Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solarvest was co-founded by Lim Chin Siu, Tan Chyi Boon, and Tan Paw Boon in 2012 as a provider of PV solutions. The company

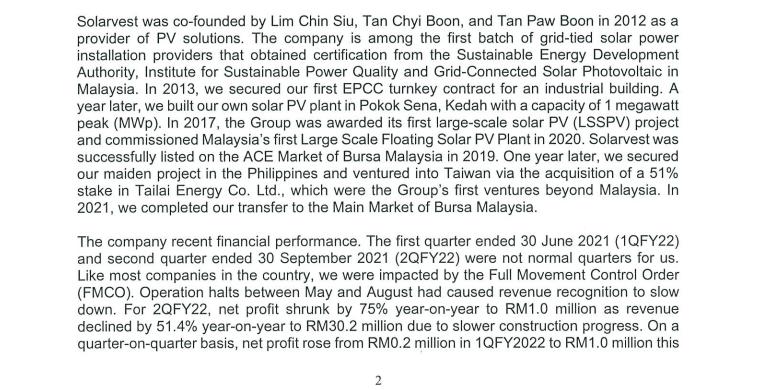

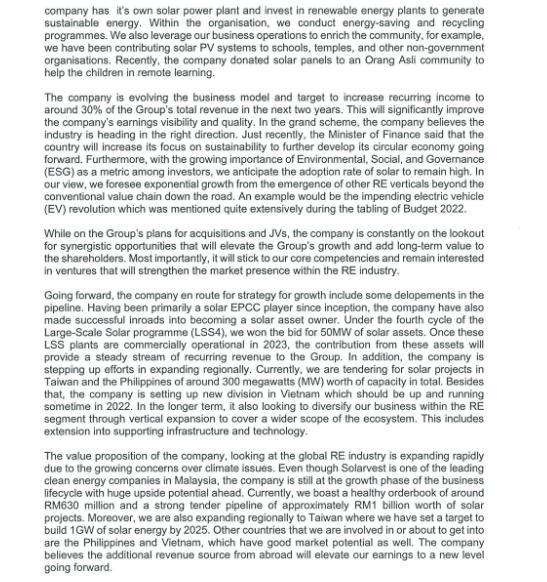

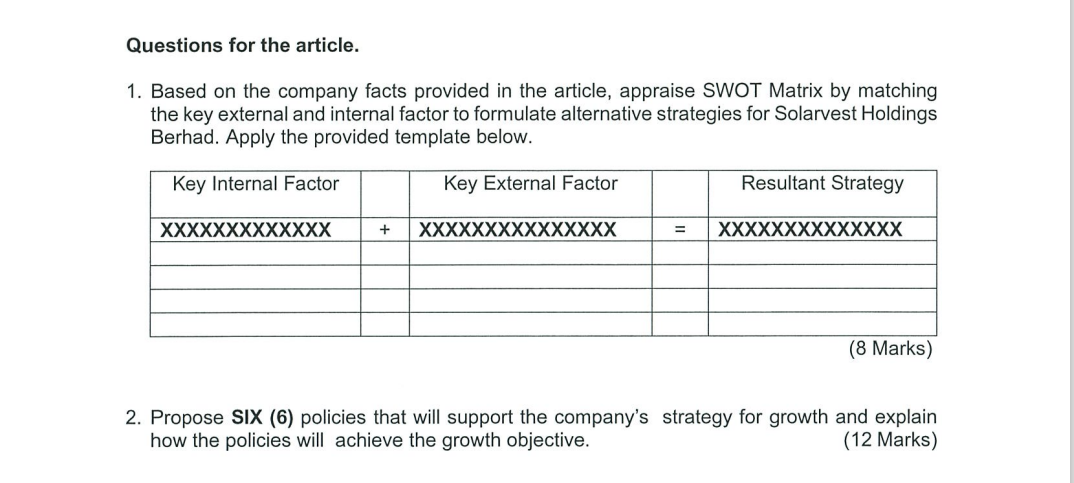

Solarvest was co-founded by Lim Chin Siu, Tan Chyi Boon, and Tan Paw Boon in 2012 as a provider of PV solutions. The company is among the first batch of grid-tied solar power installation providers that obtained certification from the Sustainable Energy Development Authority, Institute for Sustainable Power Quality and Grid-Connected Solar Photovoltaic in Malaysia. In 2013, we secured our first EPCC turnkey contract for an industrial building. A year later, we built our own solar PV plant in Pokok Sena, Kedah with a capacity of 1 megawatt peak (MWp). In 2017, the Group was awarded its first large-scale solar PV (LSSPV) project and commissioned Malaysia's first Large Scale Floating Solar PV Plant in 2020. Solarvest was successfully listed on the ACE Market of Bursa Malaysia in 2019. One year later, we secured our maiden project in the Philippines and ventured into Taiwan via the acquisition of a 51% stake in Tailai Energy Co. Ltd., which were the Group's first ventures beyond Malaysia. In 2021, we completed our transfer to the Main Market of Bursa Malaysia. The company recent financial performance. The first quarter ended 30 June 2021 (1QFY22) and second quarter ended 30 September 2021 (2QFY22) were not normal quarters for us. Like most companies in the country, we were impacted by the Full Movement Control Order (FMCO). Operation halts between May and August had caused revenue recognition to slow down. For 2QFY22, net profit shrunk by 75% year-on-year to RM1.0 million as revenue declined by 51.4% year-on-year to RM30.2 million due to slower construction progress. On a quarter-on-quarter basis, net profit rose from RM0.2 million in 1QFY2022 to RM1.0 million this 2 company has it's own solar power plant and invest in renewable energy plants to generate sustainable energy. Within the organisation, we conduct energy-saving and recycling programmes. We also leverage our business operations to enrich the community, for example, we have been contributing solar PV systems to schools, temples, and other non-government organisations. Recently, the company donated solar panels to an Orang Asli community to help the children in remote learning. The company is evolving the business model and target to increase recurring income to around 30% of the Group's total revenue in the next two years. This will significantly improve the company's earnings visibility and quality. In the grand scheme, the company believes the industry is heading in the right direction. Just recently, the Minister of Finance said that the country will increase its focus on sustainability to further develop its circular economy going forward. Furthermore, with the growing importance of Environmental, Social, and Governance (ESG) as a metric among investors, we anticipate the adoption rate of solar to remain high. In our view, we foresee exponential growth from the emergence of other RE verticals beyond the conventional value chain down