Answered step by step

Verified Expert Solution

Question

1 Approved Answer

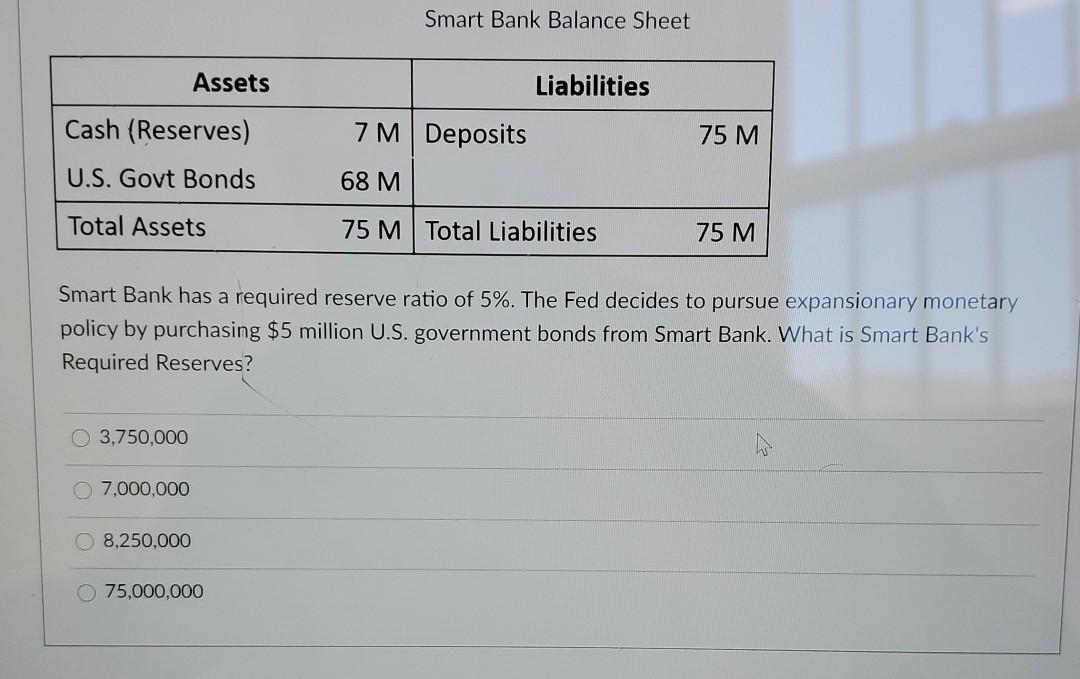

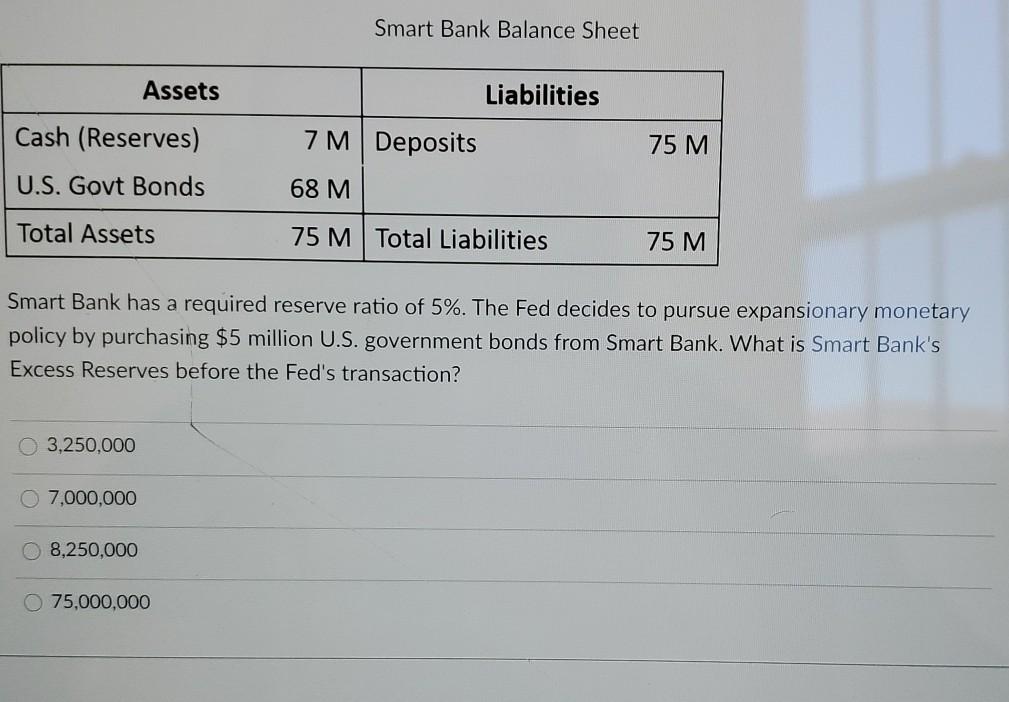

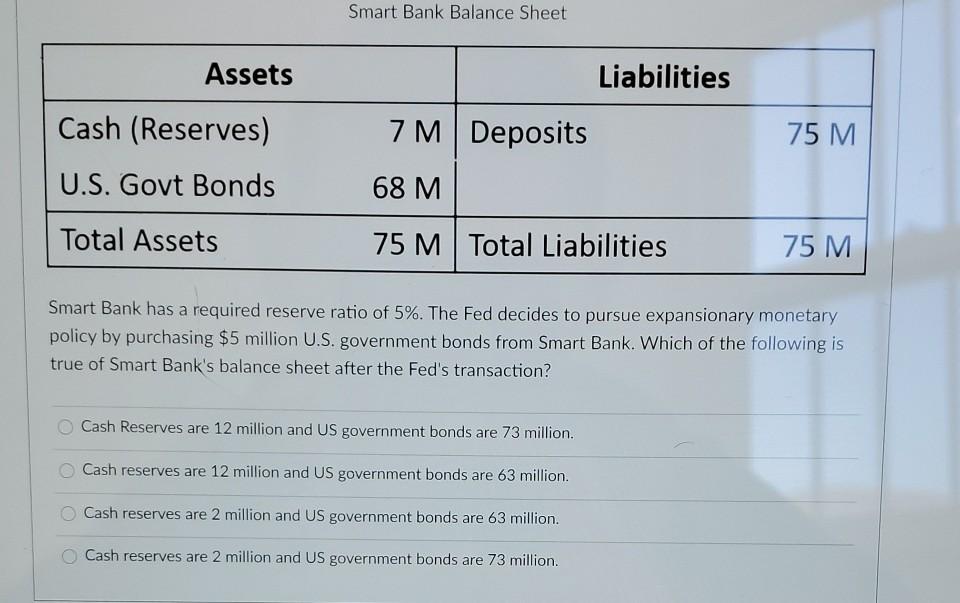

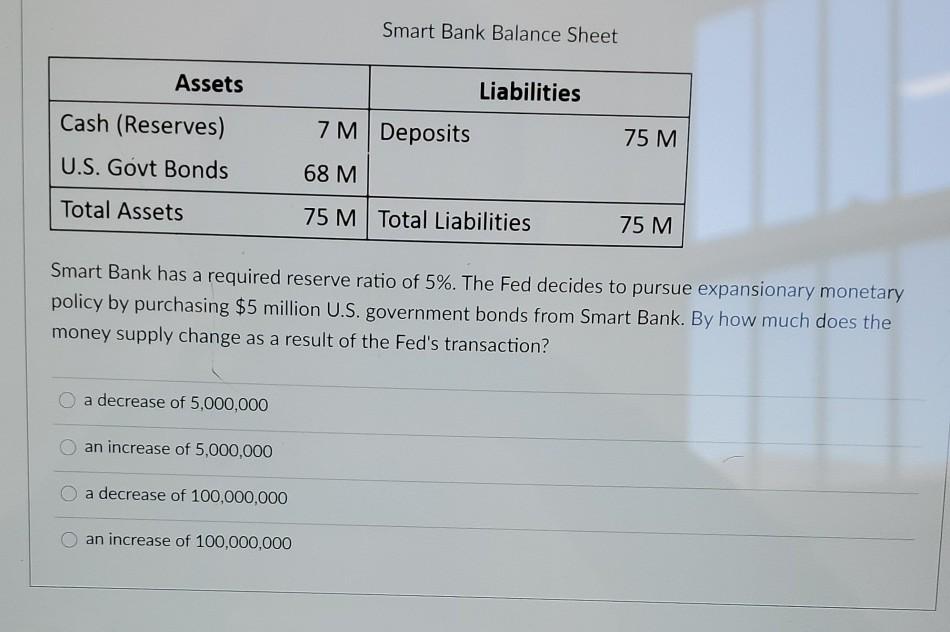

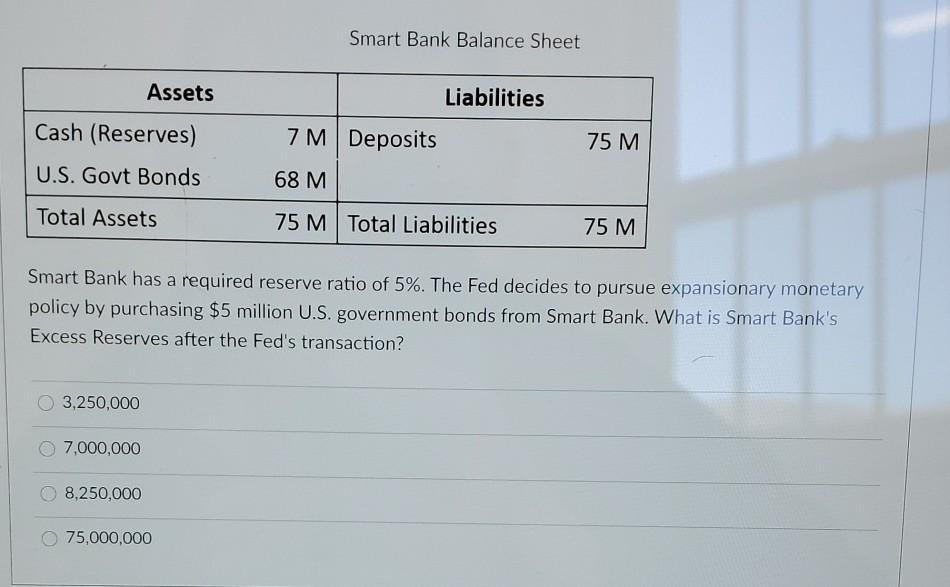

Smart Bank Balance Sheet Assets Liabilities Cash (Reserves) 7M Deposits 75 M U.S. Govt Bonds 68 M Total Assets 75 M Total Liabilities 75 M

Smart Bank Balance Sheet Assets Liabilities Cash (Reserves) 7M Deposits 75 M U.S. Govt Bonds 68 M Total Assets 75 M Total Liabilities 75 M Smart Bank has a required reserve ratio of 5%. The Fed decides to pursue expansionary monetary policy by purchasing $5 million U.S. government bonds from Smart Bank. What is Smart Bank's Required Reserves? O 3,750,000 7,000,000 8,250,000 O 75,000,000 Smart Bank Balance Sheet Assets Liabilities Cash (Reserves) 7M Deposits 75 M U.S. Govt Bonds 68 M Total Assets 75 M Total Liabilities 