Question

Smart Cars, Inc. is considering launching a new product in the coming year. The new project requires $6,000,000 capital investments at time zero, which will

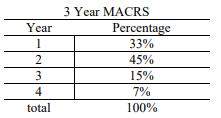

Smart Cars, Inc. is considering launching a new product in the coming year. The new project requires $6,000,000 capital investments at time zero, which will be depreciated based on the 3-year MACRS shown below. This project is expected to generate new sales of $5 million each year with a $2 million cost a year. What is the operating cash flow for year 1 and 2, if the firm’s tax rate is 40%?

3 Year MACRS Percentage Year 1 33% 45% 3 15% 4 7% total 100%

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

OCF1 5 2 1 4 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Douglas Bernheim, Michael Whinston

2nd edition

73375853, 978-0073375854

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App