Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve and provide answers: The answers below are WRONG So, here are the effective interest rates for each scenario: a. Effective Interest Rate with Points

Solve and provide answers:

The answers below are WRONG

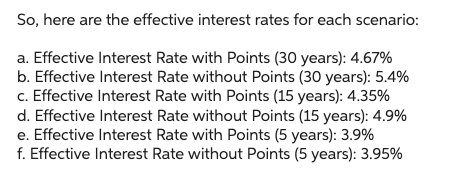

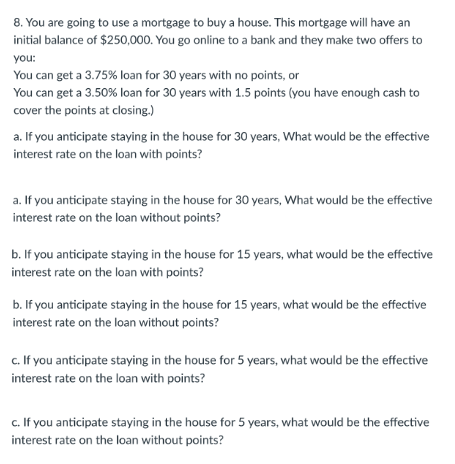

So, here are the effective interest rates for each scenario: a. Effective Interest Rate with Points (30 years): 4.67% b. Effective Interest Rate without Points (30 years): 5.4% c. Effective Interest Rate with Points (15 years): 4.35% d. Effective Interest Rate without Points (15 years): 4.9% e. Effective Interest Rate with Points (5 years): 3.9% f. Effective Interest Rate without Points (5 years): 3.95% 8. You are going to use a mortgage to buy a house. This mortgage will have an initial balance of $250,000. You go online to a bank and they make two offers to you: You can get a 3.75% loan for 30 years with no points, or You can get a 3.50% loan for 30 years with 1.5 points (you have enough cash to cover the points at closing.) a. If you anticipate staying in the house for 30 years, What would be the effective interest rate on the loan with points? a. If you anticipate staying in the house for 30 years, What would be the effective interest rate on the loan without points? b. If you anticipate staying in the house for 15 years, what would be the effective interest rate on the loan with points? b. If you anticipate staying in the house for 15 years, what would be the effective interest rate on the loan without points? c. If you anticipate staying in the house for 5 years, what would be the effective interest rate on the loan with points? c. If you anticipate staying in the house for 5 years, what would be the effective interest rate on the loan without points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started