Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SOLVE IN EXCEL Hemp Airlines ( HA , we fly high ) is about to buy five CFA 3 0 0 0 commuter jets.

SOLVE IN EXCEL

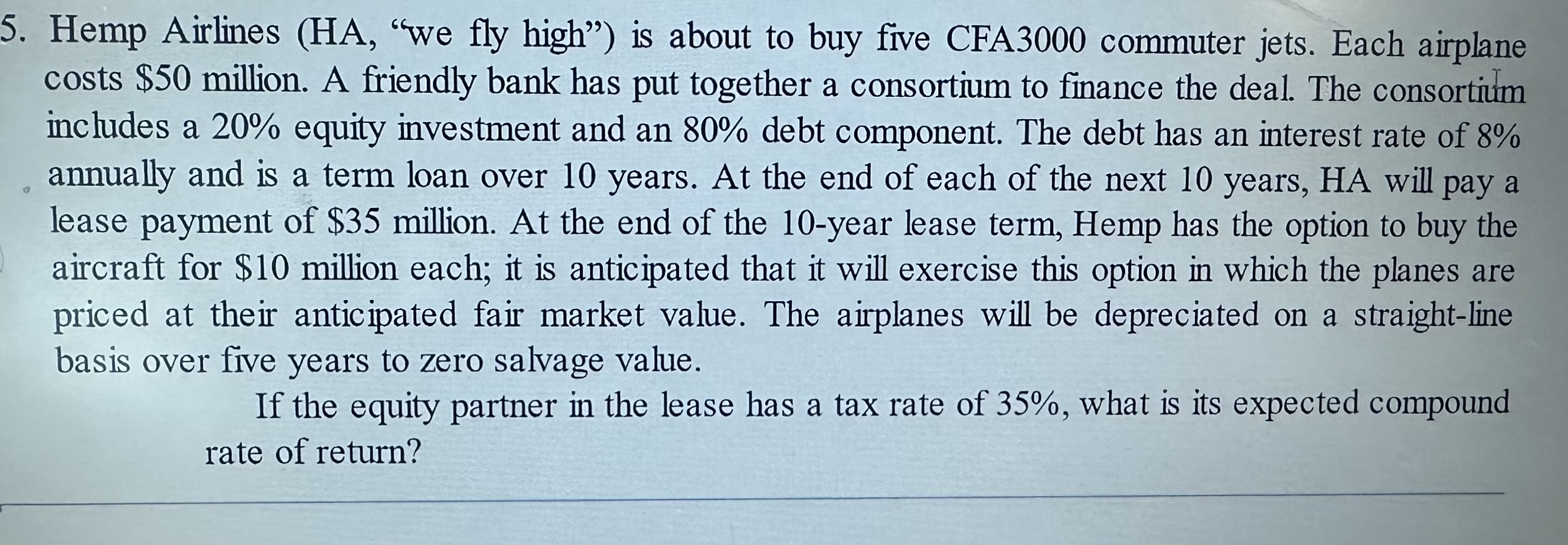

Hemp Airlines HAwe fly high" is about to buy five CFA commuter jets. Each airplane

costs $ million. A friendly bank has put together a consortium to finance the deal. The consortium

includes a equity investment and an debt component. The debt has an interest rate of

annually and is a term loan over years. At the end of each of the next years, HA will pay a

lease payment of $ million. At the end of the year lease term, Hemp has the option to buy the

aircraft for $ million each; it is anticipated that it will exercise this option in which the planes are

priced at their anticipated fair market value. The airplanes will be depreciated on a straightline

basis over five years to zero salvage value.

If the equity partner in the lease has a tax rate of what is its expected compound

rate of return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started