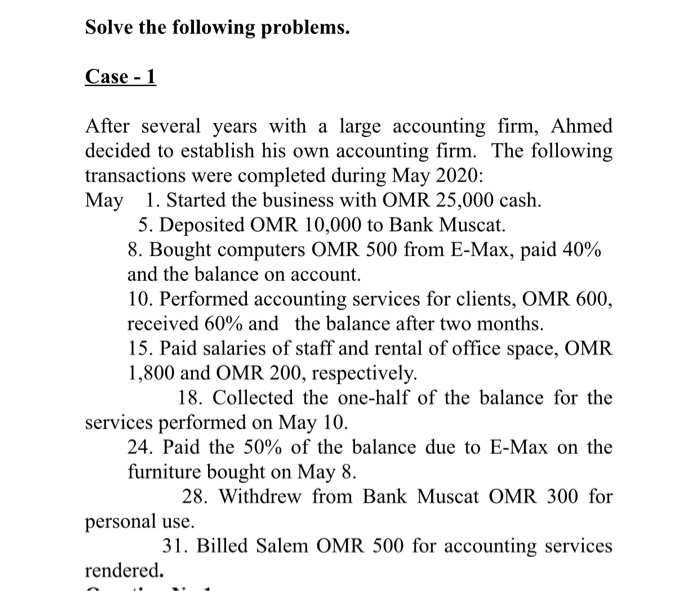

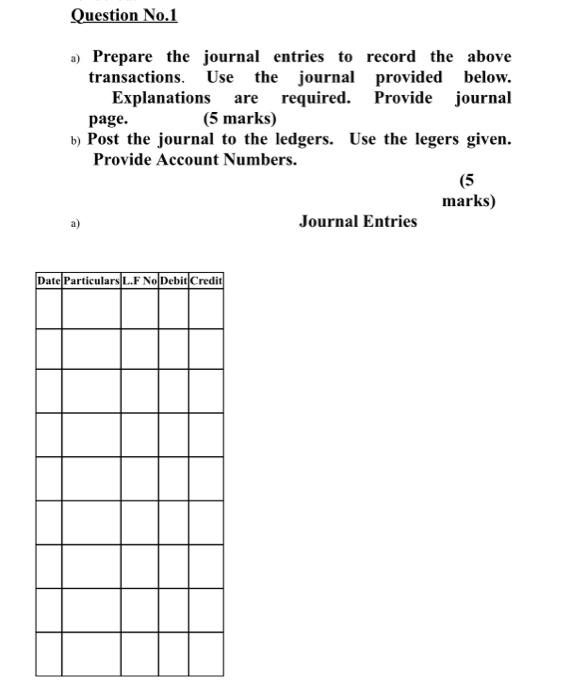

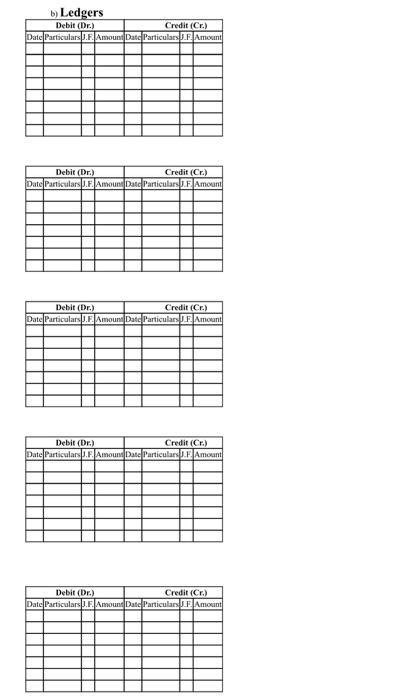

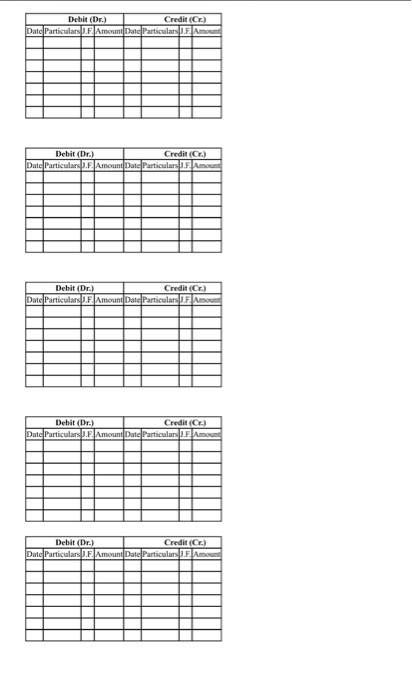

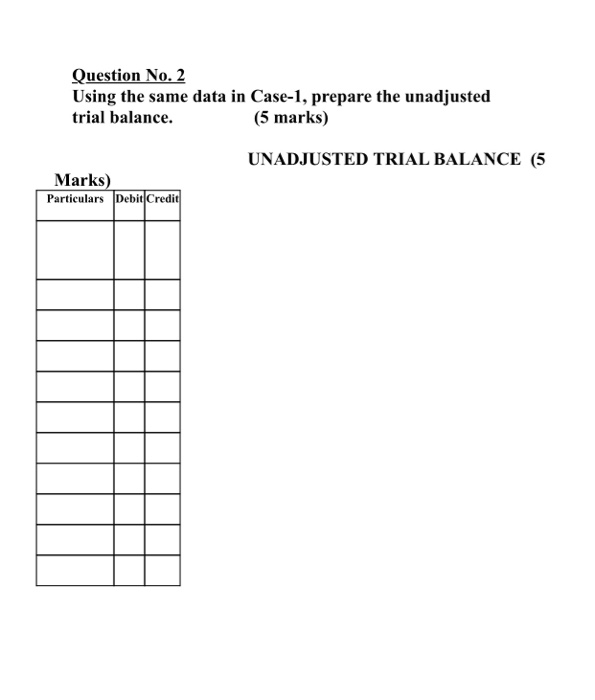

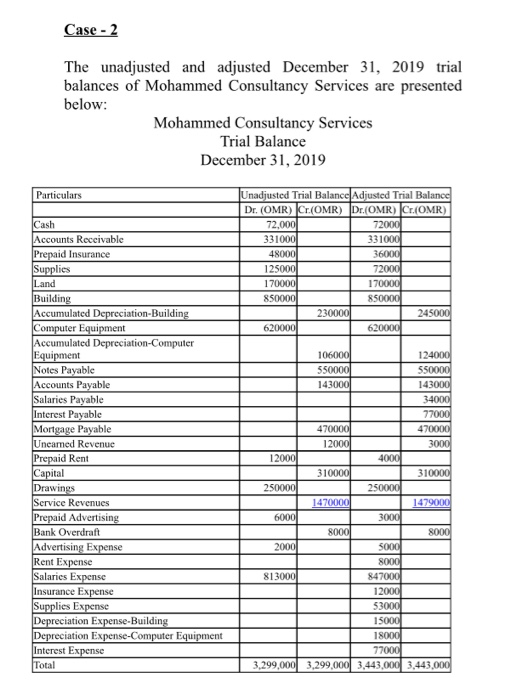

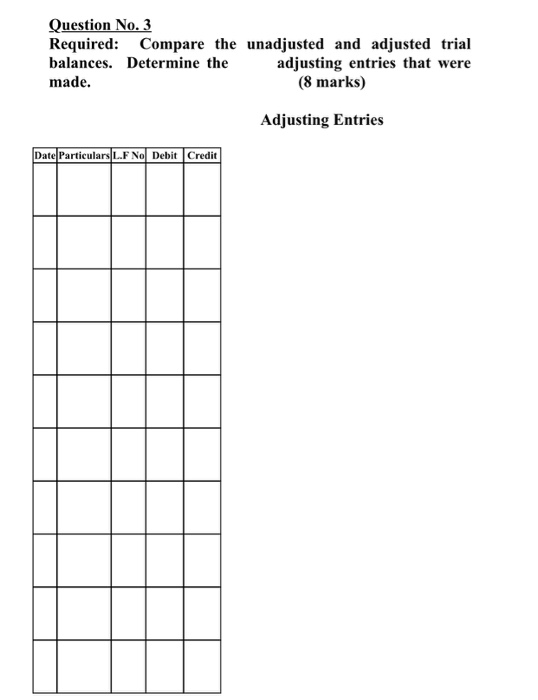

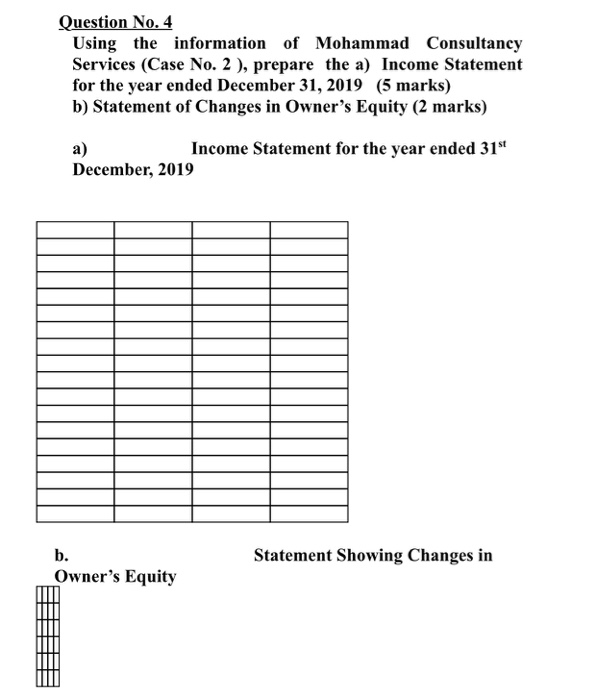

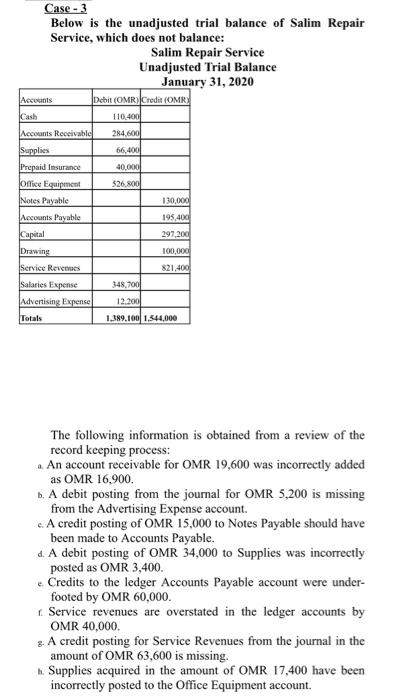

Solve the following problems. Case - 1 After several years with a large accounting firm, Ahmed decided to establish his own accounting firm. The following transactions were completed during May 2020: May 1. Started the business with OMR 25,000 cash. 5. Deposited OMR 10,000 to Bank Muscat. 8. Bought computers OMR 500 from E-Max, paid 40% and the balance on account. 10. Performed accounting services for clients, OMR 600, received 60% and the balance after two months. 15. Paid salaries of staff and rental of office space, OMR 1,800 and OMR 200, respectively. 18. Collected the one-half of the balance for the services performed on May 10. 24. Paid the 50% of the balance due to E-Max on the furniture bought on May 8. 28. Withdrew from Bank Muscat OMR 300 for personal use. 31. Billed Salem OMR 500 for accounting services rendered. Question No.1 a) Prepare the journal entries to record the above transactions. Use the journal provided below. Explanations are required. Provide journal page. (5 marks) b) Post the journal to the ledgers. Use the legers given. Provide