Answered step by step

Verified Expert Solution

Question

1 Approved Answer

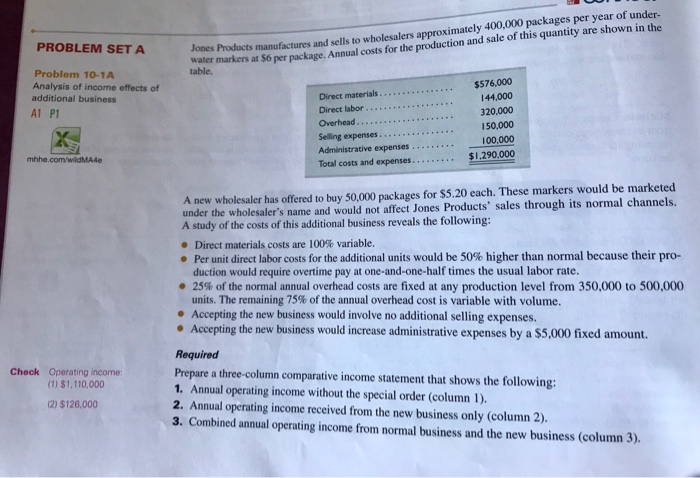

So I need someone to solve this question. First photo is all you need to know to solve this problem and whats required to solve.

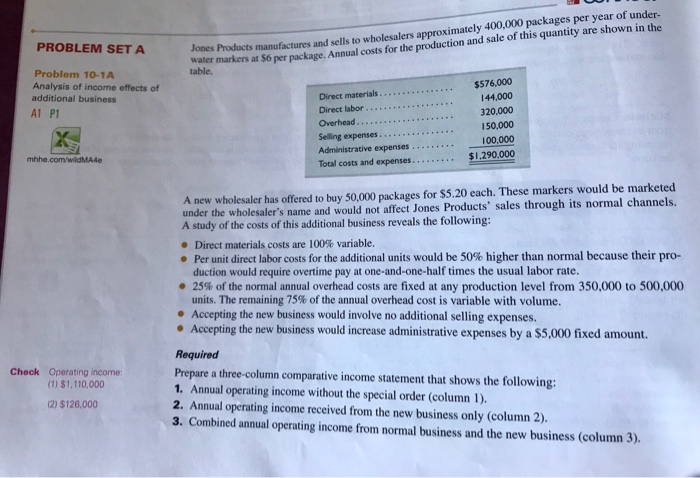

So I need someone to solve this question. First photo is all you need to know to solve this problem and whats required to solve. 2nd picture is the empty chart where you got to fill every spot with all the calculation of this problem. PLEASE ANSWER ALL THE QUESTIONS and fill every blank that I have in the second picture. To check the results in the first picture it gives 2 answers and they must match your operating income otherwise its wrong. PLEASE HELP ME! THANKS. NEED IT ASAP.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started