75 M. Smart Bank has a required reserve ratio of 5%. The Fed decides to pursue expansionary monetary policy by purchasing $5 million U.S. government bonds from Smart Bank. What is Smart Bank's Excess Reserves before the Fed's transaction? O 3,250,000 O 7,000,000 8,250,000 75,000,000 Smart Bank Balance Sheet Assets Liabilities Cash (Reserves) 7M Deposits 75 M U.S. Govt Bonds 68 M Total Assets 75 M Total Liabilities 75 M Smart Bank has a required reserve ratio of 5%. The Fed decides to pursue expansionary monetary policy by purchasing $5 million U.S. government bonds from Smart Bank. Which of the following is true of Smart Bank's balance sheet after the Fed's transaction? Cash Reserves are 12 million and US government bonds are 73 million. Cash reserves are 12 million and US government bonds are 63 million. Cash reserves are 2 million and US government bonds are 63 million. Cash reserves are 2 million and US government bonds are 73 million. Smart Bank Balance Sheet Assets Liabilities Cash (Reserves) 7M Deposits 75 M U.S. Govt Bonds 68 M Total Assets 75 M Total Liabilities 75 M Smart Bank has a required reserve ratio of 5%. The Fed decides to pursue expansionary monetary policy by purchasing $5 million U.S. government bonds from Smart Bank. By how much does the money supply change as a result of the Fed's transaction? a decrease of 5,000,000 an increase of 5,000,000 a decrease of 100,000,000 an increase of 100,000,000 Smart Bank Balance Sheet Assets Liabilities Cash (Reserves) 7M Deposits 75 M U.S. Govt Bonds 68 M Total Assets 75 M Total Liabilities 75 M Smart Bank has a required reserve ratio of 5%. The Fed decides to pursue expansionary monetary policy by purchasing $5 million U.S. government bonds from Smart Bank. What is Smart Bank's Excess Reserves after the Fed's transaction? 3,250,000 7,000,000 8,250,000 75,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started