Solve for years 2012-2017.

Solve for years 2012-2017.

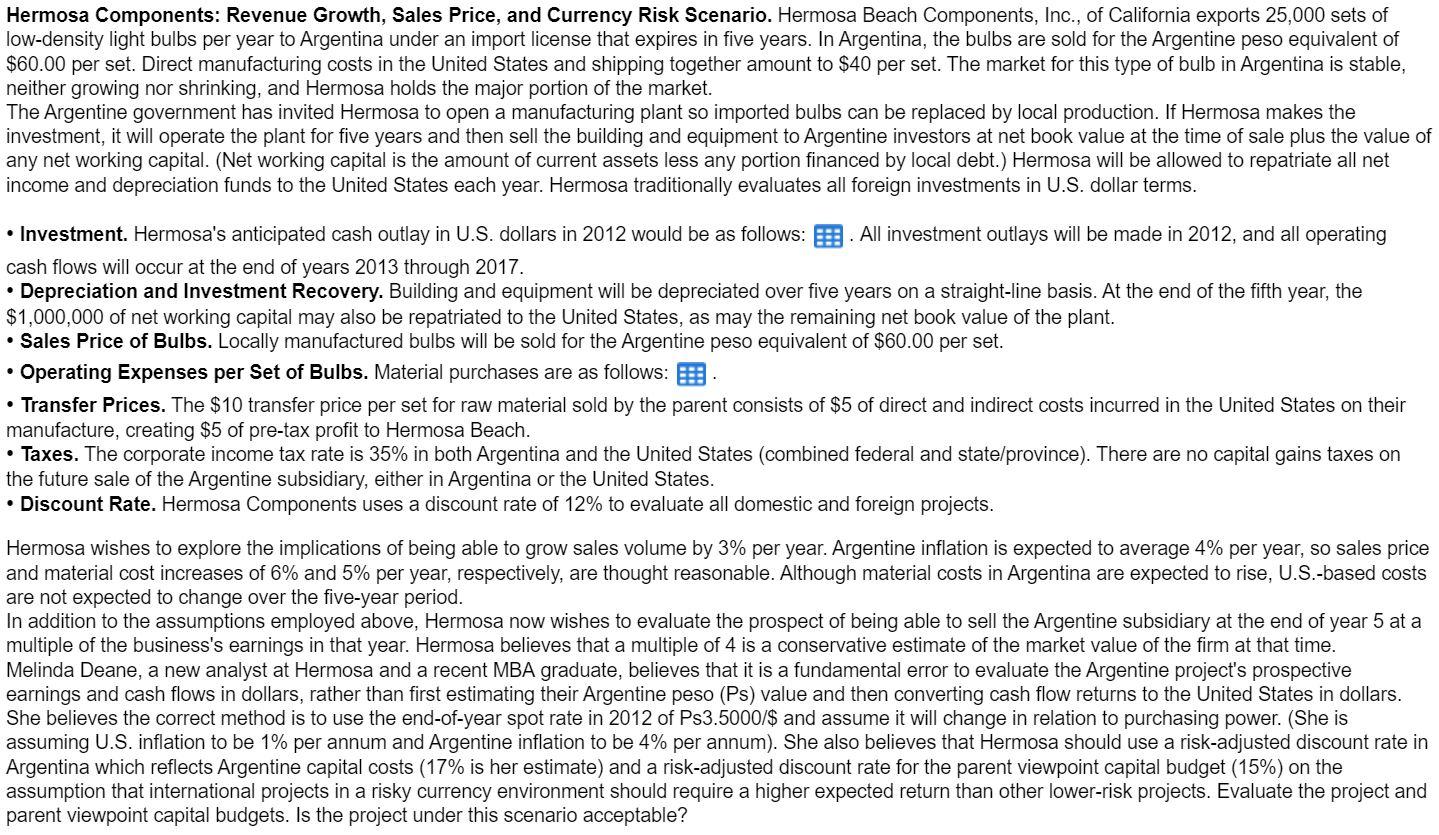

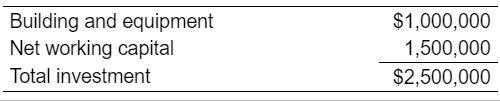

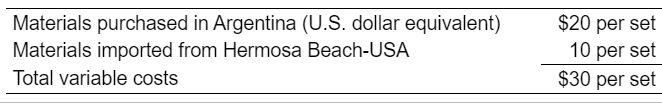

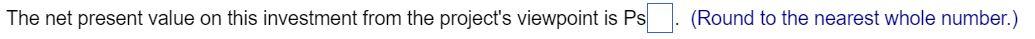

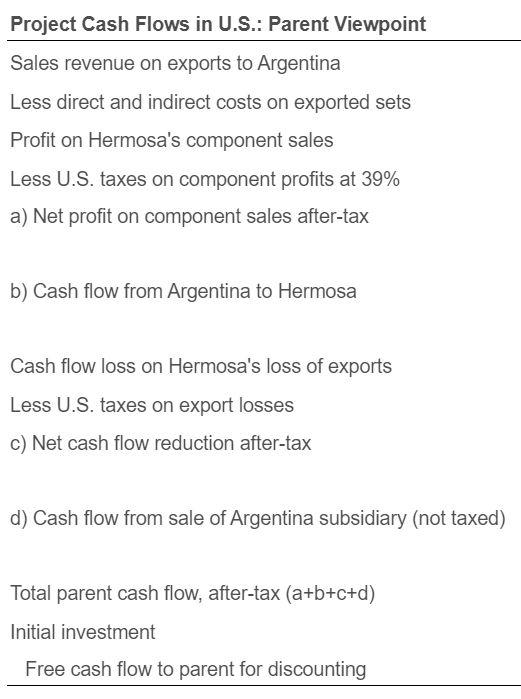

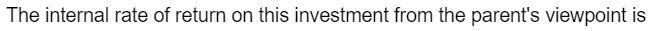

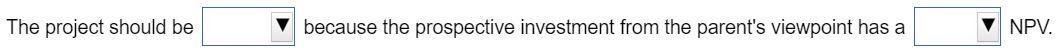

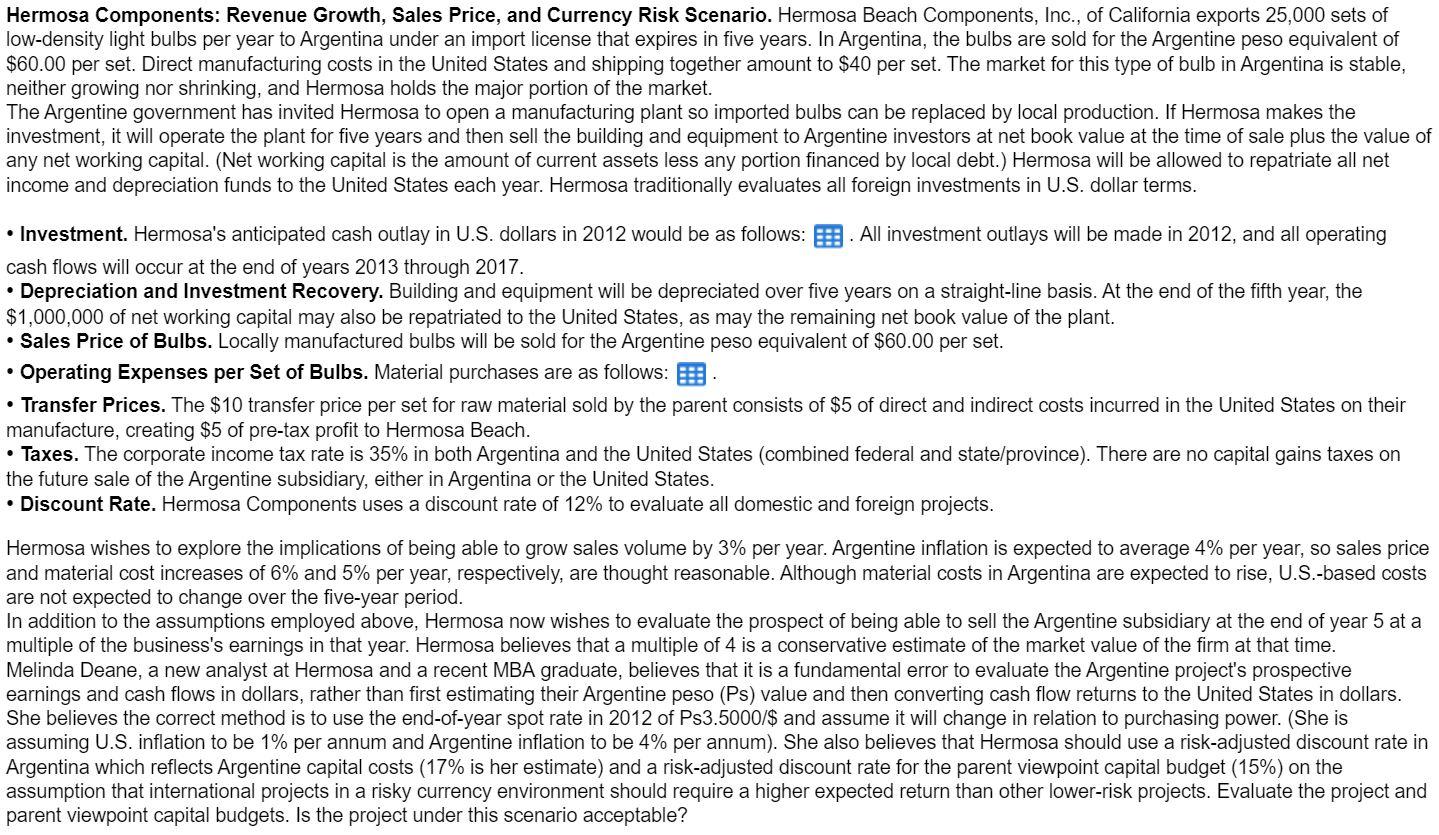

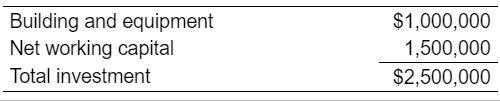

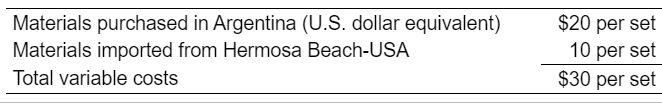

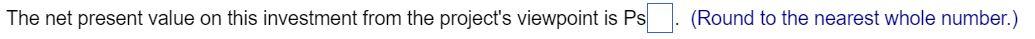

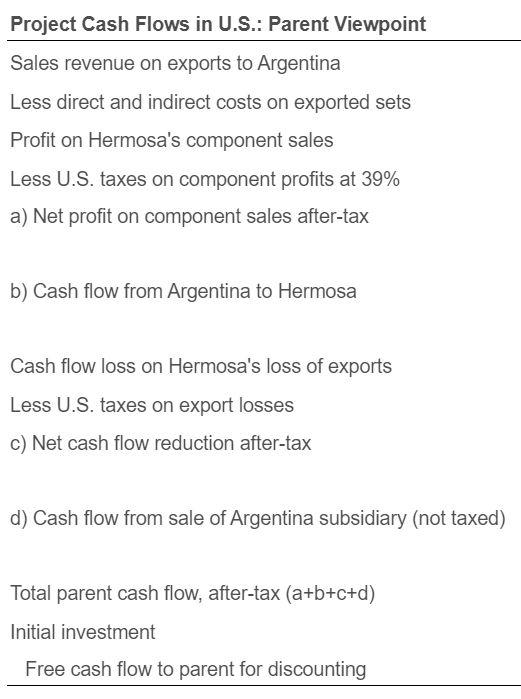

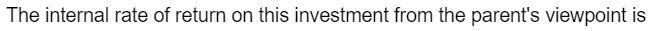

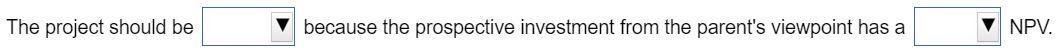

Hermosa Components: Revenue Growth, Sales Price, and Currency Risk Scenario. Hermosa Beach Components, Inc., of California exports 25,000 sets of low-density light bulbs per year to Argentina under an import license that expires in five years. In Argentina, the bulbs are sold for the Argentine peso equivalent of $60.00 per set. Direct manufacturing costs in the United States and shipping together amount to $40 per set. The market for this type of bulb in Argentina is stable, neither growing nor shrinking, and Hermosa holds the major portion of the market. The Argentine government has invited Hermosa to open a manufacturing plant so imported bulbs can be replaced by local production. If Hermosa makes the investment, it will operate the plant for five years and then sell the building and equipment to Argentine investors at net book value at the time of sale plus the value of any net working capital. (Net working capital is the amount of current assets less any portion financed by local debt.) Hermosa will be allowed to repatriate all net income and depreciation funds to the United States each year. Hermosa traditionally evaluates all foreign investments in U.S. dollar terms. Investment. Hermosa's anticipated cash outlay in U.S. dollars in 2012 would be as follows: All investment outlays will be made in 2012, and all operating cash flows will occur at the end of years 2013 through 2017. Depreciation and Investment Recovery. Building and equipment will be depreciated over five years on a straight-line basis. At the end of the fifth year, the $1,000,000 of net working capital may also be repatriated to the United States, as may the remaining net book value of the plant. Sales Price of Bulbs. Locally manufactured bulbs will be sold for the Argentine peso equivalent of $60.00 per set. . Operating Expenses per Set of Bulbs. Material purchases are as follows: Transfer Prices. The $10 transfer price per