Account Numbers. (5 marks) Journal Entries Date Particulars L.F NoDebit Credit b) Ledgers Debit (Dr.) Credit (Cr.) Date Particulars J.F.Amount Date Particulars JF Amount Debit (Dr.) Credit (Cr.) Date Particulars.F. Amount Date Particulars JF Amount Debit (Dr.) Credit (Cr.) Date Particulars .F. Amount Date Particulars JF Amount Debit (Dr.) Credit (Cr.) Date Particulars.F.Amount Datc Particulars JF Amount Debit (Dr.) Credit (Cr.) Date Particulars J.F. Amount Date Particulars JF. Amount Debit (Dr.) Credit (CE) Datc Particulars. Amount Date Particulars JF Amount Debit (Dr.) Credit (Cr.) Date Particulars J.F. Amount Date Particulars JF Amon Debit (Dr.) Credit (CE) Date Particulars JF. Amount Date Particulars JF Amount Debit (Dr.) Credit (C) Date Particulars J.F. Amount Date Particulars El Amor Debit (Dr.) Credit (C) Date Particulars J.F.Amount Date Particulars E Am Question No. 2 Using the same data in Case-1, prepare the unadjusted trial balance. (5 marks) UNADJUSTED TRIAL BALANCE (5 Marks) Particulars Debit Credit Case - 2 The unadjusted and adjusted December 31, 2019 trial balances of Mohammed Consultancy Services are presented below: Mohammed Consultancy Services Trial Balance December 31, 2019 Particulars Unadjusted Trial Balance Adjusted Trial Balance Dr. (OMR) Cr.(OMR) Dr.(OMR) Cr.