Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Slice 'N Dice Inc. (Slice) is a manufacturer that sells commercial grade meat slicers. Recently, the company has decided to start including an optional

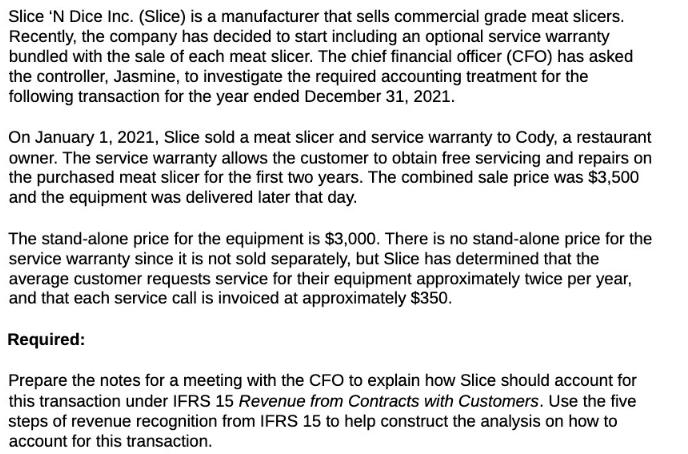

Slice 'N Dice Inc. (Slice) is a manufacturer that sells commercial grade meat slicers. Recently, the company has decided to start including an optional service warranty bundled with the sale of each meat slicer. The chief financial officer (CFO) has asked the controller, Jasmine, to investigate the required accounting treatment for the following transaction for the year ended December 31, 2021. On January 1, 2021, Slice sold a meat slicer and service warranty to Cody, a restaurant owner. The service warranty allows the customer to obtain free servicing and repairs on the purchased meat slicer for the first two years. The combined sale price was $3,500 and the equipment was delivered later that day. The stand-alone price for the equipment is $3,000. There is no stand-alone price for the service warranty since it is not sold separately, but Slice has determined that the average customer requests service for their equipment approximately twice per year, and that each service call is invoiced at approximately $350. Required: Prepare the notes for a meeting with the CFO to explain how Slice should account for this transaction under IFRS 15 Revenue from Contracts with Customers. Use the five steps of revenue recognition from IFRS 15 to help construct the analysis on how to account for this transaction.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Notes for Meeting with CFO Accounting Treatment for Sale of Meat Slicer with Service Warranty Under IFRS 15 Revenue from Contracts with Customers Slic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started