Answered step by step

Verified Expert Solution

Question

1 Approved Answer

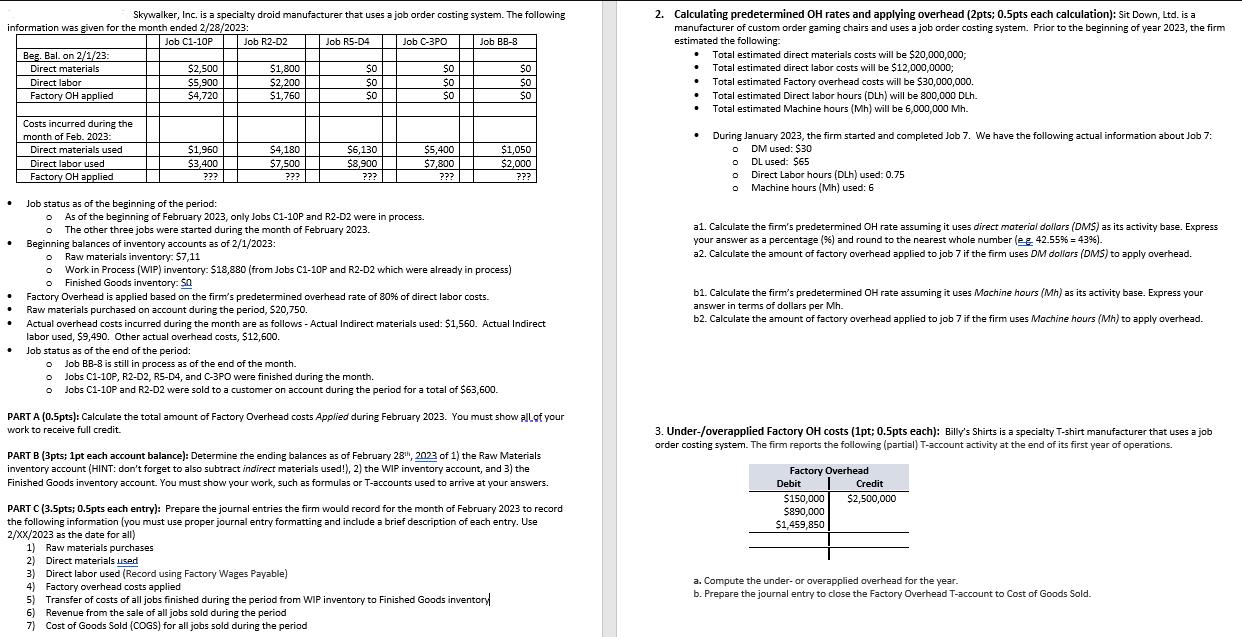

Skywalker, Inc. is a specialty droid manufacturer that uses a job order costing system. The following information was given for the month ended 2/28/2023:

Skywalker, Inc. is a specialty droid manufacturer that uses a job order costing system. The following information was given for the month ended 2/28/2023: Job C1-10P . . . Beg. Bal. on 2/1/23: Direct materials Direct labor Factory OH applied Costs incurred during the month of Feb. 2023: Direct materials used Direct labor used Factory OH applied $2,500 $5,900 $4,720 $1,960 $3,400 ??? O Job R2-D2 $1,800 $2,200 $1,760 $4,180 $7,500 ??? Job R5-D4 $0 $0 $0 $6,130 $8,900 ??? Job C-3PO $0 $0 $0 1) Raw materials purchases 2) Direct materials used Direct labor used (Record using Factory Wages Payable) $5,400 $7,800 ??? Job BB-8 Job status as of the beginning of the period: o As of the beginning of February 2023, only Jobs C1-10P and R2-D2 were in process. o The other three jobs were started during the month of February 2023. Beginning balances of inventory accounts as of 2/1/2023: O Raw materials inventory: $7,11 O Work in Process (WIP) inventory: $18,880 (from Jobs C1-10P and R2-D2 which were already in process) Finished Goods inventory: $0 0 Factory Overhead is applied based on the firm's predetermined overhead rate of 80% of direct labor costs. Raw materials purchased on account during the period, $20,750. . Actual overhead costs incurred during the month are as follows - Actual Indirect materials used: $1,560. Actual Indirect labor used, $9,490. Other actual overhead costs, $12,600. Job status as of the end of the period: o Job BB-8 is still in process as of the end of the month. 0 Jobs C1-10P, R2-D2, R5-D4, and C-3PO were finished during the month. Jobs C1-10P and R2-D2 were sold to a customer on account during the period for a total of $63,600. $0 $0 $0 $1,050 $2,000 ??? PART A (0.5pts): Calculate the total amount of Factory Overhead costs Applied during February 2023. You must show all of your work to receive full credit. PART B (3pts; 1pt each account balance): Determine the ending balances as of February 28th, 2023 of 1) the Raw Materials inventory account (HINT: don't forget to also subtract indirect materials used!), 2) the WIP inventory account, and 3) the Finished Goods inventory account. You must show your work, such as formulas or T-accounts used to arrive at your answers. PART C (3.5pts; 0.5pts each entry): Prepare the journal entries the firm would record for the month of February 2023 to record the following information (you must use proper journal entry formatting and include a brief description of each entry. Use 2/XX/2023 as the date for all) 3) 4) Factory overhead costs applied 5) Transfer of costs of all jobs finished during the period from WIP inventory to Finished Goods inventory 6) Revenue from the sale of all jobs sold during the period 7) Cost of Goods Sold (COGS) for all jobs sold during the period 2. Calculating predetermined OH rates and applying overhead (2pts; 0.5pts each calculation): Sit Down, Ltd. is a manufacturer of custom order gaming chairs and uses a job order costing system. Prior to the beginning of year 2023, the firm estimated the following: . Total estimated direct materials costs will be $20,000,000; Total estimated direct labor costs will be $12,000,0000; Total estimated Factory overhead costs will be $30,000,000. . Total estimated Direct labor hours (DLh) will be 800,000 DLh. Total estimated Machine hours (Mh) will be 6,000,000 Mh. . . During January 2023, the firm started and completed Job 7. We have the following actual information about Job 7: DM used: $30 DL used: $65 0 0 o Machine hours (Mh) used: 6 Direct Labor hours (DLh) used: 0.75 a1. Calculate the firm's predetermined OH rate assuming it uses direct material dollars (DMS) as its activity base. Express your answer as a percentage (%) and round to the nearest whole number (eg 42.55% = 43%). a2. Calculate the amount of factory overhead applied to job 7 if the firm uses DM dollars (DMS) to apply overhead. b1. Calculate the firm's predetermined OH rate assuming it uses Machine hours (Mh) as its activity base. Express your answer in terms of dollars per Mh. b2. Calculate the amount of factory overhead applied to job 7 if the firm uses Machine hours (Mh) to apply overhead. 3. Under-/overapplied Factory OH costs (1pt; 0.5pts each): Billy's Shirts is a specialty T-shirt manufacturer that uses a job order costing system. The firm reports the following (partial) T-account activity at the end of its first year of operations. Factory Overhead Debit $150,000 $890,000 $1,459,850 Credit $2,500,000 a. Compute the under-or overapplied overhead for the year. b. Prepare the journal entry to close the Factory Overhead T-account to Cost of Goods Sold.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the solutions to the questions Part A The total amount of Factory Overhead costs Applied during February 2023 is 15712 Here is the calculatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started