Answered step by step

Verified Expert Solution

Question

1 Approved Answer

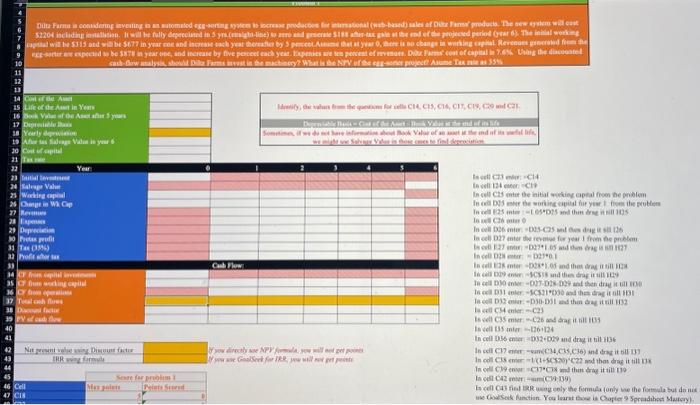

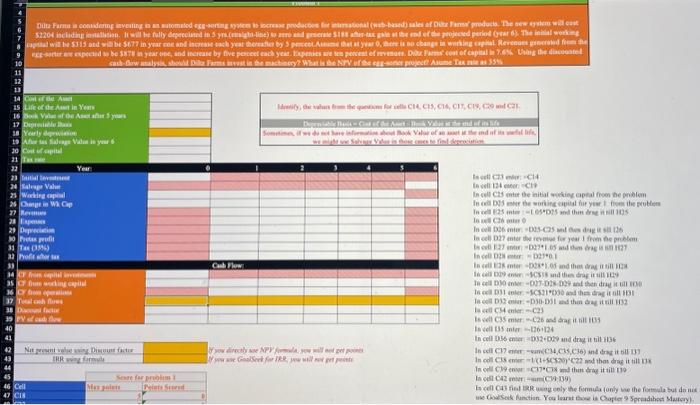

solve all boxes 10 12 Dita Farma is considering investing in an automated egg-serting system to increase producties for international (web-based) sales of Dite Farma

