Solve, Rs = RRF + Beta(MRP)

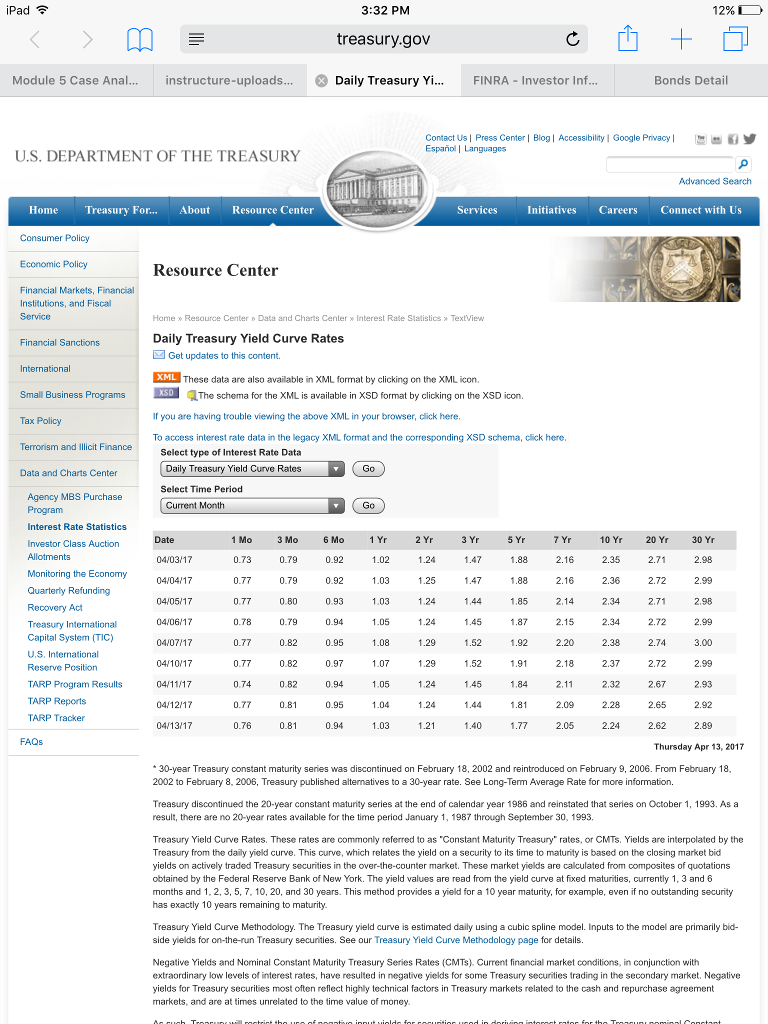

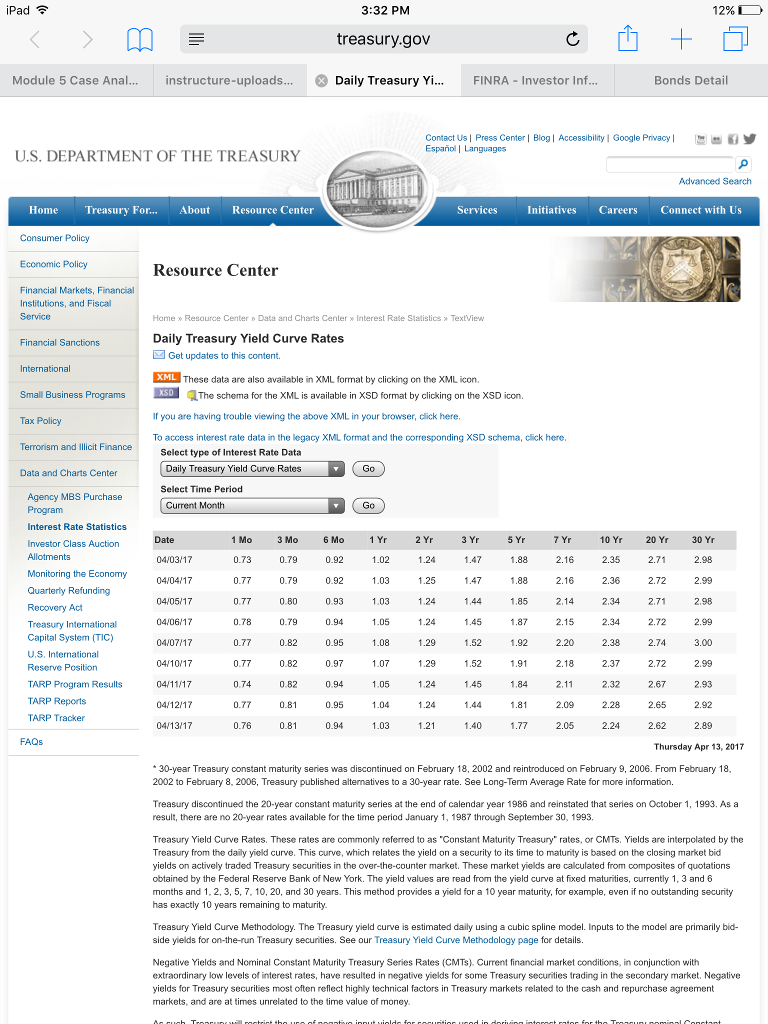

Assumptions: Risk Free Rate is based on U.S. 10 Year Treasury

MRP is based on KPMG estimate where MRP = 6%

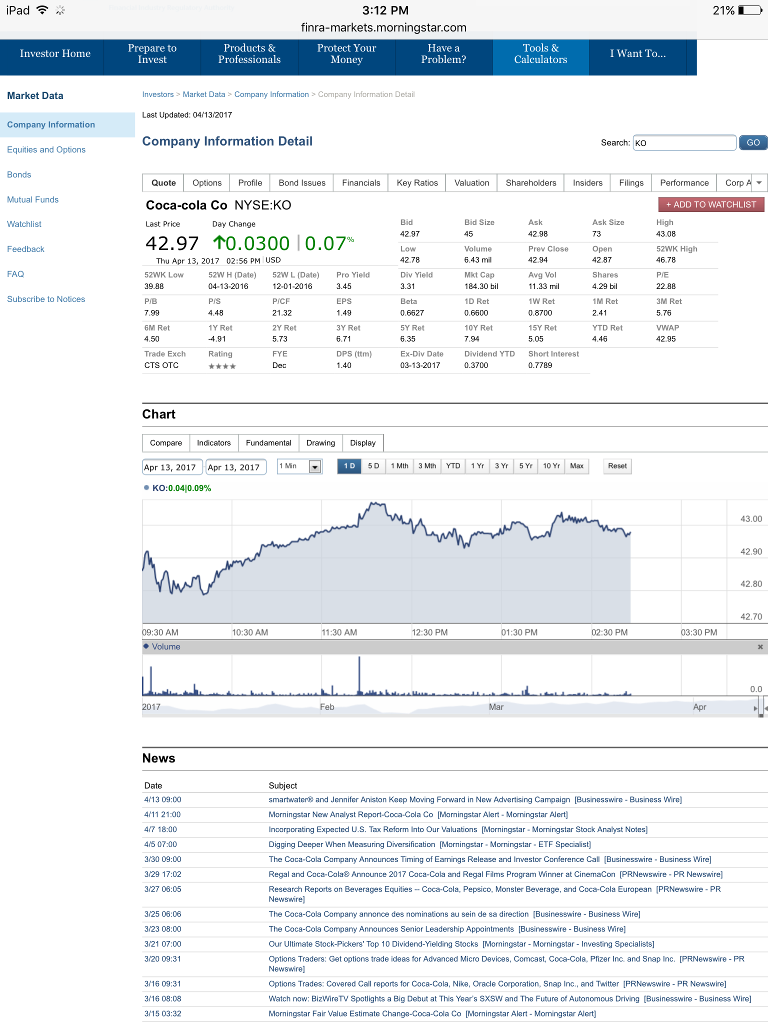

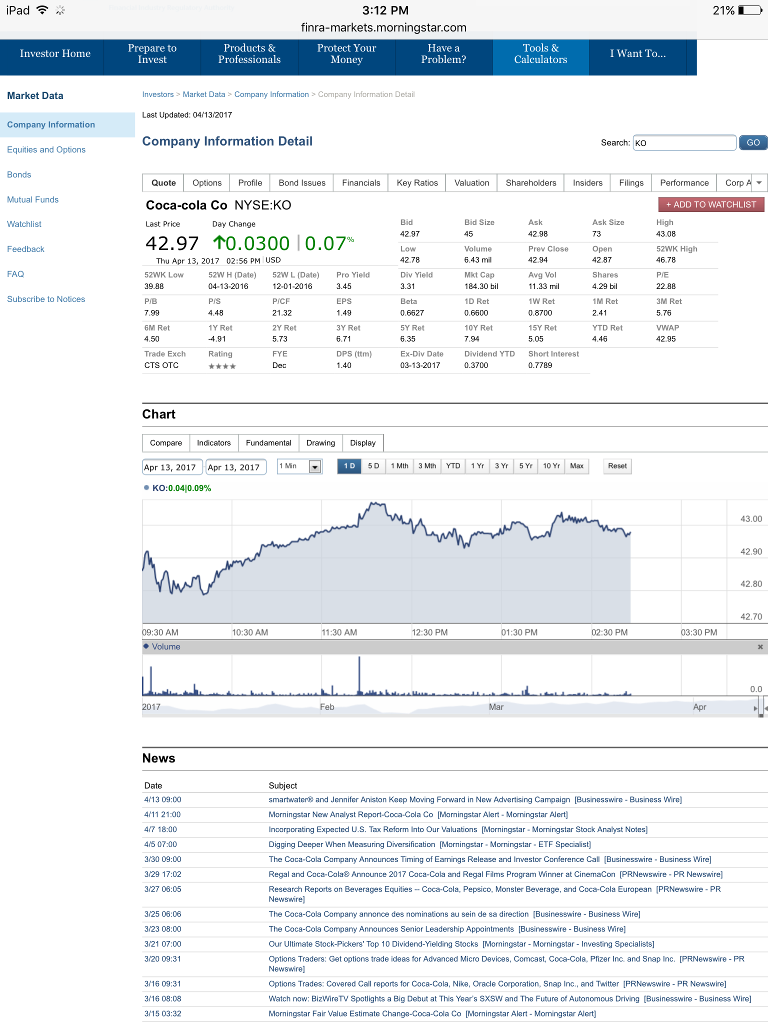

Beta comes from (Quote Tab)

Pad 3:32 PM treasury.gov Module 5 Case Ana nstructure-uploads Daily Treasury Yi nvestor Inf Bonds Deta FINRA Contact Us I Press Center Blog Accessibility I Google Privacy Espanol I Languages U.S. DEPARTMENT OF THE TREASURY Advanced Search Resource Center Services Careers Connect with Us Home Treasury For Abou atives Consume Economic Policy Resource Center Financial Markets, Financial nstitutions, and Fiscal Service Resource Center o Data and Charts Cenle nterest Rate Stat Daily Treasury Yield Curve Rates Financial Sanctions Get updates to this content nternational XML These data are also available in XML format by clicking on the XML icon. DSD a The schema for the xML is available Small Business Programs n XSD format by clicking on the XSD icon. If you are having trouble viewing the above XML in your browser, click here Tax Policy o access interest rate data in he legacy XML format and the corresponding XSD schema, click here Temorism and cit Finance Select type of Interest Rate Data Daily Treasury Yield Curve Rates Go Data and Charts