Answered step by step

Verified Expert Solution

Question

1 Approved Answer

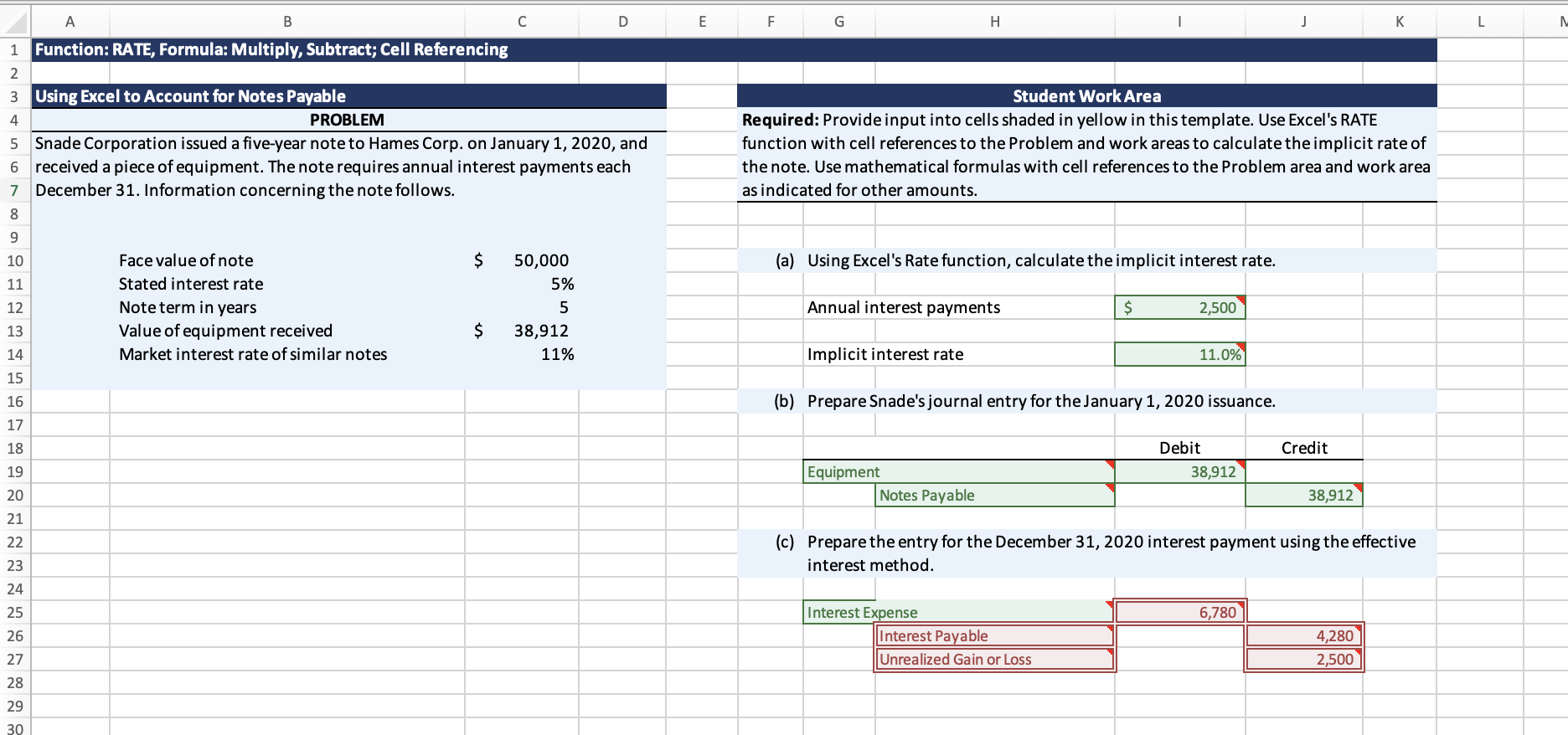

Snade Corporation issued a five-year note to Hames Corp. on January 1, 2020, and received a piece of equipment. The note requires annual interest payments

Snade Corporation issued a five-year note to Hames Corp. on January 1, 2020, and received a piece of equipment. The note requires annual interest payments each December 31. Information concerning the note follows.

| Face value of note | $50,000 |

| Stated interest rate | 5% |

| Note term in years | 5 |

| Value of equipment received | $38,912 |

| Market interest rate of similar notes | 11% |

C. Prepare the entry for the December 31, 2020 interest payment using the effective interest method.

C. Prepare the entry for the December 31, 2020 interest payment using the effective interest method.

Function: RATE, Formula: Multiply, Subtract; Cell Referencing Using Excel to Account for Notes Payable PROBLEM Snade Corporation issued a five-year note to Hames Corp. on January 1, 2020, and received a piece of equipment. The note requires annual interest payments each December 31. Information concerning the note follows. Face value of note Stated interest rate Note term in years Value of equipment received Market interest rate of similar notes $50,000 5%538,91211% Student Work Area Required: Provide input into cells shaded in yellow in this template. Use Excel's RATE function with cell references to the Problem and work areas to calculate the implicit rate of the note. Use mathematical formulas with cell references to the Problem area and work area as indicated for other amounts. (a) Using Excel's Rate function, calculate the implicit interest rate. \begin{tabular}{|l|l|} \hline \multicolumn{1}{|l|}{ Annual interest payments } & $ \\ \hline Implicit interest rate & 2,500 \\ \hline \end{tabular} (b) Prepare Snade's journal entry for the January 1, 2020 issuance. \begin{tabular}{|l|l|r|r|} \hline \multicolumn{2}{|c|}{} & & \\ \hline \multicolumn{2}{|l|}{ Equipment } & Debit & Credit \\ \hline \multicolumn{1}{|c|}{ Notes Payable } & 38,912 & \\ \hline & & 38,912 \\ \hline \end{tabular} (c) Prepare the entry for the December 31, 2020 interest payment using the effective interest method. \begin{tabular}{|l||l|r|r|} \hline Interest Expense & 6,780 & \\ \hline & Interest Payable & & \\ \hline & Unrealized Gain or Loss & 4,280 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started