Answered step by step

Verified Expert Solution

Question

1 Approved Answer

So Solid Ltd. makes bespoke furniture for high-end homes. The company has three factories across Britain and is considering what to do with these operations.

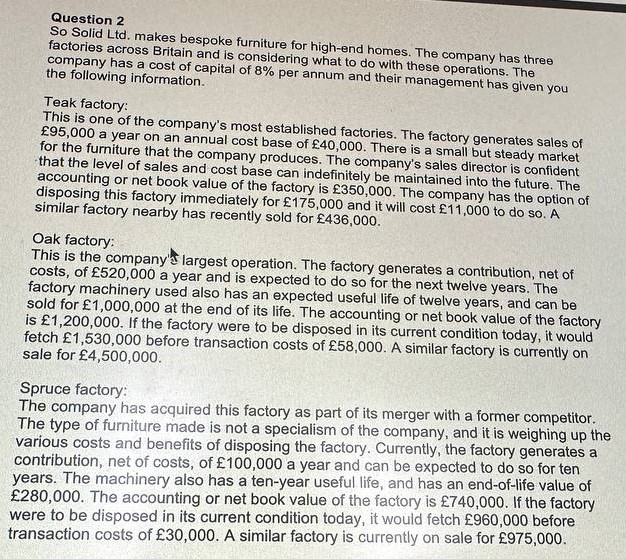

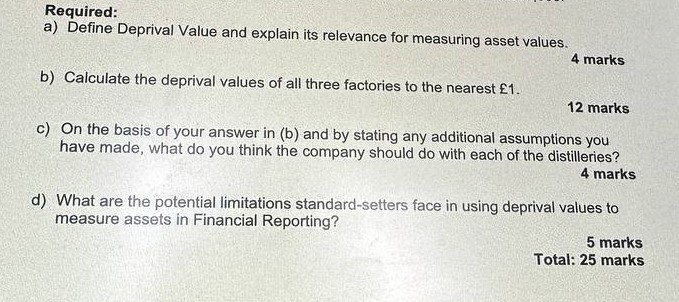

So Solid Ltd. makes bespoke furniture for high-end homes. The company has three factories across Britain and is considering what to do with these operations. The the following information. 8% per annum and their management has given you Teak factory: This is one of the company's most established factories. The factory generates sales of 95,000 a year on an annual cost base of 40,000. There is a small but steady market for the furniture that the company produces. The company's sales director is confident that the level of sales and cost base can indefinitely be maintained into the future. The accounting or net book value of the factory is 350,000. The company has the option of disposing this factory immediately for 175,000 and it will cost 11,000 to do so. A similar factory nearby has recently sold for 436,000. Oak factory: This is the company'i largest operation. The factory generates a contribution, net of costs, of 520,000 a year and is expected to do so for the next twelve years. The factory machinery used also has an expected useful life of twelve years, and can be sold for 1,000,000 at the end of its life. The accounting or net book value of the factory is 1,200,000. If the factory were to be disposed in its current condition today, it would fetch 1,530,000 before transaction costs of 58,000. A similar factory is currently on sale for 4,500,000. Spruce factory: The company has acquired this factory as part of its merger with a former competitor. The type of furniture made is not a specialism of the company, and it is weighing up the various costs and benefits of disposing the factory. Currently, the factory generates a contribution, net of costs, of 100,000 a year and can be expected to do so for ten vears. The machinery also has a ten-year useful life, and has an end-of-life value of 2280,000 . The accounting or net book value of the factory is 740,000. If the factory vere to be disposed in its current condition today, it would fetch 960,000 before ransaction costs of 30,000. A similar factory is currently on sale for 975,000. Required: a) Define Deprival Value and explain its relevance for measuring asset values. 4 marks b) Calculate the deprival values of all three factories to the nearest 1. 12 marks c) On the basis of your answer in (b) and by stating any additional assumptions you have made, what do you think the company should do with each of the distilleries? 4 marks d) What are the potential limitations standard-setters face in using deprival values to measure assets in Financial Reporting? 5 marks Total: 25 marks So Solid Ltd. makes bespoke furniture for high-end homes. The company has three factories across Britain and is considering what to do with these operations. The the following information. 8% per annum and their management has given you Teak factory: This is one of the company's most established factories. The factory generates sales of 95,000 a year on an annual cost base of 40,000. There is a small but steady market for the furniture that the company produces. The company's sales director is confident that the level of sales and cost base can indefinitely be maintained into the future. The accounting or net book value of the factory is 350,000. The company has the option of disposing this factory immediately for 175,000 and it will cost 11,000 to do so. A similar factory nearby has recently sold for 436,000. Oak factory: This is the company'i largest operation. The factory generates a contribution, net of costs, of 520,000 a year and is expected to do so for the next twelve years. The factory machinery used also has an expected useful life of twelve years, and can be sold for 1,000,000 at the end of its life. The accounting or net book value of the factory is 1,200,000. If the factory were to be disposed in its current condition today, it would fetch 1,530,000 before transaction costs of 58,000. A similar factory is currently on sale for 4,500,000. Spruce factory: The company has acquired this factory as part of its merger with a former competitor. The type of furniture made is not a specialism of the company, and it is weighing up the various costs and benefits of disposing the factory. Currently, the factory generates a contribution, net of costs, of 100,000 a year and can be expected to do so for ten vears. The machinery also has a ten-year useful life, and has an end-of-life value of 2280,000 . The accounting or net book value of the factory is 740,000. If the factory vere to be disposed in its current condition today, it would fetch 960,000 before ransaction costs of 30,000. A similar factory is currently on sale for 975,000. Required: a) Define Deprival Value and explain its relevance for measuring asset values. 4 marks b) Calculate the deprival values of all three factories to the nearest 1. 12 marks c) On the basis of your answer in (b) and by stating any additional assumptions you have made, what do you think the company should do with each of the distilleries? 4 marks d) What are the potential limitations standard-setters face in using deprival values to measure assets in Financial Reporting? 5 marks Total: 25 marks

