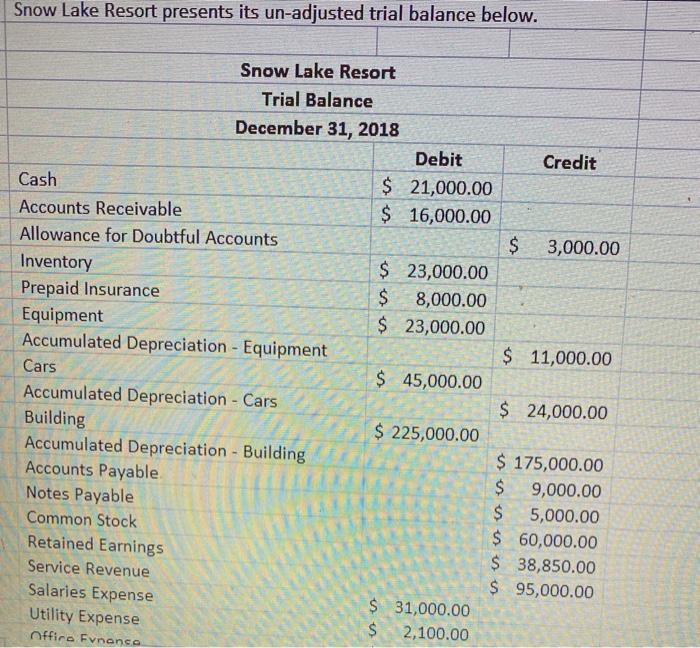

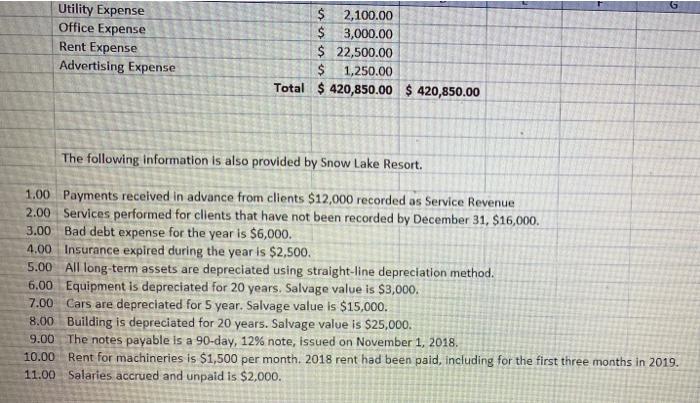

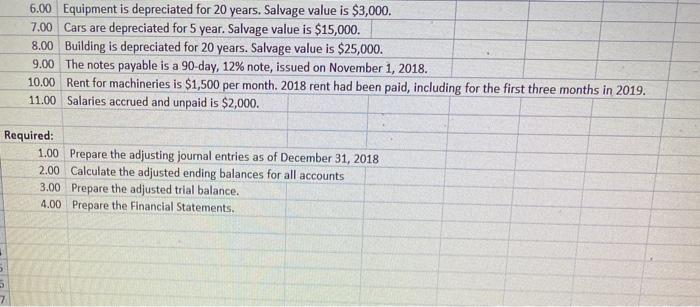

Snow Lake Resort presents its un-adjusted trial balance below. Credit $ 3,000.00 Snow Lake Resort Trial Balance December 31, 2018 Debit Cash $ 21,000.00 Accounts Receivable $ 16,000.00 Allowance for Doubtful Accounts Inventory $ 23,000.00 Prepaid Insurance $ 8,000.00 Equipment $ 23,000.00 Accumulated Depreciation - Equipment Cars $ 45,000.00 Accumulated Depreciation - Cars Building $ 225,000.00 Accumulated Depreciation - Building Accounts Payable Notes Payable Common Stock Retained Earnings Service Revenue Salaries Expense $ 31,000.00 Utility Expense 2,100.00 Office Fvnanse $ 11,000.00 $ 24,000.00 $ 175,000.00 $ 9,000.00 $ 5,000.00 $ 60,000.00 $ 38,850.00 $ 95,000.00 $ G Utility Expense Office Expense Rent Expense Advertising Expense $ 2,100.00 $ 3,000.00 $ 22,500.00 $ 1,250.00 Total $ 420,850.00 $ 420,850.00 The following information is also provided by Snow Lake Resort 1.00 Payments received in advance from clients $12,000 recorded as Service Revenue 2.00 Services performed for clients that have not been recorded by December 31, $16,000. 3.00 Bad debt expense for the year is $6,000. 4.00 Insurance expired during the year is $2,500. 5.00 All long term assets are depreciated using straight-line depreciation method. 6.00 Equipment is depreciated for 20 years. Salvage value is $3,000. 7.00 Cars are depreciated for 5 year. Salvage value is $15,000. 8.00 Building is depreciated for 20 years. Salvage value is $25,000. 9.00 The notes payable is a 90-day, 12% note, issued on November 1, 2018 10.00 Rent for machineries is $1,500 per month. 2018 rent had been paid, including for the first three months in 2019. 11.00 Salaries accrued and unpaid is $2,000. 6.00 Equipment is depreciated for 20 years. Salvage value is $3,000. 7.00 Cars are depreciated for 5 year. Salvage value is $15,000. 8.00 Building is depreciated for 20 years. Salvage value is $25,000. 9.00 The notes payable is a 90-day, 12% note, issued on November 1, 2018. 10.00 Rent for machineries is $1,500 per month. 2018 rent had been paid, including for the first three months in 2019. 11.00 Salaries accrued and unpaid is $2,000. Required: 1.00 Prepare the adjusting journal entries as of December 31, 2018 2.00 Calculate the adjusted ending balances for all accounts 3.00 Prepare the adjusted trial balance. 4.00 Prepare the Financial Statements. 3 7