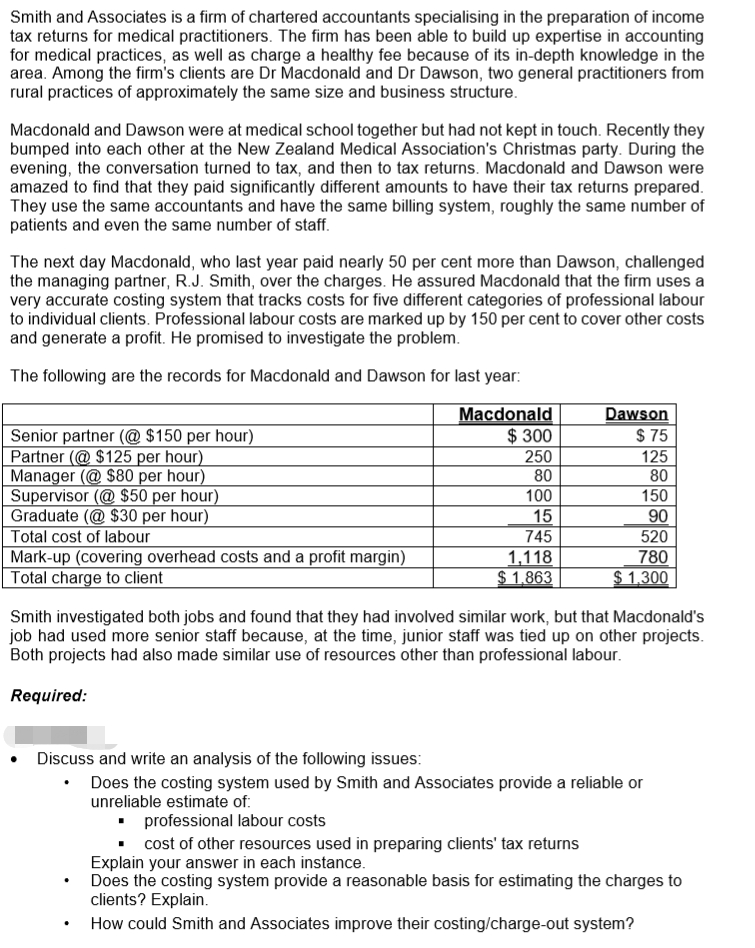

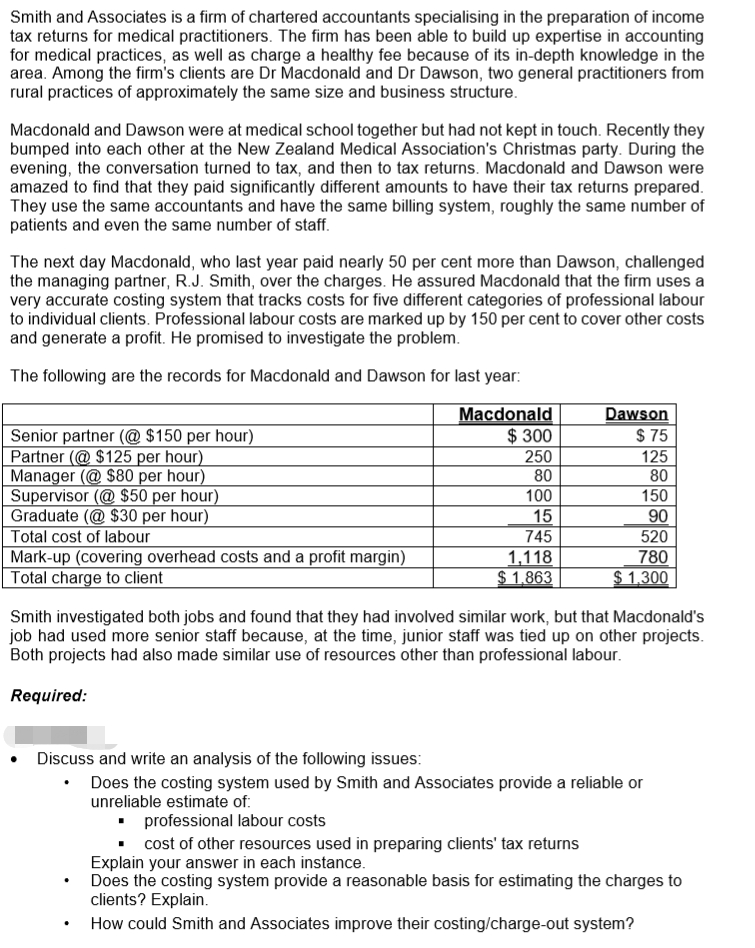

Smith and Associates is a firm of chartered accountants specialising in the preparation of income tax returns for medical practitioners. The firm has been able to build up expertise in accounting for medical practices, as well as charge a healthy fee because of its in-depth knowledge in the area. Among the firm's clients are Dr Macdonald and Dr Dawson, two general practitioners from rural practices of approximately the same size and business structure. Macdonald and Dawson were at medical school together but had not kept in touch. Recently they bumped into each other at the New Zealand Medical Association's Christmas party. During the evening, the conversation turned to tax, and then to tax returns. Macdonald and Dawson were amazed to find that they paid significantly different amounts to have their tax returns prepared. They use the same accountants and have the same billing system, roughly the same number of patients and even the same number of staff. The next day Macdonald, who last year paid nearly 50 per cent more than Dawson, challenged the managing partner, R.J. Smith, over the charges. He assured Macdonald that the firm uses a very accurate costing system that tracks costs for five different categories of professional labour to individual clients. Professional labour costs are marked up by 150 per cent to cover other costs and generate a profit. He promised to investigate the problem. The following are the records for Macdonald and Dawson for last year: Dawson $ 75 125 80 Senior partner (@ $150 per hour) Partner @ $125 per hour) Manager (@ $80 per hour) Supervisor (@ $50 per hour) Graduate (@ $30 per hour) Total cost of labour Mark-up (covering overhead costs and a profit margin) Total charge to client Macdonald $ 300 250 80 100 15 745 1.118 $ 1.863 150 90 520 780 $ 1.300 . 863 Smith investigated both jobs and found that they had involved similar work, but that Macdonald's job had used more senior staff because, at the time, junior staff was tied up on other projects. Both projects had also made similar use of resources other than professional labour. Required: Discuss and write an analysis of the following issues Does the costing system used by Smith and Associates provide a reliable or unreliable estimate of: professional labour costs cost of other resources used in preparing clients' tax returns Explain your answer in each instance. Does the costing system provide a reasonable basis for estimating the charges to clients? Explain. How could Smith and Associates improve their costing/charge-out system