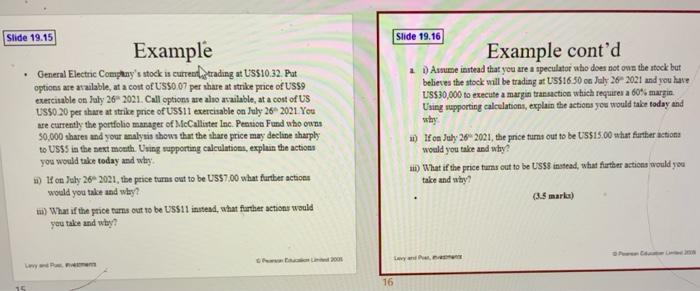

. Slide 19.16 Example cont'd 2 Asume instead that you are a speculator who does not own the stock but believes the stock will be trading at US$16.50 on July 26 2021 and you have US$30,000 to execute a margin transaction which requires a 60% margin Using supporting calculations, explain the actions you would take today and Slide 19.15 Example General Electric Company's stock is currently trading at US$10.32. Put options are available at a cost of US$0 07 per share at strike price of US$9 exercisable on July 26 2021. Call options are also available at a cost of US USSO 20 per share at strike price of US$11 exercisable on July 26 2021 You are currently the portfolio manager of McCallister Inc. Pension Fund who owns 30,000 shares and your analysis shown that the share price may decline sharply to USSS in the next month. Using supporting calculations, explain the action you would take today and why m) 1 on July 26 2021, the price turns out to be US$7.00 what further actions would you take and why? m) What if the price turns out to be US$11 instead, what further actions would you take and why? 1) If on July 28 2021, the price turns out to be US$15.00 what further actions would you take and why 1) What if the price turns out to be USSS instead, what further actions would you take and by (3.5 mark) 00 16 15 . Slide 19.16 Example cont'd 2 Asume instead that you are a speculator who does not own the stock but believes the stock will be trading at US$16.50 on July 26 2021 and you have US$30,000 to execute a margin transaction which requires a 60% margin Using supporting calculations, explain the actions you would take today and Slide 19.15 Example General Electric Company's stock is currently trading at US$10.32. Put options are available at a cost of US$0 07 per share at strike price of US$9 exercisable on July 26 2021. Call options are also available at a cost of US USSO 20 per share at strike price of US$11 exercisable on July 26 2021 You are currently the portfolio manager of McCallister Inc. Pension Fund who owns 30,000 shares and your analysis shown that the share price may decline sharply to USSS in the next month. Using supporting calculations, explain the action you would take today and why m) 1 on July 26 2021, the price turns out to be US$7.00 what further actions would you take and why? m) What if the price turns out to be US$11 instead, what further actions would you take and why? 1) If on July 28 2021, the price turns out to be US$15.00 what further actions would you take and why 1) What if the price turns out to be USSS instead, what further actions would you take and by (3.5 mark) 00 16 15