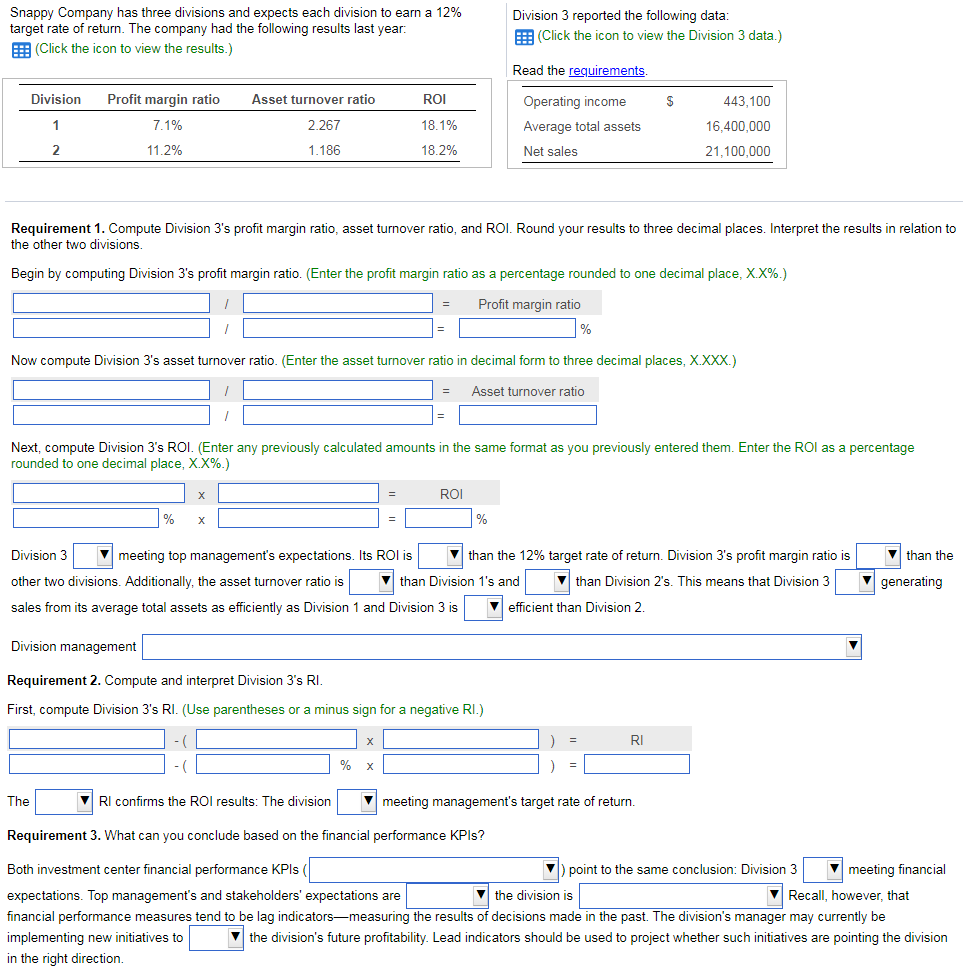

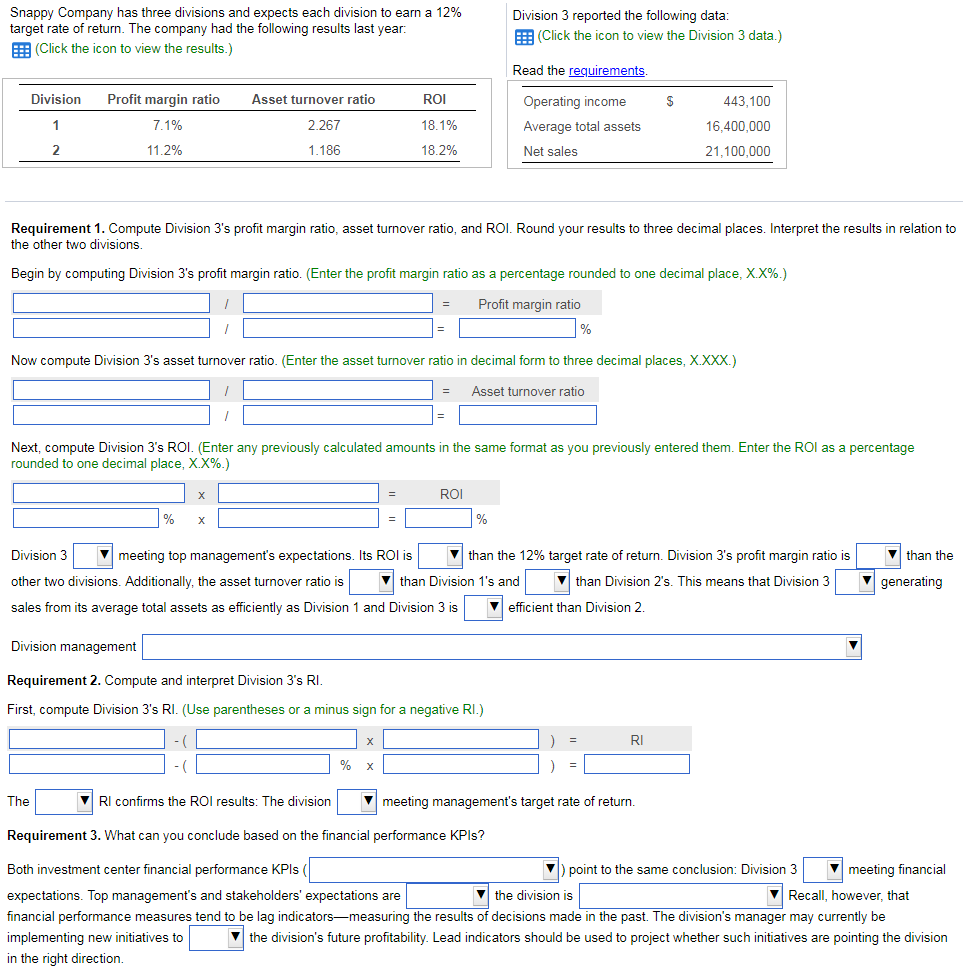

Snappy Company has three divisions and expects each division to earn a 12% target rate of return. The company had the following results last year: EE (Click the icon to view the results.) Division 3 reported the following data EE (Click the icon to view the Division 3 data.) Read the requirements ROI 18.1% 18.2% Division Profit margin ratio 7.1% 11.2% Asset turnover ratio Operating income Average total assets Net sales 443,100 16,400,000 21,100,000 2.267 1.186 Requirement 1. Compute Division 3's profit margin ratio, asset turnover ratio, and ROl. Round your results to three decimal places. Interpret the results in relation to the other two divisions Begin by computing Division 3's profit margin ratio. Enter the profit margin ratio as a percentage rounded to one decimal place. XX%. - Profit margin ratio Now compute Division 3's asset turnover ratio. (Enter the asset turnover ratio in decimal form to three decimal places, X.XXX.) Asset turnover ratio Next, compute Division 3's ROl. (Enter any previously calculated amounts in the same format as you previously entered them. Enter the ROl as a percentage rounded to one decimal place, XX%.) ROI Division 3 ? meeting top management's expectations. Its ROI IS ? than the 12% target rate of return. Division 3's profit margin ratio is other two divisions. Additionally, the asset turnover ratio is | ?| than Division 1's and | ?| than Division 2's. This means that Division 3 | sales from its average total assets as efficiently as Division 1 and Division 3 is efficient than Division 2. Division management Requirement 2. Compute and interpret Division 3's Rl First, compute Division 3's RI. (Use parentheses or a minus sign for a negative RI.) ? than the ? generating RI The ?RI confirms the ROI results. The division ?| meeting management's target rate of return. Requirement 3. What can you conclude based on the financial performance KPls? V) point to the same conclusion: Division 3 meeting financial Recall, however, that Both investment center financial performance KPls ( expectations. Top management's and stakeholders' expectations are financial performance measures tend to be lag indicators-measuring the results of decisions made in the past. The division's manager may currently be implementing new initiatives to in the right direction. Vthe division is ?| the division's future profitability. Lead indicators should be used to project whether such initiatives are pointing the division