Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SOLVE ALL PARTS INCLUDED , will upvote for correctness Total marks for this section: 80 marks Question B1: Steady Sports Limited has been formed several

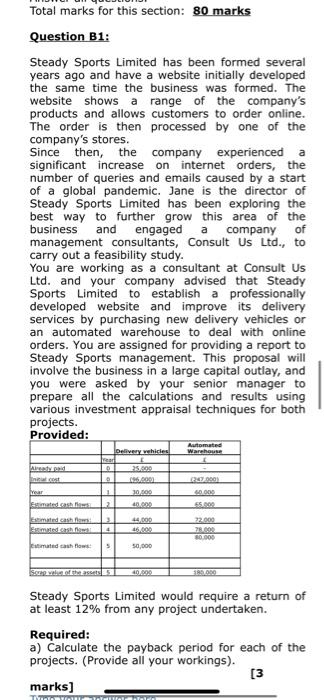

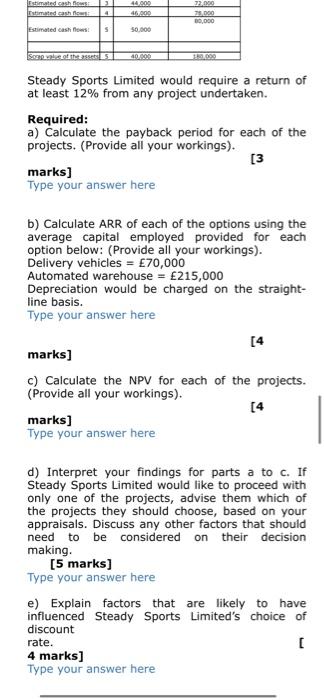

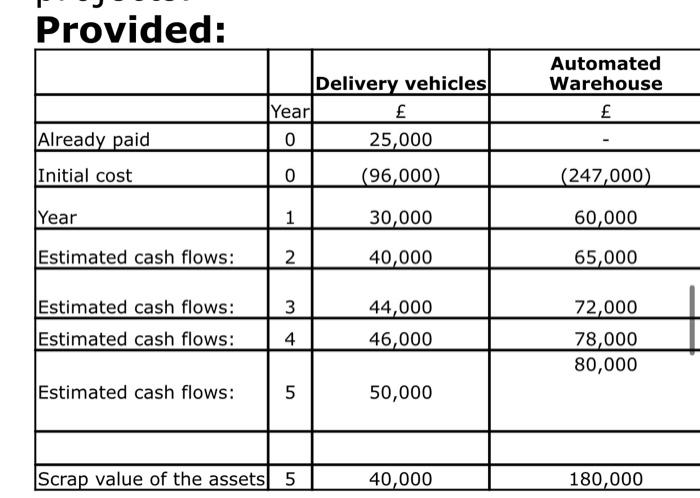

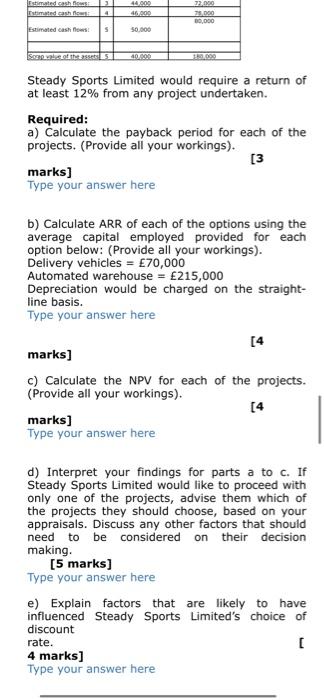

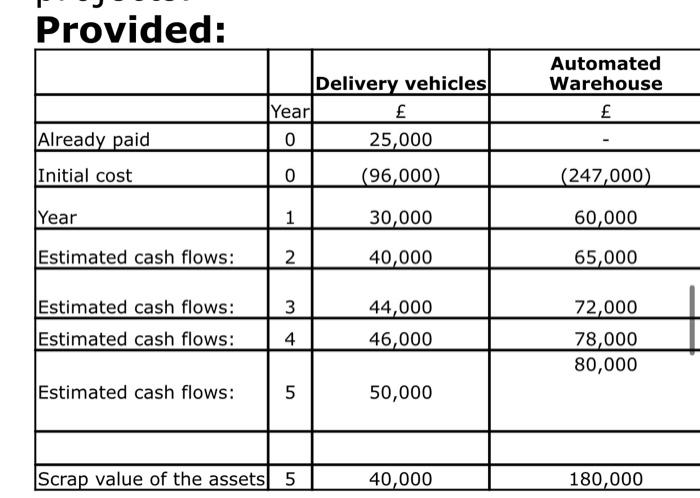

SOLVE ALL PARTS INCLUDED , will upvote for correctness Total marks for this section: 80 marks Question B1: Steady Sports Limited has been formed several years ago and have a website initially developed the same time the business was formed. The website shows a range of the company's products and allows customers to order online. The order is then processed by one of the company's stores. Since then, the company experienced significant increase on internet orders, the number of queries and emails caused by a start of a global pandemic. Jane is the director of Steady Sports Limited has been exploring the best way to further grow this area of the business and engaged a company of management consultants, Consult Us Ltd., to carry out a feasibility study. You are working as a consultant at Consult Us Ltd. and your company advised that Steady Sports Limited to establish a professionally developed website and improve its delivery services by purchasing new delivery vehicles or an automated warehouse to deal with online orders. You are assigned for providing a report to Steady Sports management. This proposal will involve the business in a large capital outlay, and you were asked by your senior manager to prepare all the calculations and results using various investment appraisal techniques for both projects. Provided: Delivery vehicles Automated Warehouse Astrid 10 2000 25.000 . 30.000 4.00 1 2 55.00 wear Sumated cost mated cash Ramasal 3 64.000 16.000 ZO 80.000 med cash flows: 5 50,000 Steady Sports Limited would require a return of at least 12% from any project undertaken. Required: a) Calculate the payback period for each of the projects. (Provide all your workings). [3 marks] Estimated cash 2000 400 66 200 10,000 Estimated cash S 50.000 Soaps 0.000 1.099 Steady Sports Limited would require a return of at least 12% from any project undertaken. Required: a) Calculate the payback period for each of the projects. (Provide all your workings). [3 marks) Type your answer here b) Calculate ARR of each of the options using the average capital employed provided for each option below: (Provide all your workings). Delivery vehicles = 70,000 Automated warehouse = 215,000 Depreciation would be charged on the straight- line basis. Type your answer here [4 marks] c) Calculate the NPV for each of the projects. (Provide all your workings). [4 marks) Type your answer here d) Interpret your findings for parts a to c. If Steady Sports Limited would like to proceed with only one of the projects, advise them which of the projects they should choose, based on your appraisals. Discuss any other factors that should need to be considered on their decision making [5 marks] Type your answer here e) Explain factors that are likely to have influenced Steady Sports Limited's choice of discount rate. [ 4 marks] Type your answer here Provided: Delivery vehicles Year 0 25,000 Automated Warehouse Already paid Initial cost 0 (96,000) (247,000) Year 1 30,000 60,000 Estimated cash flows: 2 40,000 65,000 3 Estimated cash flows: Estimated cash flows: 44,000 46,000 4 72,000 78,000 80,000 Estimated cash flows: 5 50,000 Scrap value of the assets 5 40,000 180,000

