Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve D, E and F Part 2: Job Order Costing Mr. Suncat is trying to determine if he should use a job order costing system

Solve D, E and F

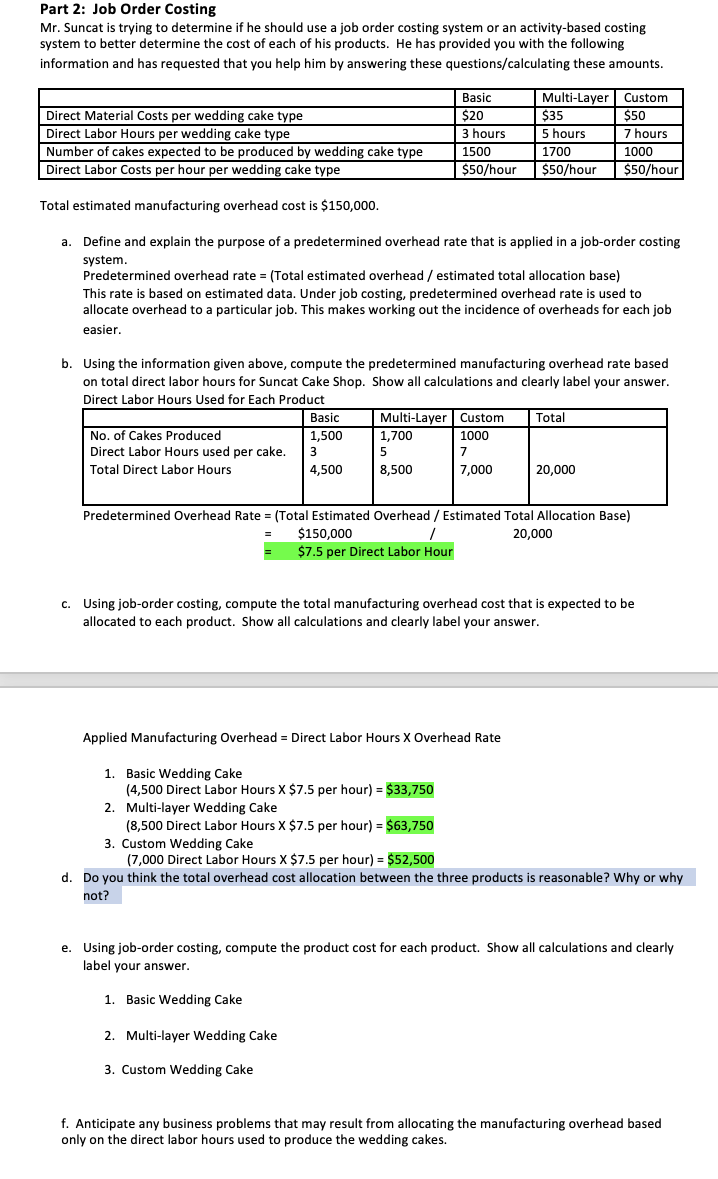

Part 2: Job Order Costing Mr. Suncat is trying to determine if he should use a job order costing system or an activity-based costing system to better determine the cost of each of his products. He has provided you with the following information and has requested that you help him by answering these questions/calculating these amounts. Total estimated manufacturing overhead cost is $150,000. a. Define and explain the purpose of a predetermined overhead rate that is applied in a job-order costing system. Predetermined overhead rate = (Total estimated overhead / estimated total allocation base) This rate is based on estimated data. Under job costing, predetermined overhead rate is used to allocate overhead to a particular job. This makes working out the incidence of overheads for each job easier. b. Using the information given above, compute the predetermined manufacturing overhead rate based on total direct labor hours for Suncat Cake Shop. Show all calculations and clearly label your answer. Direct Labor Hours Used for Each Product PredeterminedOverheadRate=(TotalEstimatedOverhead/EstimatedTotalAllocationBase)=$150,000//20,000=$7.5perDirectLaborHour c. Using job-order costing, compute the total manufacturing overhead cost that is expected to be allocated to each product. Show all calculations and clearly label your answer. Applied Manufacturing Overhead = Direct Labor Hours X Overhead Rate 1. Basic Wedding Cake (4,500 Direct Labor Hours X$7.5 per hour )=$33,750 2. Multi-layer Wedding Cake (8,500 Direct Labor Hours X$7.5 per hour )=$63,750 3. Custom Wedding Cake (7,000 Direct Labor Hours x$7.5 per hour) =$52,500 d. Do you think the total overhead cost allocation between the three products is reasonable? Why or why not? e. Using job-order costing, compute the product cost for each product. Show all calculations and clearly label your answer. 1. Basic Wedding Cake 2. Multi-layer Wedding Cake 3. Custom Wedding Cake f. Anticipate any business problems that may result from allocating the manufacturing overhead based only on the direct labor hours used to produce the wedding cakesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started