set for raw material sold by the parent consists of $5 of direct and indirect costs incurred in the United States on their manufacture, creating $5 of pre-tax profit to Hermosa Beach. Taxes. The corporate income tax rate is 35% in both Argentina and the United States (combined federal and state/province). There are no capital gains taxes on the future sale of the Argentine subsidiary, either in Argentina or the United States. Discount Rate. Hermosa Components uses a discount rate of 12% to evaluate all domestic and foreign projects. Hermosa wishes to explore the implications of being able to grow sales volume by 3% per year. Argentine inflation is expected to average 4% per year, so sales price and material cost increases of 6% and 5% per year, respectively, are thought reasonable. Although material costs in Argentina are expected to rise, U.S.-based costs are not expected to change over the five-year period. In addition to the assumptions employed above, Hermosa now wishes to evaluate the prospect of being able to sell the Argentine subsidiary at the end of year 5 at a multiple of the business's earnings in that year. Hermosa believes that a multiple of 4 is a conservative estimate of the market value of the firm at that time. Melinda Deane, a new analyst at Hermosa and a recent MBA graduate, believes that it is a fundamental error to evaluate the Argentine project's prospective earnings and cash flows in dollars, rather than first estimating their Argentine peso (Ps) value and then converting cash flow returns to the United States in dollars. She believes the correct method is to use the end-of-year spot rate in 2012 of Ps3.5000/$ and assume it will change in relation to purchasing power. (She is assuming U.S. inflation to be 1% per annum and Argentine inflation to be 4% per annum). She also believes that Hermosa should use a risk-adjusted discount rate in Argentina which reflects Argentine capital costs (17% is her estimate) and a risk-adjusted discount rate for the parent viewpoint capital budget (15%) on the assumption that international projects in a risky currency environment should require a higher expected return than other lower-risk projects. Evaluate the project and parent viewpoint capital budgets. Is the project under this scenario acceptable? Building and equipment Net working capital Total investment $1,000,000 1,500,000 $2,500,000 Materials purchased in Argentina (U.S. dollar equivalent) Materials imported from Hermosa Beach-USA Total variable costs $20 per set 10 per set $30 per set Project Cash Flows in Argentina: