Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sofea has a job as a manager in a bakery in Shah Alam earning RM30,000 a year. She is considering to take another job

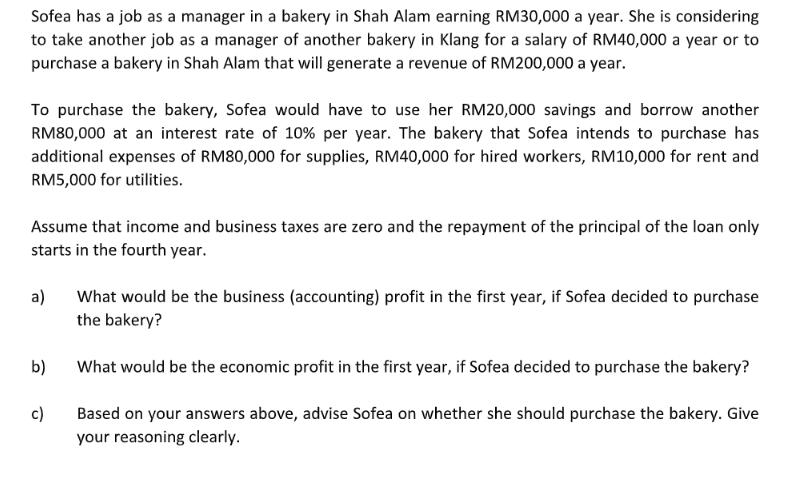

Sofea has a job as a manager in a bakery in Shah Alam earning RM30,000 a year. She is considering to take another job as a manager of another bakery in Klang for a salary of RM40,000 a year or to purchase a bakery in Shah Alam that will generate a revenue of RM200,000 a year. To purchase the bakery, Sofea would have to use her RM20,000 savings and borrow another RM80,000 at an interest rate of 10% per year. The bakery that Sofea intends to purchase has additional expenses of RM80,000 for supplies, RM40,000 for hired workers, RM10,000 for rent and RM5,000 for utilities. Assume that income and business taxes are zero and the repayment of the principal of the loan only starts in the fourth year. a) b) c) What would be the business (accounting) profit in the first year, if Sofea decided to purchase the bakery? What would be the economic profit in the first year, if Sofea decided to purchase the bakery? Based on your answers above, advise Sofea on whether she should purchase the bakery. Give your reasoning clearly.

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the business accounting profit and economic profit for Sofeas bakery purchase decision well need to consider the revenues and expenses as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started