(OMR) 72,000 72000 331000 331000 48000 36000 125000 72000 170000 170000 8500001 850000 230000 245000 620000 620000 Cash Accounts Receivable Prepaid Insurance Supplies Land Building Accumulated Depreciation-Building Computer Equipment Accumulated Depreciation-Computer Equipment Notes Payable Accounts Payable Salaries Payable Interest Payable Mortgage Payable Uneamed Revenue Prepaid Rent Capital Drawings Service Revenues Prepaid Advertising Bank Overdraft Advertising Expense Rent Expense Salaries Expense Insurance Expense Supplies Expense Depreciation Expense-Building Depreciation Expense-Computer Equipment Interest Expense Total 1060001 124000 5500001 550000 143000 143000 34000 77000 4700001 470000 12000 3000 12000 4000 310000 310000 250000 250000 1470000 1479000 6000 3000 8000 8000 2000 5000 8000 813000 847000 12000 53000 15000 18000 77000 3,299,000 3,299,000 3,443,000 3,443,000 Question No. 3 Required: Compare the unadjusted and adjusted trial balances. Determine the adjusting entries that were made. (8 marks) Adjusting Entries Date Particulars L.F No Debit Credit Question No.4 Using the information of Mohammad Consultancy Services (Case No. 2 ), prepare the a) Income Statement for the year ended December 31, 2019 (5 marks) b) Statement of Changes in Owner's Equity (2 marks) a) Income Statement for the year ended 31s December, 2019 b. Owner's Equity Statement Showing Changes in Question No. 5 Using the information of Mohammad Consultancy Services (Case No. 2), prepare the Statement of Financial Position or Balance Sheet as of December 31, 2019. (10 Marks) Statement