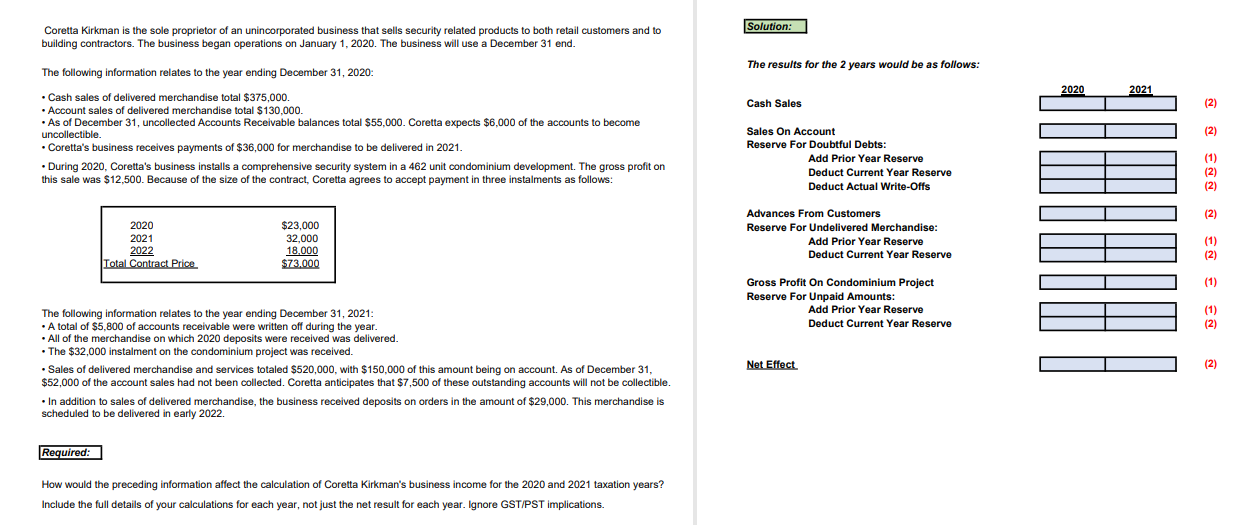

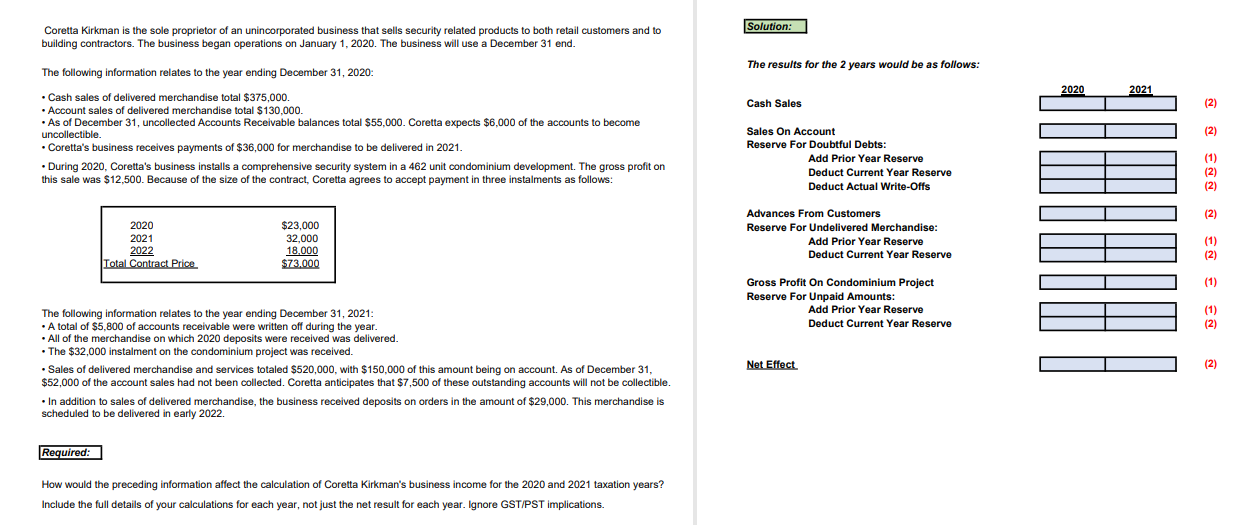

Solution: : Coretta Kirkman is the sole proprietor of an unincorporated business that sells security related products to both retail customers and to building contractors. The business began operations on January 1, 2020. The business will use a December 31 end. The results for the 2 years would be as follows: The following information relates to the year ending December 31, 2020: 2020 2021 Cash Sales (2) (2) Cash sales of delivered merchandise total $375,000. Account sales of delivered merchandise total $130,000. As of December 31, uncollected Accounts Receivable balances total $55,000. Coretta expects $6,000 of the accounts to become . uncollectible. Coretta's business receives payments of $36,000 for merchandise to be delivered in 2021. . During 2020, Coretta's business installs a comprehensive security system in a 462 unit condominium development. The gross profit on this sale was $12,500. Because of the size of the contract, Coretta agrees to accept payment in three instalments as follows: Sales On Account Reserve For Doubtful Debts: Add Prior Year Reserve Deduct Current Year Reserve Deduct Actual Write-Offs (1) (2) (2) (2) 2020 2021 2022 Total Contract Price $23,000 32,000 18,000 $73.000 Advances From Customers Reserve For Undelivered Merchandise: Add Prior Year Reserve Deduct Current Year Reserve (1) (2) ( (1) Gross Profit On Condominium Project Reserve For Unpaid Amounts: Add Prior Year Reserve Deduct Current Year Reserve (1) (2) The following information relates to the year ending December 31, 2021: A total of $5,800 of accounts receivable were written off during the year. . All of the merchandise on which 2020 deposits were received was delivered. The $32,000 instalment on the condominium project was received. Sales of delivered merchandise and services totaled $520,000, with $150,000 of this amount being on account. As of December 31, $52,000 of the account sales had not been collected. Coretta anticipates that $7,500 of these outstanding accounts will not be collectible. . In addition to sales of delivered merchandise, the business received deposits on orders in the amount of $29,000. This merchandise is scheduled to be delivered in early 2022. Net Effect (2) Required: How would the preceding information affect the calculation of Coretta Kirkman's business income for the 2020 and 2021 taxation years? Include the full details of your calculations for each year, not just the net result for each year. Ignore GST/PST implications