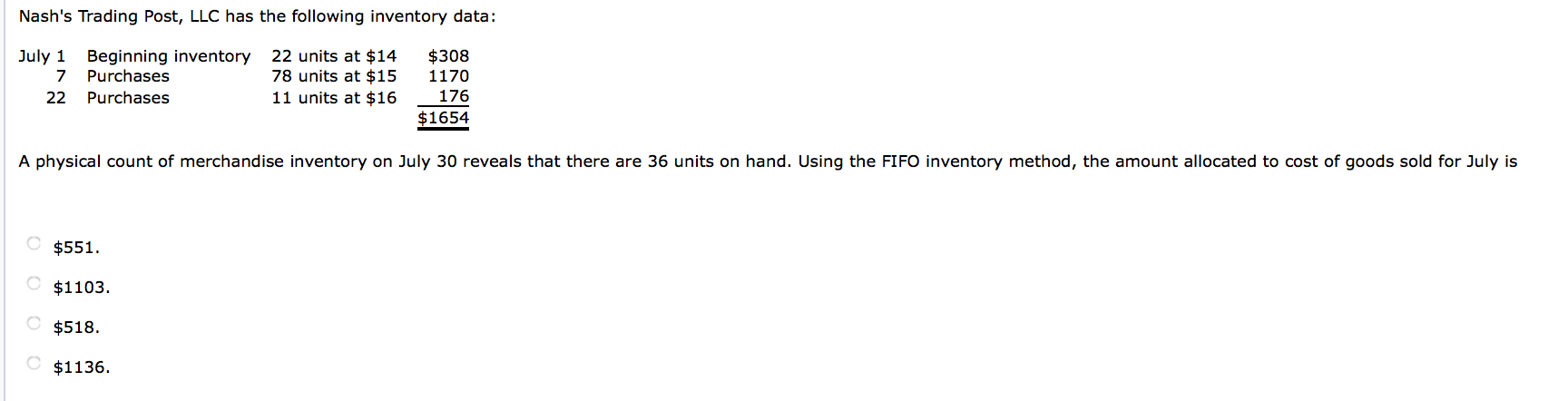

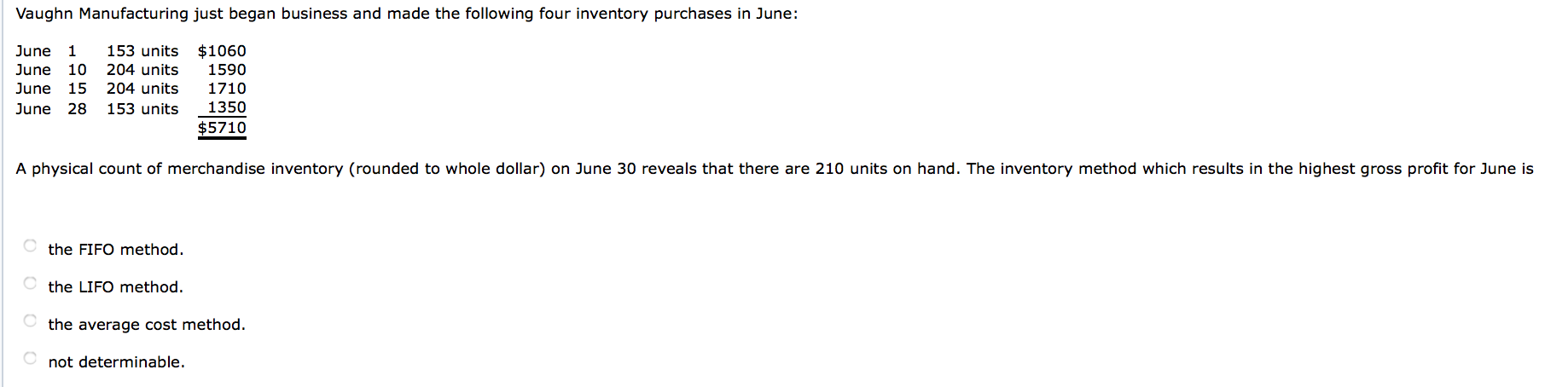

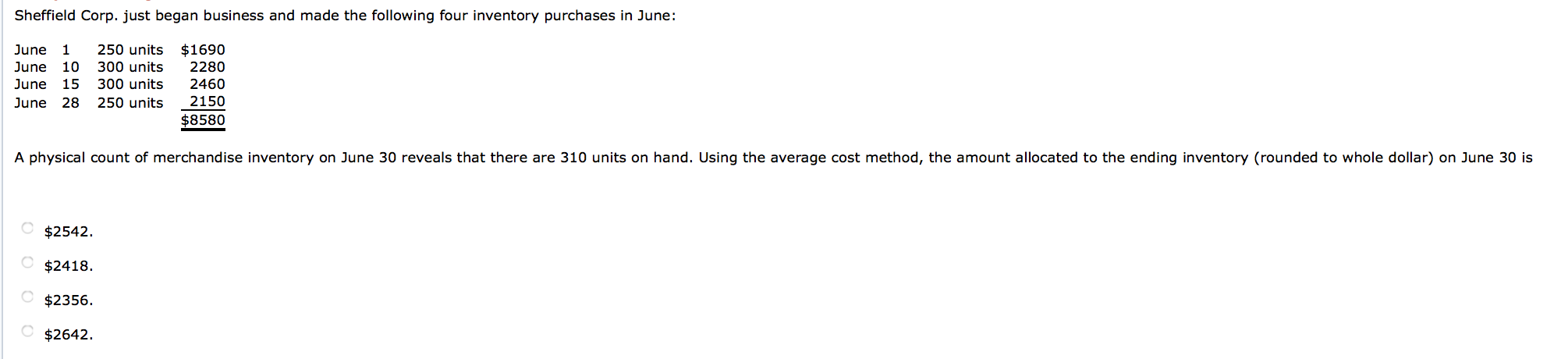

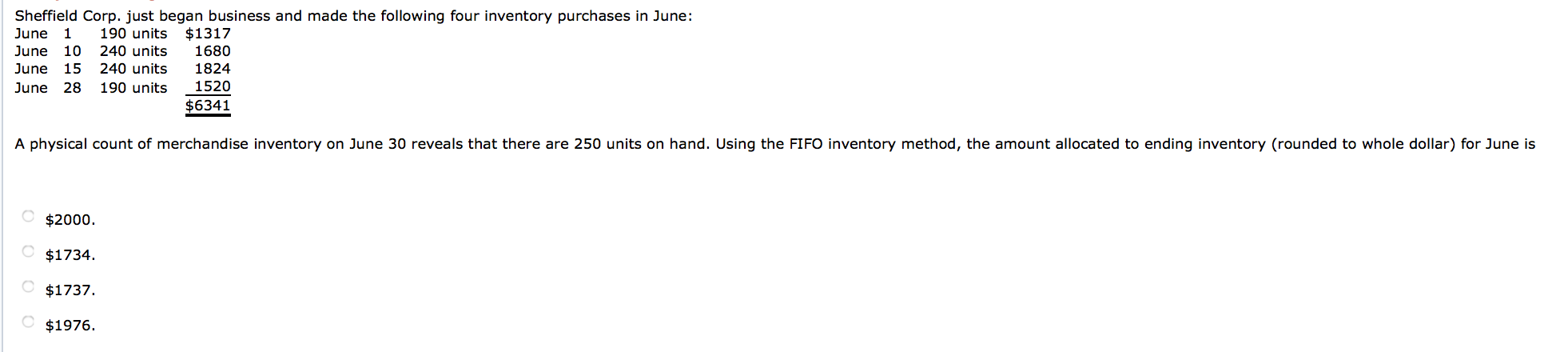

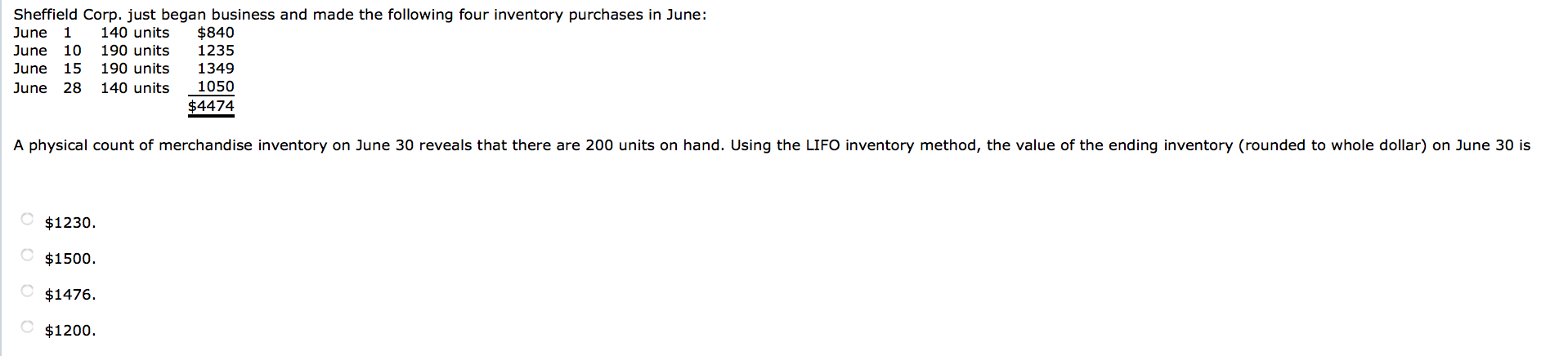

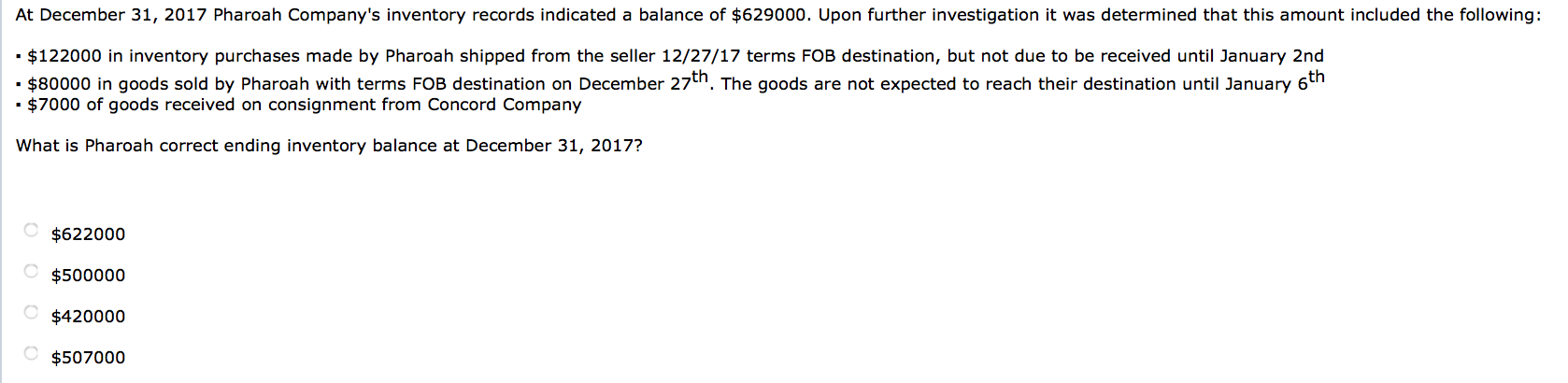

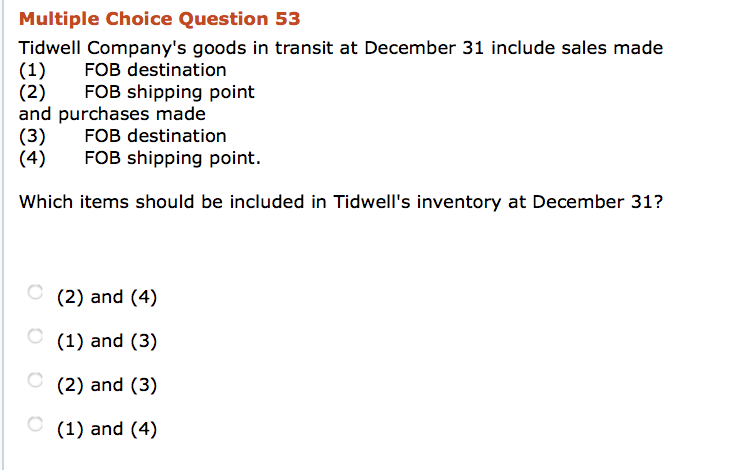

Skysong, Inc. has the following inventory data: July 5 Pu 1 Beginning inventory Purchases 14 Sale 21 Purchases 30 Sale 41 units at $98 246 units at $92 164 units 123 units at $94 115 units Assuming that a periodic inventory system is used, what is the cost of goods sold on a FIFO basis? $27780 $12298 $25914 $12230 Sheridan Company has the following inventory data: July 1 Beginning inventory 7 Purchases 22 Purchases 25 units at $16 88 units at $17 13 units at $18 $400 1496 234 $2130 A physical count of merchandise inventory on July 30 reveals that there are 40 units on hand. Using the LIFO inventory