of Financial Position as at 31" December, 2019 Case - 3 Below is the unadjusted trial balance of Salim Repair Service, which does not balance: Salim Repair Service Unadjusted Trial Balance January 31, 2020 Accounts Debit (OMR) Credit (OMR) Cash 110.400 284,600 66,400 40.000 $26.800 Accounts Receivable Supplies Prepaid Insurance Office Equipment Notes Payable Accounts Payable Capital Drawing Service Revenues salaries Expense Advertising Expense 130,000 195,400 297,200 100,000 821,400 348.700 12.200 Totals 1,389.100 1.544,000 The following information is obtained from a review of the record keeping process: . An account receivable for OMR 19,600 was incorrectly added as OMR 16,900. b. A debit posting from the journal for OMR 5,200 is missing from the Advertising Expense account. . A credit posting of OMR 15,000 to Notes Payable should have been made to Accounts Payable. d. A debit posting of OMR 34,000 to Supplies was incorrectly posted as OMR 3,400. Credits to the ledger Accounts Payable account were under- footed by OMR 60,000 1. Service revenues are overstated in the ledger accounts by OMR 40,000 3. A credit posting for Service Revenues from the journal in the amount of OMR 63,600 is missing. h. Supplies acquired in the amount of OMR 17,400 have been incorrectly posted to the Office Equipment account. Question No. 6 Required: a trial balance. Prepare corrected (10 marks) TRIAL BALANCE Particulars Debit/Credit -ALL THE BEST