Question

Solution are attached, I just wanna know how to do math, show calculations for these numbers. CLARK COMPANY: Income Statement for Year Ended December 31,

Solution are attached, I just wanna know how to do math, show calculations for these numbers.

CLARK COMPANY: Income Statement for Year Ended December 31, 2019

CLARK COMPANY: Income Statement for Year Ended December 31, 2019

| Sales revenue | $ 1,200 |

| Cost of goods sold | (300) |

| Insurance expense | (30) |

| Bad debt expense | (30) |

| Wages expense | (80) |

| Stock based compensation | (40) |

| Depreciation expense | (50) |

| Patent amortization expense | (20) |

| Interest expense | (50) |

| Loss on sale of land | (10) |

| Gain on sale of building | 30 |

| Impairment loss on land | (20) |

| Gain on bond retirement | 10 |

| Equity method investment income | 70 |

| Restructuring expense | (100) |

| Income tax expense | (140) |

| Net income | $ 440 |

CLARK COMPANY: Balance Sheets for December 31, 2018 and 2019

| Current Assets | 12-31-19 | 12-31-18 | |

| Cash and cash equivalents | $ 160 | $ 110 | |

| Accounts receivable | 340 | 310 | |

| Allowance for uncollectible accounts | (70) | (40) | |

| Marketable securities | 150 | 110 | |

| Inventory | 190 | 170 | |

| Prepaid insurance | 50 | 60 | |

| Non-Current Assets | |||

| Land | 180 | 140 | |

| Buildings | 330 | 370 | |

| Accumulated depreciation buildings | (110) | (100) | |

| Equipment | 230 | 170 | |

| Accumulated depreciation equipment | (70) | (50) | |

| Patents net of accumulated amortization | 140 | 100 | |

| Equity method investment | 110 | 0 | |

| Total Assets | $ 1,630 | $ 1,350 | |

| Current Liabilities | |||

| Accounts payable | $60 | $30 | |

| Wages payable | 30 | 20 | |

| Interest payable | 20 | 40 | |

| Income tax payable | 20 | 60 | |

| Non-Current Liabilities | |||

| Restructuring Liability | 70 | 0 | |

| Bonds payable | 200 | 330 | |

| Deferred income taxes | 140 | 110 | |

| Shareholders Equity | |||

| Preferred stock (par) | 130 | 0 | |

| Common stock (par) | 300 | 270 | |

| Additional paid in capital - common stock | 800 | 600 | |

| Treasury common stock | (270) | (210) | |

| Retained earnings | 130 | 100 | |

| Total Liabilities and Shareholders Equity | $1,630 | $ 1,350 |

ADDITIONAL DATA FOR 2019

- Purchased marketable securities. Regarding marketable securities at the beginning of the year, none were sold and their market value did not change during the year.

- Sold for cash some land that had cost $50. Also purchased other land that was judged to be impaired at year end.

- Sold for cash a building that had cost $70 and had a book value of $50. Also purchased a building.

- Purchased equipment for cash. Did not sell any equipment.

- Did not sell any patents. Obtained a patent in exchange for preferred stock valued at par.

- Made an equity method investment at the very beginning of the year. Received dividends on the equity method investment of $40 during the year.

- Created long-term restructuring plan. Reduced restructuring liability by paying severance packages.

- Bonds payable of $130 were retired by paying cash. No bonds were issued.

- Deferred income taxes pertain to operations.

- In addition to issuing preferred stock at par for a patent, sold preferred stock for cash at par.

- Issued common stock for cash.

- Declared and paid cash dividends.

- Purchased treasury common stock. This was the only transaction concerning treasury shares.

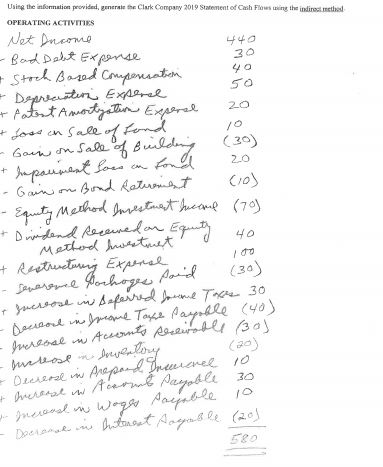

Using the information provided, generate the Clark Company 2019 Statement of Cash Flows using the indirect method.

OPERATING ACTIVITIES

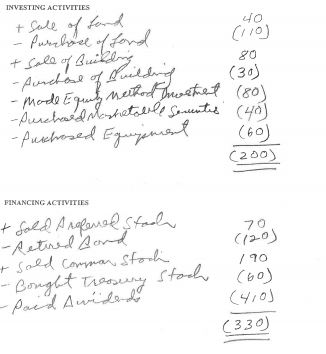

INVESTING ACTIVITIES

FINANCING ACTIVITIES

the Clark Company 2019 Statement of Cash Flows in the indirected 40 (30) Using the information provided OPERATING ACTIVITIES Net Income 440 -Band Debt Expense - Stoch Based Compensation - Depreciation Expense + Patest Amortization Experst + lose on sall of fond - Gain on sale of building + hapaniment lors on fond zo - Gain on Bond Retirement (10) -- Equity Method lavestmest hicone (70) + indend lacewelon Equt no - Method wastuet + Restructuring Expense , -Severone Pochoges paid (30) & sucrose in Seferred accome Toce 30 -secreool in Imome Toke Payable (40) - Increase in Accounts receivable (3 of toploy (20) Dlerral v Arepare Orecke 10 Prestal w for Nasset 30 - Incroad in Woges Ramble 10 - Doerant in Interest Aagalle (201 INVESTING ACTIVITIES + Sale of fond - Purchase of fond + Sale of Buikel -Aurdare of huilding - made Equity method wetment -Aurchased Mastetoele Sorentic -Purchrosed Equipment 40 (110) 80 (30) (80) (401 (60) (200) FINANCING ACTIVITIES + Sold Arglenel Stad - Retired Bond + sold Comman stoch - Bought tresury stoch - paid wided 70 (120) /90 (60) (410) (330) the Clark Company 2019 Statement of Cash Flows in the indirected 40 (30) Using the information provided OPERATING ACTIVITIES Net Income 440 -Band Debt Expense - Stoch Based Compensation - Depreciation Expense + Patest Amortization Experst + lose on sall of fond - Gain on sale of building + hapaniment lors on fond zo - Gain on Bond Retirement (10) -- Equity Method lavestmest hicone (70) + indend lacewelon Equt no - Method wastuet + Restructuring Expense , -Severone Pochoges paid (30) & sucrose in Seferred accome Toce 30 -secreool in Imome Toke Payable (40) - Increase in Accounts receivable (3 of toploy (20) Dlerral v Arepare Orecke 10 Prestal w for Nasset 30 - Incroad in Woges Ramble 10 - Doerant in Interest Aagalle (201 INVESTING ACTIVITIES + Sale of fond - Purchase of fond + Sale of Buikel -Aurdare of huilding - made Equity method wetment -Aurchased Mastetoele Sorentic -Purchrosed Equipment 40 (110) 80 (30) (80) (401 (60) (200) FINANCING ACTIVITIES + Sold Arglenel Stad - Retired Bond + sold Comman stoch - Bought tresury stoch - paid wided 70 (120) /90 (60) (410) (330)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started