SOLVE ALL PARTS INCLUDED , will upvote for correctness Total marks for this section: 80 marks Question B1: Steady Sports Limited has been formed several years ago and have a website initially developed the same time the business was formed. The website shows a range of the company's products and allows customers to order online. The order is then processed by one of the company's stores. Since then, the company experienced significant increase on internet orders, the number of queries and emails caused by a start of a global pandemic. Jane is the director of Steady Sports Limited has been exploring the best way to further grow this area of the business and engaged a company of management consultants, Consult Us Ltd., to carry out a feasibility study. You are working as a consultant at Consult Us Ltd. and your company advised that Steady Sports Limited to establish a professionally developed website and improve its delivery services by purchasing new delivery vehicles or an automated warehouse to deal with online orders. You are assigned for providing a report to Steady Sports management. This proposal will involve the business in a large capital outlay, and you were asked by your senior manager to prepare all the calculations and results using various investment appraisal techniques for both projects. Provided: Delivery vehicles Automated Warehouse Astrid 10 2000 25.000 . 30.000 4.00 1 2 55.00 wear Sumated cost mated cash Ramasal 3 64.000 16.000 ZO 80.000 med cash flows: 5 50,000 Steady Sports Limited would require a return of at least 12% from any project undertaken. Required: a) Calculate the payback period for each of the projects. (Provide all your workings). [3 marks] Estimated cash 2000 400 66 200 10,000 Estimated cash S 50.000 Soaps 0.000 1.099 Steady Sports Limited would require a return of at least 12% from any project undertaken. Required: a) Calculate the payback period for each of the projects. (Provide all your workings). [3 marks) Type your answer here b) Calculate ARR of each of the options using the average capital employed provided for each option below: (Provide all your workings). Delivery vehicles = 70,000 Automated warehouse = 215,000 Depreciation would be charged on the straight- line basis. Type your answer here [4 marks] c) Calculate the NPV for each of the projects. (Provide all your workings). [4 marks) Type your answer here d) Interpret your findings for parts a to c. If Steady Sports Limited would like to proceed with only one of the projects, advise them which of the projects they should choose, based on your appraisals. Discuss any other factors that should need to be considered on their decision making [5 marks] Type your answer here e) Explain factors that are likely to have influenced Steady Sports Limited's choice of discount rate. [ 4 marks] Type your answer here Provided: Delivery vehicles Year 0 25,000 Automated Warehouse Already paid Initial cost 0 (96,000) (247,000) Year 1 30,000 60,000 Estimated cash flows: 2 40,000 65,000 3 Estimated cash flows: Estimated cash flows: 44,000 46,000 4 72,000 78,000 80,000 Estimated cash flows: 5 50,000 Scrap value of the assets 5 40,000 180,000

SOLVE ALL PARTS INCLUDED , will upvote for correctness

SOLVE ALL PARTS INCLUDED , will upvote for correctnessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started