the road. An example would be the impending electric vehicle (EV) revolution which was mentioned quite extensively during the tabling of Budget 2022. While on the Group's plans for acquisitions and JVs, the company is constantly on the lookout for synergistic opportunities that will elevate the Group's growth and add long-term value to the shareholders. Most importantly, it will stick to our core competencies and remain interested in ventures that will strengthen the market presence within the RE industry. Going forward, the company en route for strategy for growth include some delopements in the pipeline. Having been primarily a solar EPCC player since inception, the company have also made successful inroads into becoming a solar asset owner. Under the fourth cycle of the Large-Scale Solar programme (LSS4), we won the bid for 50MW of solar assets. Once these LSS plants are commercially operational in 2023, the contribution from these assets will provide a steady stream of recurring revenue to the Group. In addition, the company is stepping up efforts in expanding regionally. Currently, we are tendering for solar projects in Taiwan and the Philippines of around 300 megawatts (MW) worth of capacity in total. Besides that, the company is setting up new division in Vietnam which should be up and running sometime in 2022. In the longer term, it also looking to diversify our business within the RE segment through vertical expansion to cover a wider scope of the ecosystem. This includes extension into supporting infrastructure and technology. The value proposition of the company, looking at the global RE industry is expanding rapidly due to the growing concerns over climate issues. Even though Solarvest is one of the leading clean energy companies in Malaysia, the company is still at the growth phase of the business lifecycle with huge upside potential ahead. Currently, we boast a healthy orderbook of around RM630 million and a strong tender pipeline of approximately RM1 billion worth of solar projects. Moreover, we are also expanding regionally to Taiwan where we have set a target to build 1GW of solar energy by 2025. Other countries that we are involved in or about to get into are the Philippines and Vietnam, which have good market potential as well. The company believes the additional revenue source from abroad will elevate our earnings to a new level going forward. Questions for the article. 1. Based on the company facts provided in the article, appraise SWOT Matrix by matching the key external and internal factor to formulate alternative strategies for Solarvest Holdings Berhad. Apply the provided template below. Key Internal Factor Key External Factor XXXXXXXXXXXXX XXXXXXXXXXXXXXX + = Resultant Strategy XXXXXXXXXXXXXX (8 Marks) 2. Propose SIX (6) policies that will support the company's strategy for growth and explain how the policies will achieve the growth objective. (12 Marks)

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 SWOT Matrix for Solarvest Holdings Berhad Key Internal Factor 1 Strong expertise in solar EPCC Engineering Procurement Construction and Commissioning services 2 Existing solar PV plant and ownership ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started