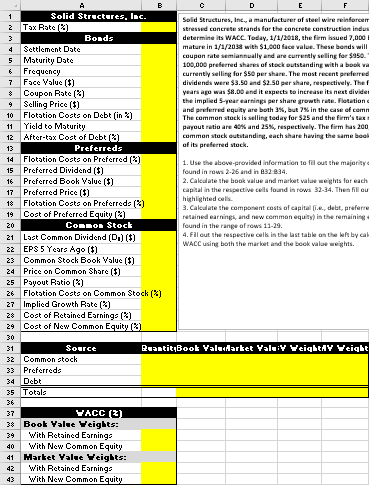

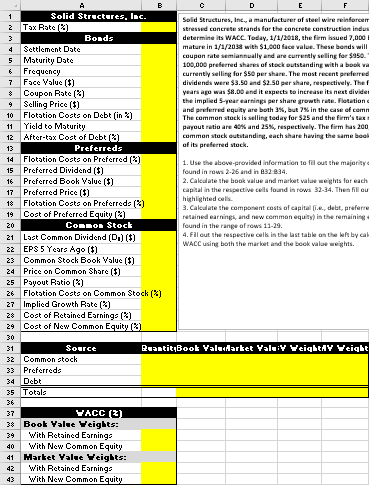

Solid Structures, Inc., a manufacturer of steel wire reinforcements and pre-stressed concrete strands for the concrete construction industry, wants to determine its WACC. Today, 1/1/2018, the firm issued 7,000 bonds that will mature in 1/1/2038 with $1,000 face value. These bonds will pay a 9% coupon rate semiannually and are currently selling for $950. The firm has 100,000 preferred shares of stock outstanding with a book value of $40, but currently selling for $50 per share. The most recent preferred and common dividends were $3.50 and $2.50 per share, respectively. The firms EPS five years ago was $8.00 and it expects to increase its next dividend payment by the implied 5-year earnings per share growth rate. Flotation costs on debt and preferred equity are both 3%, but 7% in the case of common stocks. The common stock is selling today for $25 and the firms tax rate and payout ratio are 40% and 25%, respectively. The firm has 200,000 shares of common stock outstanding, each share having the same book value as that of its preferred stock.

1. Use the above-provided information to fill out the majority of the cells found in rows 2-26 and in B32:B34.

2. Calculate the book value and market value weights for each source of capital in the respective cells found in rows 32-34. Then fill out row 35's highlighted cells.

3. Calculate the component costs of capital (i.e., debt, preferred equity, retained earnings, and new common equity) in the remaining empty cells found in the range of rows 11-29.

4. Fill out the respective cells in the last table on the left by calculating the WACC using both the market and the book value weights.

Solid Strect res, Inc Rate Solid Struetures, Inc., a manufacturer of steel wire reinforcem stressed concrete strands for the concrete construction indus debermine its WACE Today. 1/1218, the firm sued 7,000 mature in 11/2033 with $1,000 face value. These bonds will coupon rate semiannually and are currently selling for $as0 0dOdpreferred shares of stock outstanding with a book v currently selling for $50 per share. The most recent preferred dividends were $3.50 and $2.50 per share, respectively. The f years ago was $8.00nd it espects to increase its next divider the implied 5-year earnings per share growth rate. Flotation e and preferred equay are both 3%, but 7% in the case of comm The common stock is selling today for $25 and the firm's payout ratio are 40% and 25%, respectively. The Firm has 200 common stock outitanding, each share having the same boak of its preferred stuck. Bonds 4 ettlement Date 5 Maturity Date 6 Frequency 7 Face Value (3) 9 Selling Price ) Flotation Costs on Debt (in %) Yield to Maturity 11 12 I Aftcr-tax Cost of Debt?%) Preferreds 14 Flotation Costs on Preferred (% 15 Preferred Dividend () 16 Preferred Book Value () 17 Preferred Price ($ 18 Flotation Costs on Preferreds (%) 19 Cost of Preferred Equity [%) . Use the abowe-provided information to fil out the majonty d in 832 834 2. Caelate the book value and market vale eghts for each capital in the respective cels found in rows 32-34. Th fil ou highlighted cels. 3. Cakelate the compent costs of capital [.,debt, preferre etained earnings, and new common equinheremaining found in the r 4. Fill out the respectie cel inthe last tabl on the oft by ea WACC using both the markat and the boek valae weghts. Con on Stock 21 | Last Common Dividend ? 22 EPS 5 Years Ago () 23 Common Stock Book Value (3) 24 Price on Common Share () 25 | Payout Ratio(%) 26 | Flotation Costs on Common Stock(%) 27 | Implied Growth Rate 2* . Cost of Retained Earnings(%) 29 | Cost of New Common Equity 32 Common stock 33 Preferreds 34 Debt TACC 3 with Retained Earnings 40 with New Common Equity 41 Harket Yalse Yeights: 42 ith Retained Earnings 43 With New Common Equit Solid Strect res, Inc Rate Solid Struetures, Inc., a manufacturer of steel wire reinforcem stressed concrete strands for the concrete construction indus debermine its WACE Today. 1/1218, the firm sued 7,000 mature in 11/2033 with $1,000 face value. These bonds will coupon rate semiannually and are currently selling for $as0 0dOdpreferred shares of stock outstanding with a book v currently selling for $50 per share. The most recent preferred dividends were $3.50 and $2.50 per share, respectively. The f years ago was $8.00nd it espects to increase its next divider the implied 5-year earnings per share growth rate. Flotation e and preferred equay are both 3%, but 7% in the case of comm The common stock is selling today for $25 and the firm's payout ratio are 40% and 25%, respectively. The Firm has 200 common stock outitanding, each share having the same boak of its preferred stuck. Bonds 4 ettlement Date 5 Maturity Date 6 Frequency 7 Face Value (3) 9 Selling Price ) Flotation Costs on Debt (in %) Yield to Maturity 11 12 I Aftcr-tax Cost of Debt?%) Preferreds 14 Flotation Costs on Preferred (% 15 Preferred Dividend () 16 Preferred Book Value () 17 Preferred Price ($ 18 Flotation Costs on Preferreds (%) 19 Cost of Preferred Equity [%) . Use the abowe-provided information to fil out the majonty d in 832 834 2. Caelate the book value and market vale eghts for each capital in the respective cels found in rows 32-34. Th fil ou highlighted cels. 3. Cakelate the compent costs of capital [.,debt, preferre etained earnings, and new common equinheremaining found in the r 4. Fill out the respectie cel inthe last tabl on the oft by ea WACC using both the markat and the boek valae weghts. Con on Stock 21 | Last Common Dividend ? 22 EPS 5 Years Ago () 23 Common Stock Book Value (3) 24 Price on Common Share () 25 | Payout Ratio(%) 26 | Flotation Costs on Common Stock(%) 27 | Implied Growth Rate 2* . Cost of Retained Earnings(%) 29 | Cost of New Common Equity 32 Common stock 33 Preferreds 34 Debt TACC 3 with Retained Earnings 40 with New Common Equity 41 Harket Yalse Yeights: 42 ith Retained Earnings 43 With New Common Equit