So Solid Ltd. makes bespoke furniture for high-end homes. The company has three factories across Britain and is considering what to do with these operations. The the following information. 8% per annum and their management has given you Teak factory: This is one of the company's most established factories. The factory generates sales of 95,000 a year on an annual cost base of 40,000. There is a small but steady market for the furniture that the company produces. The company's sales director is confident that the level of sales and cost base can indefinitely be maintained into the future. The accounting or net book value of the factory is 350,000. The company has the option of disposing this factory immediately for 175,000 and it will cost 11,000 to do so. A similar factory nearby has recently sold for 436,000. Oak factory: This is the company'i largest operation. The factory generates a contribution, net of costs, of 520,000 a year and is expected to do so for the next twelve years. The factory machinery used also has an expected useful life of twelve years, and can be sold for 1,000,000 at the end of its life. The accounting or net book value of the factory is 1,200,000. If the factory were to be disposed in its current condition today, it would fetch 1,530,000 before transaction costs of 58,000. A similar factory is currently on sale for 4,500,000. Spruce factory: The company has acquired this factory as part of its merger with a former competitor. The type of furniture made is not a specialism of the company, and it is weighing up the various costs and benefits of disposing the factory. Currently, the factory generates a contribution, net of costs, of 100,000 a year and can be expected to do so for ten vears. The machinery also has a ten-year useful life, and has an end-of-life value of 2280,000 . The accounting or net book value of the factory is 740,000. If the factory vere to be disposed in its current condition today, it would fetch 960,000 before ransaction costs of 30,000. A similar factory is currently on sale for 975,000. Required: a) Define Deprival Value and explain its relevance for measuring asset values. 4 marks b) Calculate the deprival values of all three factories to the nearest 1. 12 marks c) On the basis of your answer in (b) and by stating any additional assumptions you have made, what do you think the company should do with each of the distilleries? 4 marks d) What are the potential limitations standard-setters face in using deprival values to measure assets in Financial Reporting? 5 marks Total: 25 marks So Solid Ltd. makes bespoke furniture for high-end homes. The company has three factories across Britain and is considering what to do with these operations. The the following information. 8% per annum and their management has given you Teak factory: This is one of the company's most established factories. The factory generates sales of 95,000 a year on an annual cost base of 40,000. There is a small but steady market for the furniture that the company produces. The company's sales director is confident that the level of sales and cost base can indefinitely be maintained into the future. The accounting or net book value of the factory is 350,000. The company has the option of disposing this factory immediately for 175,000 and it will cost 11,000 to do so. A similar factory nearby has recently sold for 436,000. Oak factory: This is the company'i largest operation. The factory generates a contribution, net of costs, of 520,000 a year and is expected to do so for the next twelve years. The factory machinery used also has an expected useful life of twelve years, and can be sold for 1,000,000 at the end of its life. The accounting or net book value of the factory is 1,200,000. If the factory were to be disposed in its current condition today, it would fetch 1,530,000 before transaction costs of 58,000. A similar factory is currently on sale for 4,500,000. Spruce factory: The company has acquired this factory as part of its merger with a former competitor. The type of furniture made is not a specialism of the company, and it is weighing up the various costs and benefits of disposing the factory. Currently, the factory generates a contribution, net of costs, of 100,000 a year and can be expected to do so for ten vears. The machinery also has a ten-year useful life, and has an end-of-life value of 2280,000 . The accounting or net book value of the factory is 740,000. If the factory vere to be disposed in its current condition today, it would fetch 960,000 before ransaction costs of 30,000. A similar factory is currently on sale for 975,000. Required: a) Define Deprival Value and explain its relevance for measuring asset values. 4 marks b) Calculate the deprival values of all three factories to the nearest 1. 12 marks c) On the basis of your answer in (b) and by stating any additional assumptions you have made, what do you think the company should do with each of the distilleries? 4 marks d) What are the potential limitations standard-setters face in using deprival values to measure assets in Financial Reporting? 5 marks Total: 25 marks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started