Project Viewpoint PPP expected exchange rate (pesos/$) Annual units sold (sets) Sales price in Argentina per set (in $) Sales price in Argentina per set (in pesos) Sales revenue Less direct manufacturing and shipping costs Less cost of U.S. components at $10/set Gross profit Less depreciation Pre-tax profit Less 35% Argentina taxes Net income Add back depreciation Annual project cash flow Sales value in year 5 (multiple of earnings) Initial investment Free cash flow for discounting Ps Ps 2012 3.5000 $ 2013 25,000 60.00 2014 The net present value on this investment from the project's viewpoint is Ps (Round to the nearest whole number.) The internal rate of return on this investment from the project's viewpoint is %. (Round to two decimal places.) Project Cash Flows in U.S.: Parent Viewpoint Sales revenue on exports to Argentina Less direct and indirect costs on exported sets Profit on Hermosa's component sales Less U.S. taxes on component profits at 39% a) Net profit on component sales after-tax b) Cash flow from Argentina to Hermosa Cash flow loss on Hermosa's loss of exports Less U.S. taxes on export losses c) Net cash flow reduction after-tax d) Cash flow from sale of Argentina subsidiary (not taxed) Total parent cash flow, after-tax (a+b+c+d) Initial investment Free cash flow to parent for discounting The net present value on this investment from the parent's viewpoint is $ (Round to the nearest dollar.) The internal rate of return on this investment from the parent's viewpoint is The project should be because the prospective investment from the parent's viewpoint has a NPV. Hermosa Components: Revenue Growth, Sales Price, and Currency Risk Scenario. Hermosa Beach Components, Inc., of California exports 25,000 sets of low-density light bulbs per year to Argentina under an import license that expires in five years. In Argentina, the bulbs are sold for the Argentine peso equivalent of $60.00 per set. Direct manufacturing costs in the United States and shipping together amount to $40 per set. The market for this type of bulb in Argentina is stable, neither growing nor shrinking, and Hermosa holds the major portion of the market. The Argentine government has invited Hermosa to open a manufacturing plant so imported bulbs can be replaced by local production. If Hermosa makes the investment, it will operate the plant for five years and then sell the building and equipment to Argentine investors at net book value at the time of sale plus the value of any net working capital. (Net working capital is the amount of current assets