solve

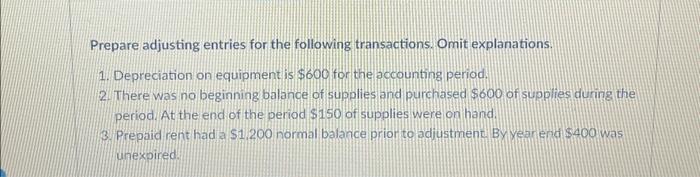

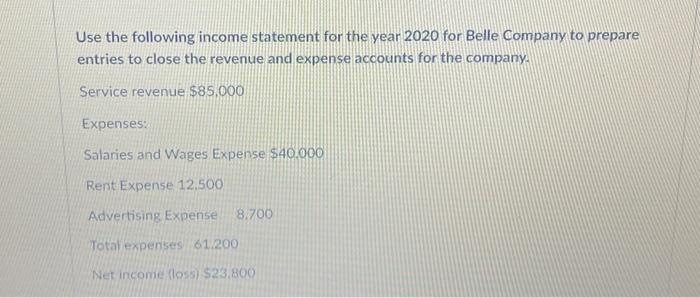

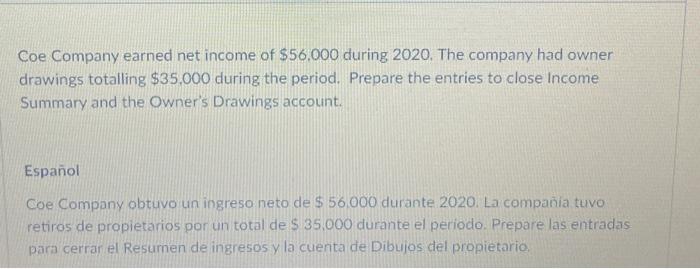

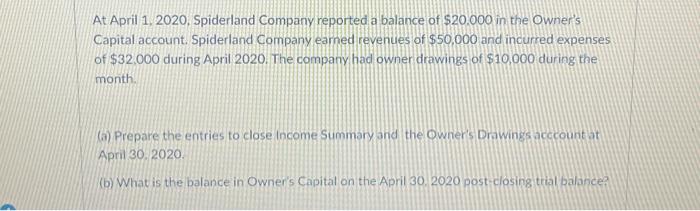

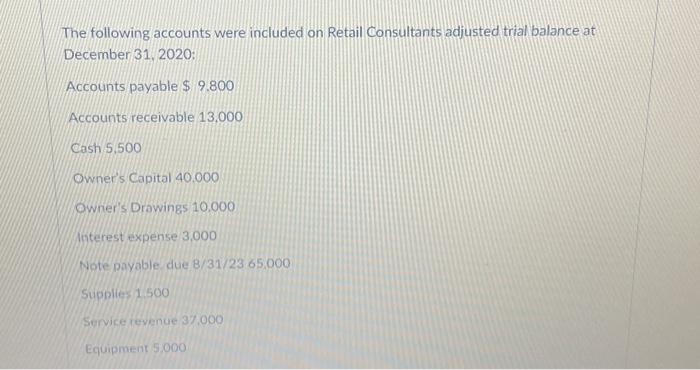

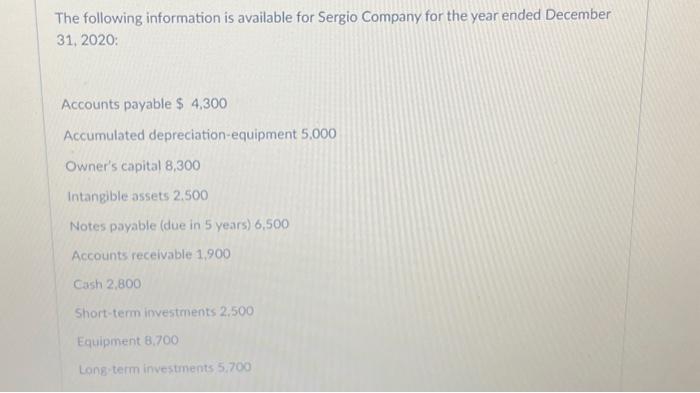

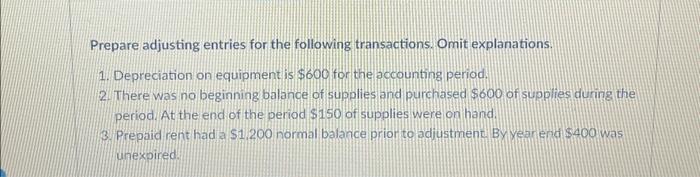

Prepare adjusting entries for the following transactions. Omit explanations. 1. Depreciation on equipment is $600 for the accounting period. 2. There was no beginning balance of supplies and purchased \$600 of supplies during the period. At the end of the period $150 of supplies were on hand. 3. Prepaid rent had a \$1,200 normal balance prior to adjustment. By Year end $400 was unexpired. Use the following income statement for the year 2020 for Belle Company to prepare entries to close the revenue and expense accounts for the company. Service revenue $85,000 Expenses: Salaries and Wages Expense $40,000 Rent Expense 12.500 Advertising Expense 8.700 Total expenses 61.200 Net income (loss) $23,800 Coe Company earned net income of $56.000 during 2020. The company had owner drawings totalling $35.000 during the period. Prepare the entries to close Income Summary and the Owner's Drawings account. Espaol Coe Company obtuvo un ingreso neto de $56,000 durante 2020. La compaia tuvo retiros de propietarios por un total de $35,000 durante el periodo. Prepare las entradas para cerrar el Resurnen de ingresos y la cuenta de Dibujos del propietario. At April 1, 2020, Spiderland Company reported a balance of $20.000 in the Owner's Capital account. Spiderland Company eamed revenues of $50,000 and incurred expenses of $32,000 during April 2020. The company had owner drawings of $10,000 during the month. (a) Prepare the entries to close Income Summary and the Owner's Drawings acccount at Apri 30.2020. (b) What is the balance in Owners Capital on the April 30. 2020 post-closing trial balance? The following accounts were included on Retail Consultants adjusted trial balance at December 31, 2020: Accounts payable $9.800 Accounts receivable 13.000 Cash 5.500 Owner's Capital 40.000 Owner's Drawings 10.000 Anterest expense 3,000 Note payable due 8/31/23.65.000 Supblies 1500 Service revenue 37,000 Equipment 5,000 The following information is available for Sergio Company for the year ended December 31, 2020: Accounts payable $4,300 Accumulated depreciation-equipment 5.000 Owner's capital 8,300 Intangible assets 2.500 Notes payable (due in 5 years) 6,500 Accounts receivable 1,900 Cash 2,800 Short-term investments 2.500 Equipment 8,700 Long-term investments 5,700