Question

Solomon Publications established the following standard price and costs for a hardcover picture book that the company produces. Standard price and variable costs Sales price

Solomon Publications established the following standard price and costs for a hardcover picture book that the company produces.

| Standard price and variable costs | |||

| Sales price | $ | 36.70 | |

| Materials cost | 8.60 | ||

| Labor cost | 4.00 | ||

| Overhead cost | 5.50 | ||

| Selling, general, and administrative costs | 6.60 | ||

| Planned fixed costs | |||

| Manufacturing overhead | $ | 135,000 | |

| Selling, general, and administrative | 51,000 | ||

Solomon planned to make and sell 22,000 copies of the book.

Required:

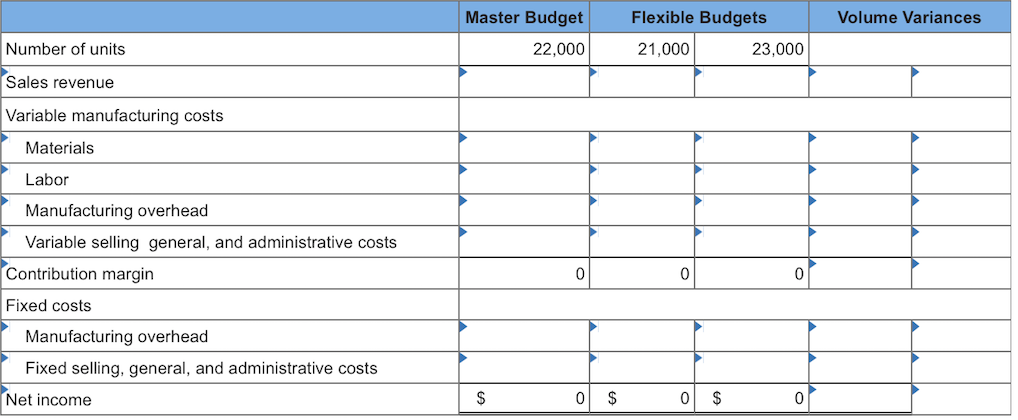

a. - d. Prepare the pro forma income statement that would appear in the master budget and also flexible budget income statements, assuming production volumes of 21,000 and 23,000 units. Determine the sales and variable cost volume variances, assuming volume is actually 23,000 units. Indicate whether the variances are favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).)

Thornton Publications established the following standard price and costs for a hardcover picture book that the company produces.

| Standard price and variable costs | |||

| Sales price | $ | 36.40 | |

| Materials cost | 8.00 | ||

| Labor cost | 3.80 | ||

| Overhead cost | 5.60 | ||

| Selling, general, and administrative costs | 7.00 | ||

| Planned fixed costs | |||

| Manufacturing overhead | $ | 128,000 | |

| Selling, general, and administrative | 50,000 | ||

Assume that Thornton actually produced and sold 28,000 books. The actual sales price and costs incurred follow:

| Actual price and variable costs | |||

| Sales price | $ | 35.40 | |

| Materials cost | 8.20 | ||

| Labor cost | 3.70 | ||

| Overhead cost | 5.65 | ||

| Selling, general, and administrative costs | 6.80 | ||

| Actual fixed costs | |||

| Manufacturing overhead | $ | 113,000 | |

| Selling, general, and administrative | 56,000 | ||

Required

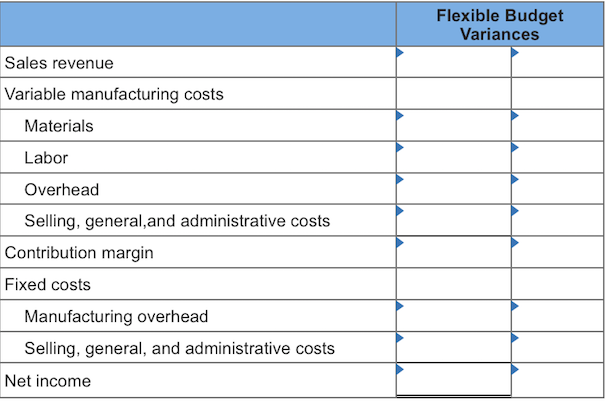

a. & b. Determine the flexible budget variances and also indicate the effect of each variance by selecting favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started