solve all boxes

10 12 Dita Farma is considering investing in an automated egg-serting system to increase producties for international (web-based) sales of Dite Farma products. The new system will cast $2204 including installation. It will be fully depreciated in 5 yrs.comsight-line) so zero and generate $188 after-tax gain at the end of the projected period (year 6). The initial working capital will be $315 and will be $677 in year con and increase each year thereafter by 5 percent Assume that year there is no change in working capital Revenues generated from the e-sorterare expected to be $878 year one, and increase by five pesceet each year. Expenses are ten percent of revenare. Du Farms cost of capital is 7.6% Using the discounted cash-ow analysis should Dil Farms invest in the machinery? What is the NPV of the egg-soner project? Asume Texas 35% 13 14 Cost of the Ame 15 Life of the Austin Years 16 Book Val 17 Depreciable 18 Yearly depewnion 19 Afersas Salvage Valin in your 20 Cost of capital 21 T 22 23 Initial lever 24 Sala Val 25 Working capa 25 Change in Wk Cap 27 Res 28 Exp 29 Depreciation 30 Pi 31 Tax (35%) 32 Profit shorts De Afyours 38 Daca factur 39 PV of ca flow 40 41 42 34 CF from capitulo 35 C7 um working capital 36 CY bom operation 37 Teal ash flow 47 CI Cell Year Nit present value ing Discount factor IRR wing formule Seare for problem 1 Max palets Peints Stored Cab Flow Identify the values from the questions for cells CIA, C15, C1, CIT, C1, C2 C2 Duniable Bois Cnt of the Asset Bk Vabar at the mud of its life Sometimes, if we do not have information about Book Value of an asset at the end of life, you directly see NPV for you will not get points you use GoalSeek for IRR, you will get pent In cell C23 In cell 124 CH CH In cell C25 enter the initial working capital from the problem In D25 er the working capital for your from the problem -1.05 D25 and thim drag itill 105 In cell 25 In C260 In cell D26 enter:-D25-C25 and des dragit si 126 In cell D27 enter the revoise for year I from the problem. Is 127 en D271.05 and them drag is 1927 In cell 028 027 01 In cell E28 enter -D2105 and thes drag till In cell D29-SCS18 and then dragit till 129 In cell D30 enter-027-028 029 and then dragit till 100 In cell 031 enter-SC521 000 and then dragit till 191 -D30-D31 and then dragit till 132 In cell D32 In cell Center-C23 Is cell C35 mer:--C26 and drag it till 135 In cell 135 anter-126-124 In cell 036 enter-0324029 and drag it till 1136 In cell C17 enerunC34,C35,C36) and drag it till 137 In cell C3S emer-1(1-5C530) C22 and than drag it till 13 In cell C39 en C37C8 and the dragit till 130 In cell C42 ener(39-139) In cell C43 find IRR using only the formula (only see the formula but do not use Goal Seck function. You learnt those in Chapter 9 Spreadsheet Mastery) 10 12 Dita Farma is considering investing in an automated egg-serting system to increase producties for international (web-based) sales of Dite Farma products. The new system will cast $2204 including installation. It will be fully depreciated in 5 yrs.comsight-line) so zero and generate $188 after-tax gain at the end of the projected period (year 6). The initial working capital will be $315 and will be $677 in year con and increase each year thereafter by 5 percent Assume that year there is no change in working capital Revenues generated from the e-sorterare expected to be $878 year one, and increase by five pesceet each year. Expenses are ten percent of revenare. Du Farms cost of capital is 7.6% Using the discounted cash-ow analysis should Dil Farms invest in the machinery? What is the NPV of the egg-soner project? Asume Texas 35% 13 14 Cost of the Ame 15 Life of the Austin Years 16 Book Val 17 Depreciable 18 Yearly depewnion 19 Afersas Salvage Valin in your 20 Cost of capital 21 T 22 23 Initial lever 24 Sala Val 25 Working capa 25 Change in Wk Cap 27 Res 28 Exp 29 Depreciation 30 Pi 31 Tax (35%) 32 Profit shorts De Afyours 38 Daca factur 39 PV of ca flow 40 41 42 34 CF from capitulo 35 C7 um working capital 36 CY bom operation 37 Teal ash flow 47 CI Cell Year Nit present value ing Discount factor IRR wing formule Seare for problem 1 Max palets Peints Stored Cab Flow Identify the values from the questions for cells CIA, C15, C1, CIT, C1, C2 C2 Duniable Bois Cnt of the Asset Bk Vabar at the mud of its life Sometimes, if we do not have information about Book Value of an asset at the end of life, you directly see NPV for you will not get points you use GoalSeek for IRR, you will get pent In cell C23 In cell 124 CH CH In cell C25 enter the initial working capital from the problem In D25 er the working capital for your from the problem -1.05 D25 and thim drag itill 105 In cell 25 In C260 In cell D26 enter:-D25-C25 and des dragit si 126 In cell D27 enter the revoise for year I from the problem. Is 127 en D271.05 and them drag is 1927 In cell 028 027 01 In cell E28 enter -D2105 and thes drag till In cell D29-SCS18 and then dragit till 129 In cell D30 enter-027-028 029 and then dragit till 100 In cell 031 enter-SC521 000 and then dragit till 191 -D30-D31 and then dragit till 132 In cell D32 In cell Center-C23 Is cell C35 mer:--C26 and drag it till 135 In cell 135 anter-126-124 In cell 036 enter-0324029 and drag it till 1136 In cell C17 enerunC34,C35,C36) and drag it till 137 In cell C3S emer-1(1-5C530) C22 and than drag it till 13 In cell C39 en C37C8 and the dragit till 130 In cell C42 ener(39-139) In cell C43 find IRR using only the formula (only see the formula but do not use Goal Seck function. You learnt those in Chapter 9 Spreadsheet Mastery)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started