Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve the above problem please. Thank you so much!!!!!!!! Duet Entertainment Corporation (DEC) sells multimedia presentation systems in Hong Kong. (a) The following are six

Solve the above problem please. Thank you so much!!!!!!!!

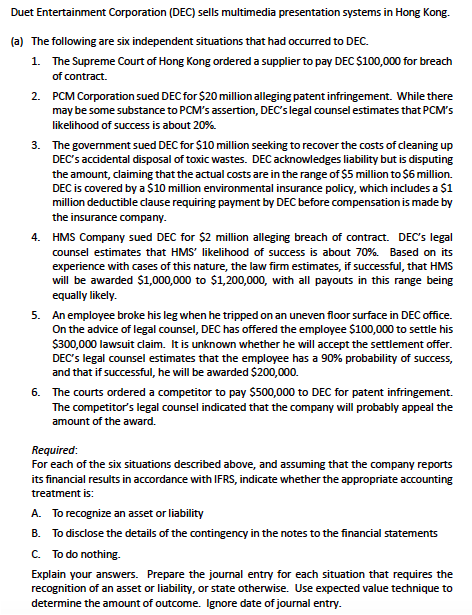

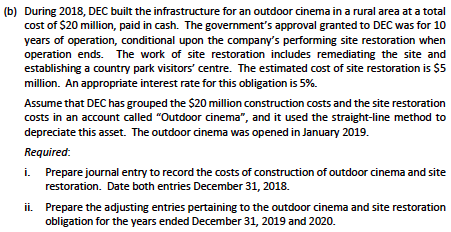

Duet Entertainment Corporation (DEC) sells multimedia presentation systems in Hong Kong. (a) The following are six independent situations that had occurred to DEC. The Supreme Court of Hong Kong ordered a supplier to pay DEC $100,000 for breach of contract. 1. 2. PCM Corporation sued DECfor $20 million alleging patent infringement. While there may be some substance to PCM's assertion, DEC'slegal counsel estimates that PCM's likelihood of success is about 20%. 3. The government sued DEC for $10 million seeking to recover the costs of cleaning up DEC's accidental disposal of toxic wastes. DECacknowledges liability but is disputing the amount, claiming that the actual costs are in the range of $5 million to $6 million. DEC is covered by a $10 million environmental insurance policy, which includes a $1 million deductible clause requiring payment by DEC before compensation is made by the insurance company HMS Company sued DEC for $2 million alleging breach of contract. DEC's legal counsel estimates that HMS' likelihood of success is about 70%. Based on its experience with cases of this nature, the law firm estimates, if successful, that HMS will be awarded $1,000,000 to $1,200,000, with all payouts in this range being equally likely. An employee broke his leg when he tripped on an uneven floor surface in DEC office. On the advice of legal counsel, DEC has offered the employee $100,000 to settle his $300,000 lawsuit claim. It is unknown whether he will accept the settlement offer. DEC's legal counsel estimates that the employee has a 90% probability of success, and that if successful, he will be awarded $200,000. The courts ordered a competitor to pay $500,000 to DEC for patent infringement. The competitor's legal counsel indicated that the company will probably appeal the amount of the award. 4. 5. 6. Required: For each of the six situations described above, and assuming that the company reports its financial results in accordance with IFRS, indicate whether the appropriate accounting treatment is: A. To recognize an asset or liability To disclose the details of the contingency in the notes to the financial statements B. C. To do nothing. Explain your answers. Prepare the journal entry for each situation that requires the recognition of an asset or liability, or state otherwise. Use expected value technique to determine the amount of outcome. Ignore date of journal entry (b) During 2018, DEC built the infrastructure for an outdoor cinema in a rural area at a total cost of $20 million, paid in cash. The government's approval granted to DEC was for 10 years of operation, conditional upon the company's performing site restoration when operation ends. The work of site restoration includes remediating the site and establishing a country park visitors' centre. The estimated cost of site restoration is $5 million. An appropriate interest rate for this obligation is 5%. Assume that DEC has grouped the $20 million construction costs and the site restoration costs in an account called "Outdoor cinema", and it used the straight-line method to depreciate this asset. The outdoor cinema was opened in January 2019. Required: i. Prepare journal entry to record the costs of construction of outdoor cinema and site restoration. Date both entries December 31, 2018. ii. Prepare the adjusting entries pertaining to the outdoor cinema and site restoration obligation for the years ended December 31, 2019 and 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started