Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Smart Phone sold 800 cell phones in 2019 at $300 per phone. It has no beginning inventory (BI), the variable operating marketing cost per

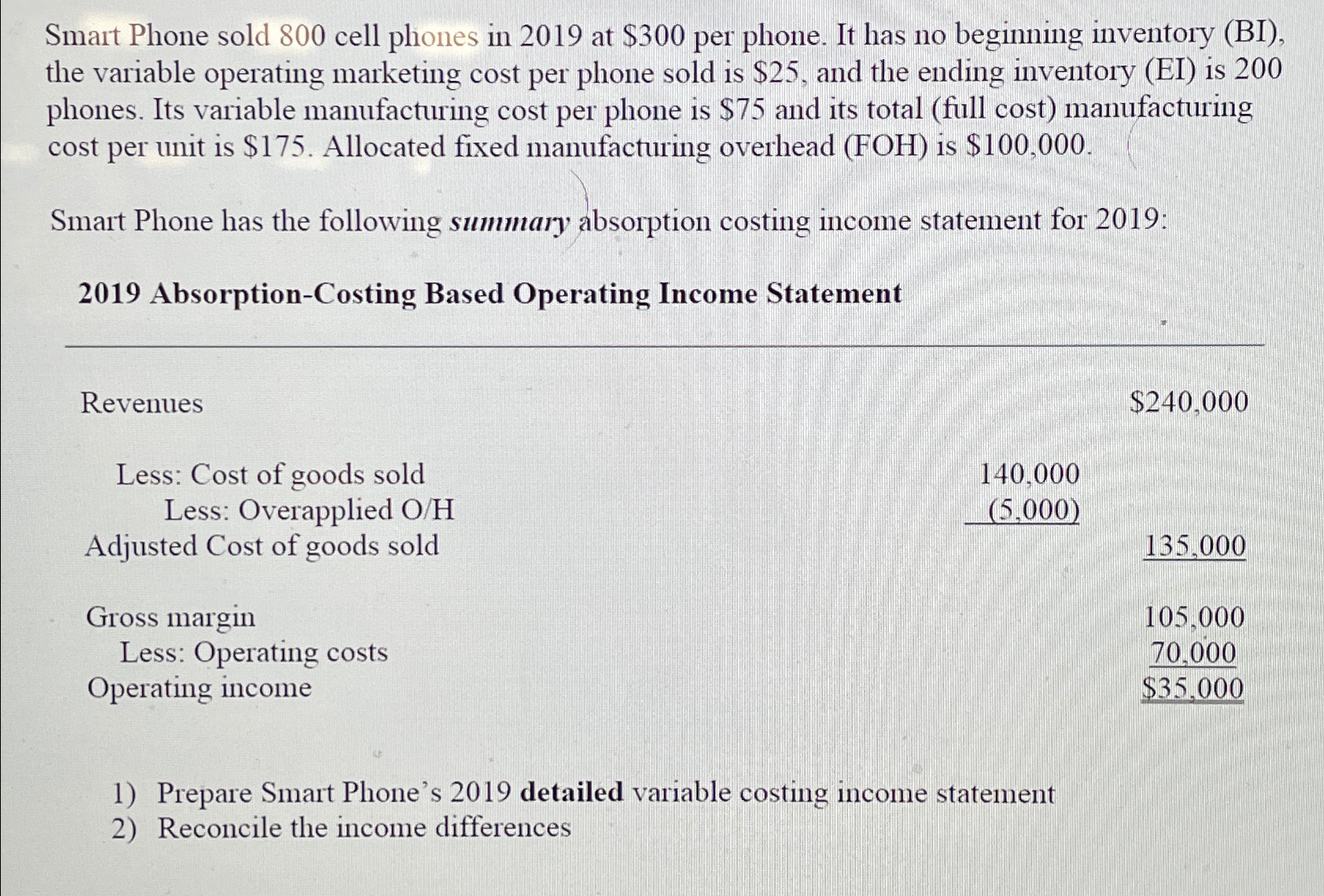

Smart Phone sold 800 cell phones in 2019 at $300 per phone. It has no beginning inventory (BI), the variable operating marketing cost per phone sold is $25, and the ending inventory (EI) is 200 phones. Its variable manufacturing cost per phone is $75 and its total (full cost) manufacturing cost per unit is $175. Allocated fixed manufacturing overhead (FOH) is $100,000. Smart Phone has the following summary absorption costing income statement for 2019: 2019 Absorption-Costing Based Operating Income Statement Revenues Less: Cost of goods sold Less: Overapplied O/H Adjusted Cost of goods sold Gross margin Less: Operating costs $240,000 140.000 (5,000) 135.000 105.000 70.000 $35.000 Operating income 1) Prepare Smart Phone's 2019 detailed variable costing income statement 2) Reconcile the income differences

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets start by preparing Smart Phones 2019 detailed variable costing income statement 2019 Variable C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started