Answered step by step

Verified Expert Solution

Question

1 Approved Answer

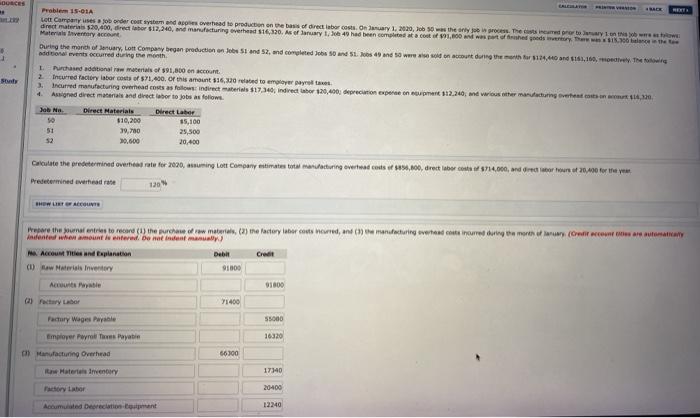

solve missing in blank boxes DOCES + . Problem 15-01A Lot Company uses onder cut womand comes overhead to production on the basis of direct

solve missing in blank boxes

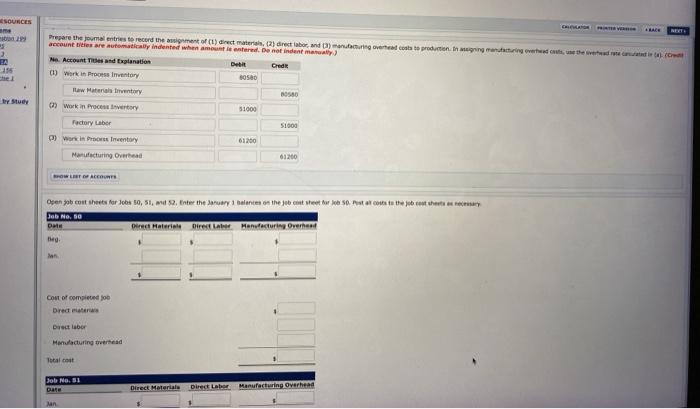

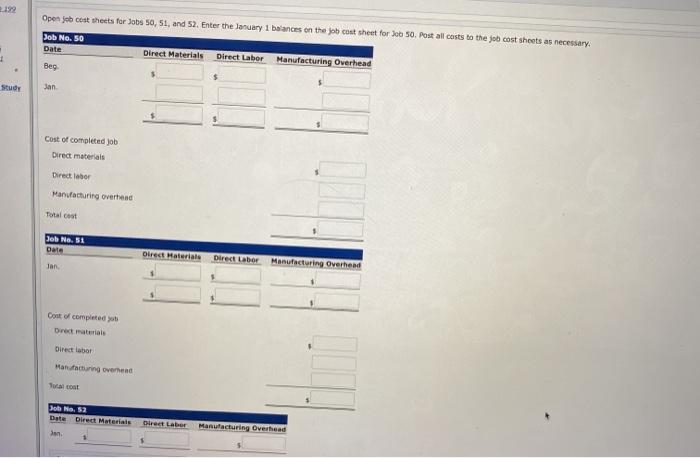

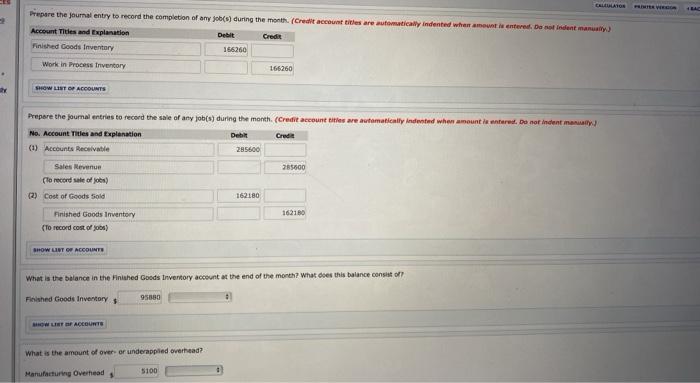

DOCES + . Problem 15-01A Lot Company uses onder cut womand comes overhead to production on the basis of direct labor costs. On ay 1, 2020, low there. The concerned to the rest direct materials 520,400, director $12,240, and manufacturing evethet 16,320. As of January 1, 49 had been completed of 1.600 stof fished ads story Materi travery at 5.796 Dung the month of January, Lot Company began production on Jobs 51 and 52, and completed to an 1. Jos 49 and so we court during the 124.0 and 141.100. The add events occurred during the month L Pinched on raw materials of $91,800 ont 2 incurred factory labor costs of $71.400 of this amount $16.20 related to employer payroll taxe curred manufacturing overned costs as fatore indirect materials $17.940, indred wer 120,400, preciation expert on pere 812,340, we wrous other mastering test 1,200 Assigned direct materials and direct labor to jobs as follow Job Ne Direct Materials Direct Labor 110,200 15,100 51 39,700 25,500 20,400 Stut Calculate the predetermined over to rate for 2020, assuming Lott Company estimates to acting werd of,00, direct obc714.000, andre 20.400 torty Predetermined overhead rate 12 rrethe une entre to record by the real w material (1) the fatory to couts nord, ond (1) neturing were concurred during a more Www (Creccom www Andented when amount is enferm. Bende manually Me Account Titles and Explanation Debi Cro (1) Materials inventory 91000 Accountable 1800 71400 55000 Factory Wages Payable Employer Payroll To Payati Manufacturing Overhead 16320 66300 Hattenwery 17:40 20400 Accumulated Depreciation 12240 ESOURCES 155 Prepare the journal entries to record the entf(t) direct materials, (2) direct labor, and manufacturing costs to production Ingmaring