Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve it by using DecisionTools software When you purchase a car, you may consider buying a brand-new car or a used one. A fundamental trade-offin

Solve it by using DecisionTools software

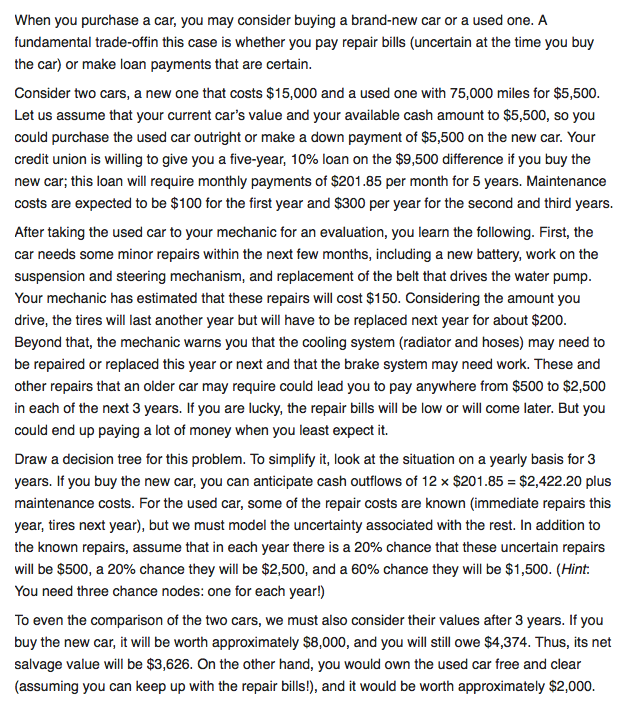

When you purchase a car, you may consider buying a brand-new car or a used one. A fundamental trade-offin this case is whether you pay repair bills (uncertain at the time you buy the car) or make loan payments that are certain. Consider two cars, a new one that costs $15,000 and a used one with 75,000 miles for $5,500. Let us assume that your current car's value and your available cash amount to $5,500, so you could purchase the used car outright or make a down payment of $5,500 on the new car. Your credit union is willing to give you a five-year, 10% loan on the $9,500 difference if you buy the new car; this loan will require monthly payments of $201.85 per month for 5 years. Maintenance costs are expected to be $100 for the first year and $300 per year for the second and third years. After taking the used car to your mechanic for an evaluation, you learn the following. First, the car needs some minor repairs within the next few months, including a new battery, work on the suspension and steering mechanism, and replacement of the belt that drives the water pump. Your mechanic has estimated that these repairs will cost $150. Considering the amount you drive, the tires will last another year but will have to be replaced next year for about $200. Beyond that, the mechanic warns you that the cooling system (radiator and hoses) may need to be repaired or replaced this year or next and that the brake system may need work. These and other repairs that an older car may require could lead you to pay anywhere from $500 to $2,500 in each of the next 3 years. If you are lucky, the repair bills will be low or will come later. But you could end up paying a lot of money when you least expect it. Draw a decision tree for this problem. To simplify it, look at the situation on a yearly basis for 3 years. If you buy the new car, you can anticipate cash outflows of 12 * $201.85 = $2,422.20 plus maintenance costs. For the used car, some of the repair costs are known (immediate repairs this year, tires next year), but we must model the uncertainty associated with the rest. In addition to the known repairs, assume that in each year there is a 20% chance that these uncertain repairs will be $500, a 20% chance they will be $2,500, and a 60% chance they will be $1,500. (Hint: You need three chance nodes: one for each year!) To even the comparison of the two cars, we must also consider their values after 3 years. If you buy the new car, it will be worth approximately $8,000, and you will still owe $4,374. Thus, its net salvage value will be $3,626. On the other hand, you would own the used car free and clear (assuming you can keep up with the repair bills!), and it would be worth approximately $2,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started