less any portion financed by local debt.) Hermosa will be allowed to repatriate all net income and depreciation funds to the United States each year. Hermosa traditionally evaluates all foreign investments in U.S. dollar terms. Investment. Hermosa's anticipated cash outlay in U.S. dollars in 2012 would be as follows: All investment outlays will be made in 2012, and all operating cash flows will occur at the end of years 2013 through 2017. Depreciation and Investment Recovery. Building and equipment will be depreciated over five years on a straight-line basis. At the end of the fifth year, the $1,000,000 of net working capital may also be repatriated to the United States, as may the remaining net book value of the plant. Sales Price of Bulbs. Locally manufactured bulbs will be sold for the Argentine peso equivalent of $60.00 per set. . Operating Expenses per Set of Bulbs. Material purchases are as follows: Transfer Prices. The $10 transfer price per set for raw material sold by the parent consists of $5 of direct and indirect costs incurred in the United States on their manufacture, creating $5 of pre-tax profit to Hermosa Beach. Taxes. The corporate income tax rate is 35% in both Argentina and the United States (combined federal and state/province). There are no capital gains taxes on the future sale of the Argentine subsidiary, either in Argentina or the United States. Discount Rate. Hermosa Components uses a discount rate of 12% to evaluate all domestic and foreign projects. Hermosa wishes to explore the implications of being able to grow sales volume by 3% per year. Argentine inflation is expected to average 4% per year, so sales price and material cost increases of 6% and 5% per year, respectively, are thought reasonable. Although material costs in Argentina are expected to rise, U.S.-based costs are not expected to change over the five-year period. In addition to the assumptions employed above, Hermosa now wishes to evaluate the prospect of being able to sell the Argentine subsidiary at the end of year 5 at a multiple of the business's earnings in that year. Hermosa believes that a multiple of 4 is a conservative estimate of the market value of the firm at that time. Melinda Deane, a new analyst at Hermosa and a recent MBA graduate, believes that it is a fundamental error to evaluate the Argentine project's prospective earnings and cash flows in dollars, rather than first estimating their Argentine peso (Ps) value and then converting cash flow returns to the United States in dollars. She believes the correct method is to