Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve ONLY part C D & E of this question on PAPER as soon as possible. URGENT HELP REQUIRED. i'll surely give u Thumbs up.

solve ONLY part C D & E of this question on PAPER as soon as possible. URGENT HELP REQUIRED. i'll surely give u Thumbs up.

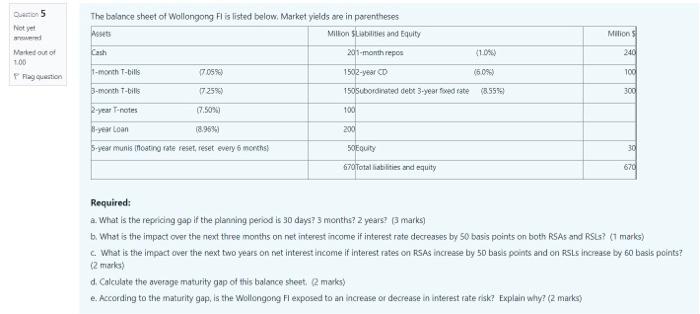

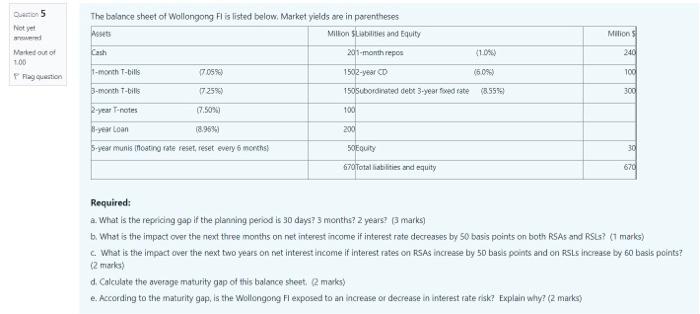

5 Not yet Milion Marted out of 1.00 Magasin The balance sheet of Wollongong Fl is listed below. Market yields are in parentheses Assets Milton sobilities and Equity Cash 201 month repos 10% 1-month T-bills 17.05% 15012-year CD (609 3-month-bills 725% 150 Subordinated debt 3-year foredrate (8.5599 240 100 300 R-year notes (7.50%) 100 Bye Loan 18.96% 200 5-year munis Moating rate reset, reset every 5 months 30 50 Equity 670 Total liabilities and equity 670 Required: a. What is the repricing gap if the planning period is 30 days? 3 months? 2 years? 3 marks) b. What is the impact over the next three monthis on net interest income if interest rate decreases by 50 basis points on both RSAs and RSLE? (1 marks) What is the impact over the next two years on net interest income if interest rates on RSAs increase by 50 basis points and on RSLS increase by 60 basis points? (2 marks) d Calculate the average maturity gap of this balance sheet 2 marks) e. According to the maturity gap, is the Wollongong Hexposed to an increase or decrease in interest rate risk? Explain why? (2 marks) 5 Not yet Milion Marted out of 1.00 Magasin The balance sheet of Wollongong Fl is listed below. Market yields are in parentheses Assets Milton sobilities and Equity Cash 201 month repos 10% 1-month T-bills 17.05% 15012-year CD (609 3-month-bills 725% 150 Subordinated debt 3-year foredrate (8.5599 240 100 300 R-year notes (7.50%) 100 Bye Loan 18.96% 200 5-year munis Moating rate reset, reset every 5 months 30 50 Equity 670 Total liabilities and equity 670 Required: a. What is the repricing gap if the planning period is 30 days? 3 months? 2 years? 3 marks) b. What is the impact over the next three monthis on net interest income if interest rate decreases by 50 basis points on both RSAs and RSLE? (1 marks) What is the impact over the next two years on net interest income if interest rates on RSAs increase by 50 basis points and on RSLS increase by 60 basis points? (2 marks) d Calculate the average maturity gap of this balance sheet 2 marks) e. According to the maturity gap, is the Wollongong Hexposed to an increase or decrease in interest rate risk? Explain why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started