Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve in 50 mins i will give thumb up Question 5 (20 points) Today, December 31, 2021, you are celebrating your 31st birthday, and decided

solve in 50 mins i will give thumb up

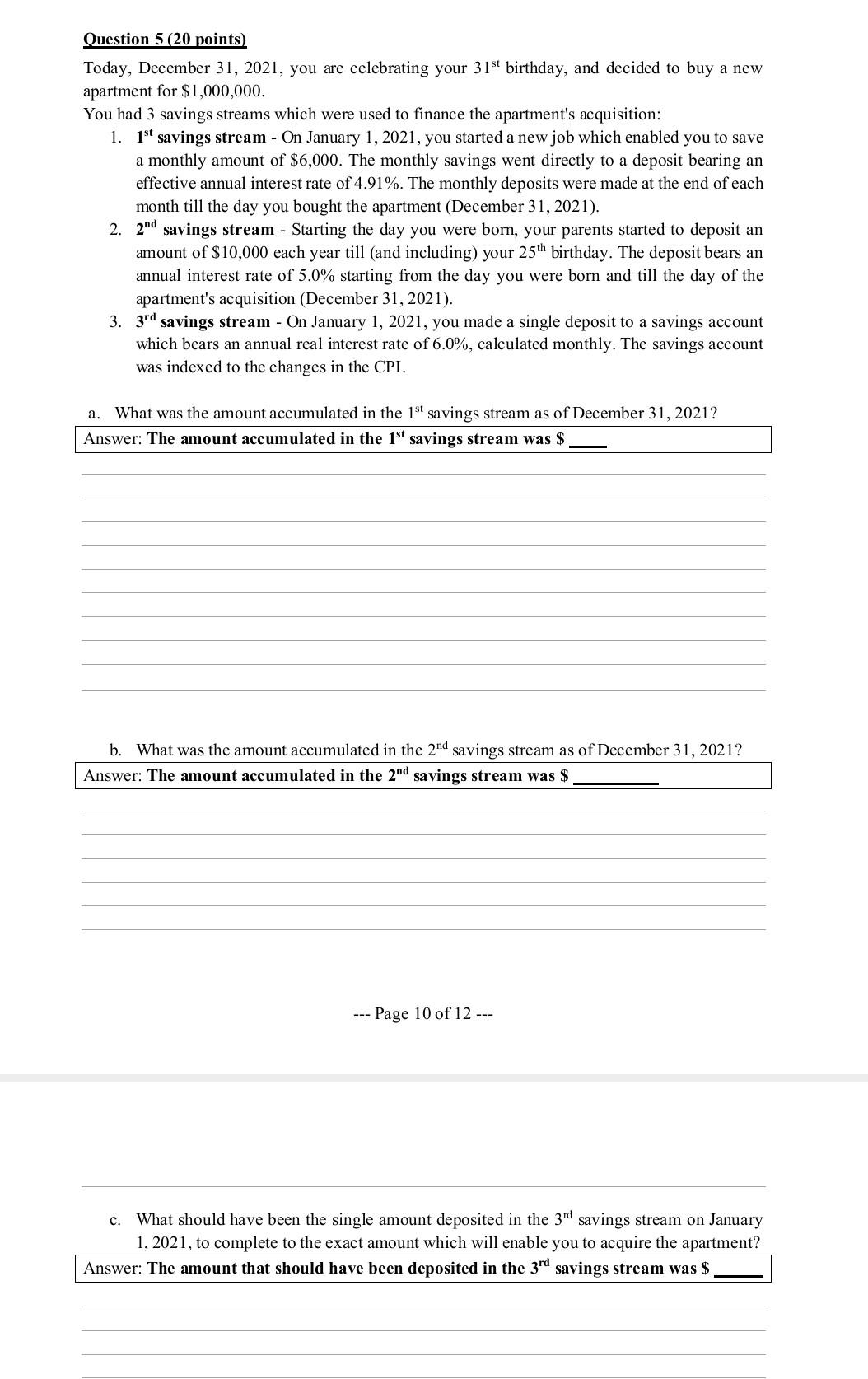

Question 5 (20 points) Today, December 31, 2021, you are celebrating your 31st birthday, and decided to buy a new apartment for $1,000,000. You had 3 savings streams which were used to finance the apartment's acquisition: 1. 1st savings stream - On January 1, 2021, you started a new job which enabled you to save a monthly amount of $6,000. The monthly savings went directly to a deposit bearing an effective annual interest rate of 4.91%. The monthly deposits were made at the end of each month till the day you bought the apartment (December 31, 2021). 2. 2nd savings stream - Starting the day you were born, your parents started to deposit an amount of $10,000 each year till (and including) your 25th birthday. The deposit bears an annual interest rate of 5.0% starting from the day you were born and till the day of the apartment's acquisition (December 31, 2021). 3. 3rd savings stream - On January 1, 2021, you made a single deposit to a savings account which bears an annual real interest rate of 6.0%, calculated monthly. The savings account was indexed to the changes in the CPI. a. What was the amount accumulated in the 1st savings stream as of December 31, 2021? Answer: The amount accumulated in the 1st savings stream was $ b. What was the amount accumulated in the 2nd savings stream as of December 31, 2021? Answer: The amount accumulated in the 2nd savings stream was $ --- Page 10 of 12 --- c. What should have been the single amount deposited in the 3rd savings stream on January 1, 2021, to complete to the exact amount which will enable you to acquire the apartment? Answer: The amount that should have been deposited in the 3rd savings stream was $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started