Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve in 60 mins I will give thumb up Robson Plc (Robson) closed its accounts on 31 March 2021. Its financial statements were approved on

solve in 60 mins I will give thumb up

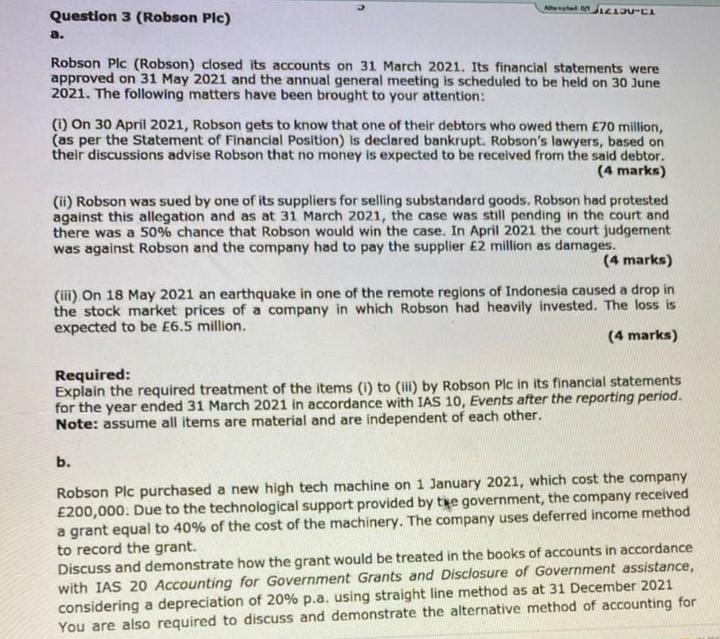

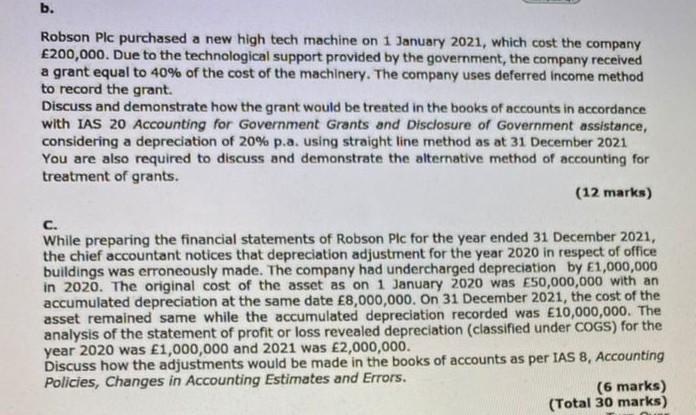

Robson Plc (Robson) closed its accounts on 31 March 2021. Its financial statements were approved on 31 May 2021 and the annual general meeting is scheduled to be held on 30 June 2021. The following matters have been brought to your attention: (i) On 30 April 2021, Robson gets to know that one of their debtors who owed them 70 million, (as per the Statement of Financial Position) is declared bankrupt. Robson's lawyers, based on their discussions advise Robson that no money is expected to be received from the said debtor. (4 marks) (ii) Robson was sued by one of its suppliers for selling substandard goods. Robson had protested against this allegation and as at 31 March 2021, the case was still pending in the court and there was a 50% chance that Robson would win the case. In April 2021 the court judgement was against Robson and the company had to pay the supplier E2 million as damages. (4 marks) (iii) On 18 May 2021 an earthquake in one of the remote regions of Indonesia caused a drop in the stock market prices of a company in which Robson had heavily invested. The loss is expected to be E6.5 million. (4 marks) Required: Explain the required treatment of the items (i) to (iii) by Robson Plc in its financial statements for the year ended 31 March 2021 in accordance with IAS 10, Events after the reporting period. Note: assume all items are material and are independent of each other. b. Robson Plc purchased a new high tech machine on 1 January 2021, which cost the company E200,000. Due to the technological support provided by tike government, the company received a grant equal to 40% of the cost of the machinery. The company uses deferred income method to record the grant. Discuss and demonstrate how the grant would be treated in the books of accounts in accordance with IAS 20 Accounting for Government Grants and Disclosure of Government assistance, considering a depreciation of 20% p.a. using straight line method as at 31 December 2021 Vous also required to discuss and demonstrate the alternative method of accounting for Robson Plc purchased a new high tech machine on 1 January 2021, which cost the company 200,000. Due to the technological support provided by the government, the company received a grant equal to 40% of the cost of the machinery. The company uses deferred income method to record the grant. Discuss and demonstrate how the grant would be treated in the books of accounts in accordance with IAS 20 Accounting for Government Grants and Disclosure of Government assistance, considering a depreciation of 20% p.a. using straight line method as at 31 December 2021 You are also required to discuss and demonstrate the alternative method of accounting for treatment of grants. (12 marks) C. While preparing the financial statements of Robson Pic for the year ended 31 December 2021, the chief accountant notices that depreciation adjustment for the year 2020 in respect of office buildings was erroneously made. The company had undercharged depreciation by E1,000,000 in 2020. The original cost of the asset as on 1 January 2020 was E50,000,000 with an accumulated depreciation at the same date 8,000,000. On 31 December 2021 , the cost of the asset remained same while the accumulated depreciation recorded was E10,000,000. The analysis of the statement of profit or loss revealed depreciation (classified under COGS) for the year 2020 was 1,000,000 and 2021 was 2,000,000. Discuss how the adjustments would be made in the books of accounts as per IAS B, Accounting Policies, Changes in Accounting Estimates and Errors. (6 marks) (Total 30 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started