Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Soalan 3 Question 3 a) Sebuah syarikat pembuatan simen telah membeli sebuah mesin yang merupakan asset penting dalam penghasilan simen. Kos asas pembelian asset tersebut

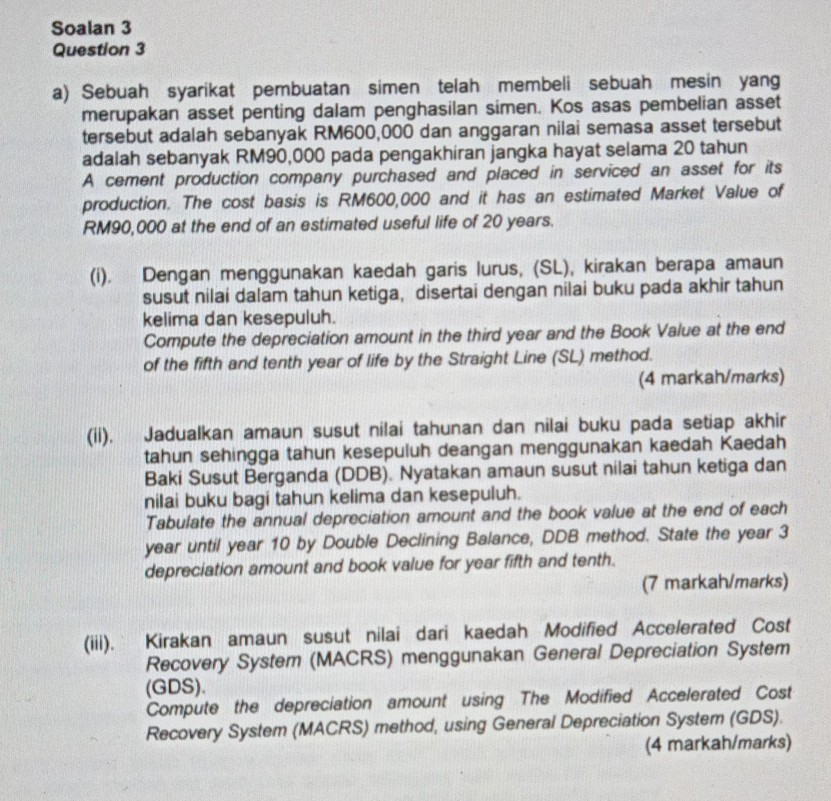

Soalan 3 Question 3 a) Sebuah syarikat pembuatan simen telah membeli sebuah mesin yang merupakan asset penting dalam penghasilan simen. Kos asas pembelian asset tersebut adalah sebanyak RM600,000 dan anggaran nilai semasa asset tersebut adalah sebanyak RM90,000 pada pengakhiran jangka hayat selama 20 tahun A cement production company purchased and placed in serviced an asset for its production. The cost basis is RM600,000 and it has an estimated Market Value of RM90,000 at the end of an estimated useful life of 20 years () susut nilai dalam tahun ketiga, disertai dengan nilai buku pada akhir tahun kelima dan kesepuluh. Compute the depreciation amount in the third year and the Book Value at the end of the fifth and tenth year of life by the Straight Line (SL) method Dengan menggunakan kaedah garis lurus, (SL), kirakan berapa amaun (4 markah/marks) (i). Jadualkan amaun susut nilai tahunan dan nilai buku pada setiap akhir tahun sehingga tahun kesepuluh deangan menggunakan kaedah Kaedah Baki Susut Berganda (DDB). Nyatakan amaun susut nilai tahun ketiga dan nilai buku bagi tahun kelima dan kesepuluh. Tabulate the annual depreciation amount and the book value at the end of each year until year 10 by Double Declining Balance, DDB method. State the year 3 depreciation amount and book value for year fifth and tenth (7 markah/marks) Kirakan amaun susut nilai dari kaedah Modified Accelerated Cost (i). Recovery System (MACRS) menggunakan General Depreciation System (GDS). Compute the depreciation amount using The Modified Accelerated Cost Recovery System (MACRS) method, using General Depreciation System (GDS) (4 markah/marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started