Answered step by step

Verified Expert Solution

Question

1 Approved Answer

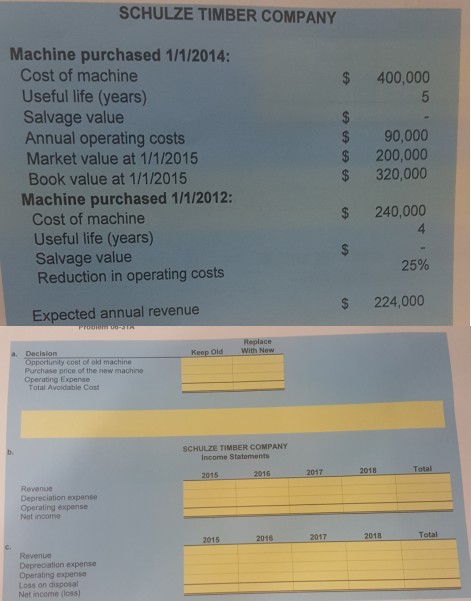

solve please SCHULZE TIMBER COMPANY Machine purchased 1/1/2014: Cost of machine Useful life (years) Salvage value Annual operating costs Market value at 1/1/2015 Book value

solve please

SCHULZE TIMBER COMPANY Machine purchased 1/1/2014: Cost of machine Useful life (years) Salvage value Annual operating costs Market value at 1/1/2015 Book value at 1/1/2015 Machine purchased 1/1/2012: Cost of machine Useful life (years) Salvage value Reduction in operating costs $ 400,000 $ 90,000 $ 200,000 $ 320,000 $ 240,000 4 25% $ 224,000 Expected annual revenue Replace With New Decisiorn Opportunity cost of old machine Purchase price of the new machine Operating Expense Keep Old Total Avoidable Cost b. SCHULZE TIMBER COMPANY Income Statements 2015 2016 2017 2018 Total Revenue Depreciation expense Operating expense Net income 2015 2016 2017 2018 Total Revenue Depreciation expense Loss on disposal Net income (loss) SCHULZE TIMBER COMPANY Machine purchased 1/1/2014: Cost of machine Useful life (years) Salvage value Annual operating costs Market value at 1/1/2015 Book value at 1/1/2015 Machine purchased 1/1/2012: Cost of machine Useful life (years) Salvage value Reduction in operating costs $ 400,000 $ 90,000 $ 200,000 $ 320,000 $ 240,000 4 25% $ 224,000 Expected annual revenue Replace With New Decisiorn Opportunity cost of old machine Purchase price of the new machine Operating Expense Keep Old Total Avoidable Cost b. SCHULZE TIMBER COMPANY Income Statements 2015 2016 2017 2018 Total Revenue Depreciation expense Operating expense Net income 2015 2016 2017 2018 Total Revenue Depreciation expense Loss on disposal Net income (loss)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started