Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve and provide steps: Below is helpful information: Explanation: the current monthly payments under the original mortgage is 1,111.664956 Explanation: Monthly payment on this new

Solve and provide steps:

Below is helpful information:

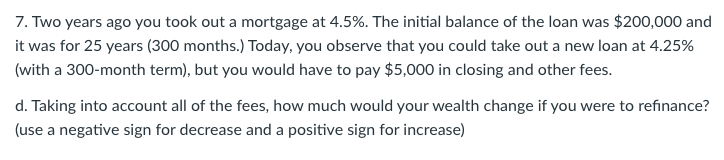

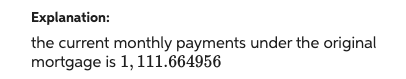

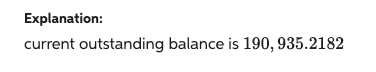

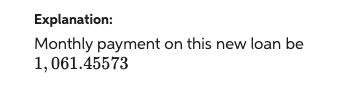

Explanation: the current monthly payments under the original mortgage is 1,111.664956 Explanation: Monthly payment on this new loan be 1,061.45573 Explanation: current outstanding balance is 190,935.2182 7. Two years ago you took out a mortgage at 4.5%. The initial balance of the loan was $200,000 and it was for 25 years (300 months.) Today, you observe that you could take out a new loan at 4.25% (with a 300-month term), but you would have to pay $5,000 in closing and other fees. d. Taking into account all of the fees, how much would your wealth change if you were to refinance? (use a negative sign for decrease and a positive sign for increase)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started