method, the amount allocated to cost of goods sold for July is $1475. C$655. C$693. $1437. Nash's Trading Post, LLC has the following inventory data: July 1 Beginning inventory 7 Purchases 22 Purchases 22 units at $14 78 units at $15 11 units at $16 $308 1170 176 $1654 A physical count of merchandise inventory on July 30 reveals that there are 36 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for July is $551. $1103. $518. $1136. Vaughn Manufacturing just began business and made the following four inventory purchases in June: June 1 June 10 June 15 June 28 153 units 204 units 204 units 153 units $1060 1590 1710 1350 $5710 A physical count of merchandise inventory (rounded to whole dollar) on June 30 reveals that there are 210 units on hand. The inventory method which results in the highest gross profit for June is the FIFO method. the LIFO method. the average cost method. o not determinable. Sheffield Corp. just began business and made the following four inventory purchases in June: June 1 June 10 June 15 June 28 250 units 300 units 300 units 250 units $1690 2280 2460 2150 $8580 A physical count of merchandise inventory on June 30 reveals that there are 310 units on hand. Using the average cost method, the amount allocated to the ending inventory (rounded to whole dollar) on June 30 is $2542. $2418. $2356. $2642. Sheffield Corp. just began business and made the following four inventory purchases in June: June 1 140 units $840 June 10 190 units 1235 June 15 190 units 1349 June 28 140 units 1050 $4474 A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand. Using the LIFO inventory method, the value of the ending inventory (rounded to whole dollar) on June 30 is $1230. O $1500. $1476. $1200. At December 31, 2017 Pharoah Company's inventory records indicated a balance of $629000. Upon further investigation it was determined that this amount included the following: . $122000 in inventory purchases made by Pharoah shipped from the seller 12/27/17 terms FOB destination, but not due to be received until January 2nd - $80000 in goods sold by Pharoah with terms FOB destination on December 27th. The goods are not expected to reach their destination until January 6th $7000 of goods received on consignment from Concord Company What is Pharoah correct ending inventory balance at December 31, 2017? $622000 $500000 $420000 $507000 Multiple Choice Question 53 Tidwell Company's goods in transit at December 31 include sales made (1) FOB destination (2) FOB shipping point and purchases made (3) FOB destination (4) FOB shipping point. Which items should be included in Tidwell's inventory at December 31? C (2) and (4) C (1) and (3) C (2) and (3) C (1) and (4)