Question

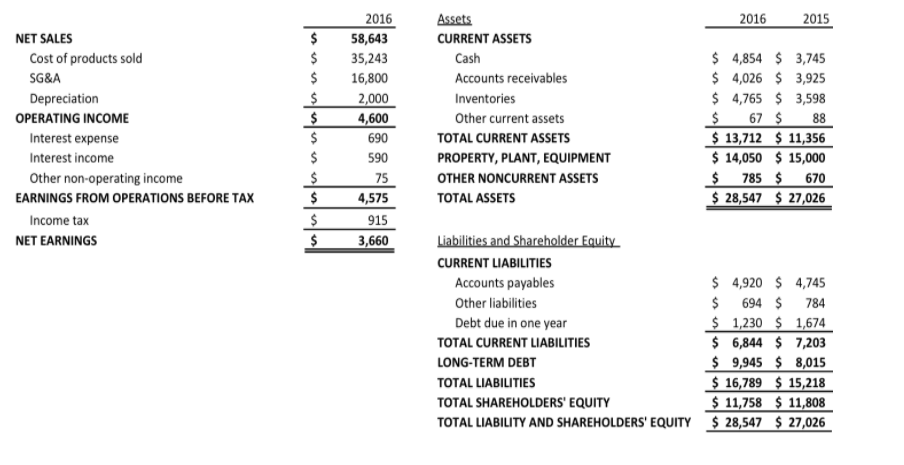

SmallCo hopes to roll out an inventory reduction program in 2017. The company expects to reduce its inventories by 900 dollars. There has been some

SmallCo hopes to roll out an inventory reduction program in 2017. The company expects to reduce its inventories by 900 dollars. There has been some concerns that this may affect sales negatively.

If sales were to reduce by 2400 dollars while inventories are reduced by 900 dollars, how would working capital turnover be affected? Assume all other numbers are the same in 2017 as in the 2016 reports.

Select the best answer

Working capital turnover will increase by 10%

Working capital turnover will increase by 15%

Working capital turnover will increase by 19%

Working capital turnover will not change

None of the above

After the inventory reduction project, what would be the cash-to-cash cycle?

2016 2015 NET SALES Cost of products sold SG&A Depreciation OPERATING INCOME Interest expense Interest income Other non-operating income EARNINGS FROM OPERATIONS BEFORE TAX Income tax NET EARNINGS $ $ $ $ $ $ $ $ $ $ $ 2016 58,643 35,243 16,800 2,000 4,600 690 590 75 4,575 915 3,660 Assets CURRENT ASSETS Cash Accounts receivables Inventories Other current assets TOTAL CURRENT ASSETS PROPERTY, PLANT, EQUIPMENT OTHER NONCURRENT ASSETS TOTAL ASSETS $ 4,854 $ 3,745 $ 4,026 $ 3,925 $ 4,765 $ 3,598 $ 67 $ 88 $ 13,712 $ 11,356 $ 14,050 $ 15,000 $ 785 $ 670 $ 28,547 $ 27,026 $ Liabilities and Shareholder Equity CURRENT LIABILITIES Accounts payables $ 4,920 $ 4,745 Other liabilities $ 694 $ 784 Debt due in one year $ 1,230 $ 1,674 TOTAL CURRENT LIABILITIES $ 6,844 $ 7,203 LONG-TERM DEBT $ 9,945 $ 8,015 TOTAL LIABILITIES $ 16,789 $ 15,218 TOTAL SHAREHOLDERS' EQUITY $ 11,758 $ 11,808 TOTAL LIABILITY AND SHAREHOLDERS' EQUITY $ 28,547 $ 27,026Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started