use the end-of-year spot rate in 2012 of Ps3.5000/$ and assume it will change in relation to purchasing power. (She is assuming U.S. inflation to be 1% per annum and Argentine inflation to be 4% per annum). She also believes that Hermosa should use a risk-adjusted discount rate in Argentina which reflects Argentine capital costs (17% is her estimate) and a risk-adjusted discount rate for the parent viewpoint capital budget (15%) on the assumption that international projects in a risky currency environment should require a higher expected return than other lower-risk projects. Evaluate the project and parent viewpoint capital budgets. Is the project under this scenario acceptable? Building and equipment Net working capital Total investment $1,000,000 1,500,000 $2,500,000 Materials purchased in Argentina (U.S. dollar equivalent) Materials imported from Hermosa Beach-USA Total variable costs $20 per set 10 per set $30 per set Project Cash Flows in Argentina: Project Viewpoint PPP expected exchange rate (pesos/$) Annual units sold (sets) Sales price in Argentina per set (in $) Sales price in Argentina per set (in pesos) Sales revenue Less direct manufacturing and shipping costs Less cost of U.S. components at $10/set Gross profit Less depreciation Pre-tax profit Less 35% Argentina taxes Net income Add back depreciation Annual project cash flow Sales value in year 5 (multiple of earnings) Initial investment Free cash flow for discounting Ps Ps 2012 3.5000 $ 2013 25,000 60.00 2014 The net present value on this investment from the project's viewpoint is Ps (Round to the nearest whole number.) The internal rate of return on this investment from the project's viewpoint is %. (Round to two decimal places.) Project Cash Flows in U.S.: Parent Viewpoint Sales revenue on exports to Argentina Less direct and indirect costs on exported sets Profit on Hermosa's component sales Less U.S. taxes on component profits at 39% a) Net profit on component sales after-tax b) Cash flow from Argentina to Hermosa Cash flow loss on Hermosa's loss of exports Less U.S. taxes on export losses c) Net cash flow reduction after-tax d) Cash flow from sale of Argentina subsidiary (not taxed) Total parent cash flow, after-tax (a+b+c+d) Initial investment Free cash flow to parent for discounting The net present value on this investment from the parent's viewpoint is $ (Round to the nearest dollar.) The internal rate of return on this investment from the parent's viewpoint is The project should be because the prospective investment from the parent's viewpoint has a NPV