the weed account bees are automatically indented when amount is entered. Do not indent manual No Account oes and Explanation De Credi (1) Work in Process Inventory BOSC Iaw Material tentory 0580 0) Work in Process invertory 51000 51000 Factory Labor 0) Work in Proventory Manufacturing Overhead 61200 ORTACARTE Oren about there for Jobs 50, 51, 52, Enter the Sery balance on the job sheet for Starcoss the context Jab No. Da Direct Materiale tirer La Montering Overhead to an cost of completed Dred Drect labor Manufacturing overed Total cost So Ne 1 Date Direct Materiale Direct Manufacturing Overhead sun 2192 Openjob cost sheets for Jobs 50, 51, and 52. Enter the laruary 1 balances on the job cost sheet for Job 50. Post all costs to the job cost sheets as necessary Job No. 50 Date Direct Materials Direct Labor Manufacturing Overhead Beg Study Jan Cost of completed job Direct materials Director Manufacturing overhead Total cost Job No. 51 Date Direct Materiale Direct Laber Manufacturing Overhead Cost of completed Direct materials Direct labor Manfacturing overhead Toast Job No. 52 Date Direct Materiais Direct Labor Manufacturing Overhead CALATO Prepare the journal entry to record the completion of any ob(s) during the month (Credit account titles are automatically indented what amount is entered Desindent manually Account Titles and Explanation Debit Credit Finished Goods Inventory 156260 Work in Process Triventory 166260 SHOW LIST OF ACCOUNTS Prepare the journal entries to record the sale of any job(s) during the month (Credit account sites are automatically indsted when amount is entered. Do not inden man No. Account Titles and Explanation Debit Cred (1) Accounts Receivable 285600 Sales Revenue 25100 (to record sale of you) 2) Cost of Goods Sold 162180 Finished Goods Inventory 162180 To record cost of SHOW LINTO ACCOUNT What is the balance in the finished Goods Inventory account at the end of the month? What does this balance consist of Fished Goods Inventory 95880 BOW USB ACCOUNTS What is the amount of over or underapplied overhead? 5100 Manufacturing Overhead Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started