Center Select Time Period Agency MBS Purchase Current Month Go nterest Rate Statistics Mo 3 Mo 6 Mo 2 Y 3 YI 5 Y 7 Yr 10 Yr 20 Yr 30 Yr nvestor Class Auction Allotments 04/03/17 0.73 0.79 0.92 02 1.24 47 88 2.16 2.35 2.7 2.98 Monitoring the Economy 0404 17 0.77 0.79 0.92 03 25 47 88 2.16 2.36 2.72 2.99 Quarterly Refunding 0405 17 0,77 0,80 0.93 03 2.34 2,7 2.98 Recovery Act 04/06/17 0.78 0.79 0.94 05 1.24 .45 87 2.15 2.34 2.72 2.99 reasury International Capital System TIC 0407/17 0.77 0.82 0.95 08 29 52 2.20 2.38 2.74 3.00 U,S, International 04 10/17 0.77 0.82 0.97 07 29 52 2.18 2.37 2.72 2.99 Reserve Position TARP Program Results 04111/17 2.32 2,67 2.93 0,74 0,82 0.94 05 1.24 45 TARP Reports 04/12117 0.77 0.8 0.95 04 1.24 .44. 2.09 2.28 2.65 2.92 TARP Tracker 04/13/17 0.76 0.8 0.94 03 40 2.05 2.24 2.62 2.89 FAQs Thursday Apr 13, 2017 30-year Treasury const series was discon d on February 18, 2002 and reintroduced on February 9, 2006. From February 18. 2002 to February 8, 2006, Treasury published alternati ves to a 30-ye ar rate. See L ong-Tem Average Rate for more info Treasury discontinued the 20-year constant maturity series at the end of calendar year 1986 and reinstated that series on Octo be 993. As a result, there are no 20-year rates available fo he time period January 987 through September 30, 1993 reasury Yield Curve Rates. These rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs, Yields are interpolated by the reasury from the daily yield curve. This curve, which relates the yield on a secu ty to its time to maturity is based on the closing market bid yields on actively traded Treasury securit in the over-the-counte market. These market yield are calculated from composites of quotations obtained by the Federal Reserve Bank of New York. The yield values are read from the yield curve at fixed maturiti ly 1, 3 and months and 1, 2, 3, 5, 7. 10 20, and 30 years. This method provides a yield for a 10 year maturity, for example, even if no outstanding secu has exactly 10 years remaining to maturity. Treasury Yield Curve Methodology. The Treasury yield curve is estimated daily using a cubic spline model. In puts to the model are primarily bid- side yields for on-the-run Treasury securities. See ou Treasury Yield Curve Methodology page for details Negative Yields and Nominal Constant Maturity Treasury Series Rates (CMTs) Current financial market conditions, in conjunction with extraordinary low levels of interest rates, have resulted in negative yields for some Treasury securities trading in the secondary market. Negative yields for Treasury securities most often reflect highly technical factors in Treasury markets related to the cash and repurchase agreement markets, and are a mes unrelated to the time value of money