Answered step by step

Verified Expert Solution

Question

1 Approved Answer

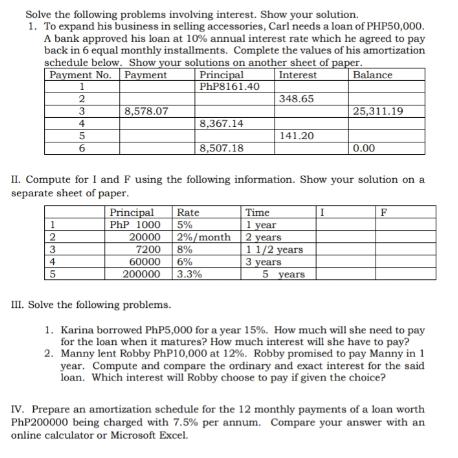

Solve the following problems involving interest. Show your solution. 1. To expand his business in selling accessories, Carl needs a loan of PHP50,000. A

Solve the following problems involving interest. Show your solution. 1. To expand his business in selling accessories, Carl needs a loan of PHP50,000. A bank approved his loan at 10% annual interest rate which he agreed to pay back in 6 equal monthly installments. Complete the values of his amortization schedule below. Show your solutions on another sheet of paper. Payment No. Payment Interest 1 2 1 3 4 5 123 2 3 4 5 6 8,578.07 Principal PhP 1000 20000 Principal PhP8161.40 8,367.14 8,507.18 200000 II. Compute for I and F using the following information. Show your solution on a separate sheet of paper. Rate 5% 2%/month 7200 8% 60000 6% 348.65 3.3% 141.20 Time 1 year 2 years 1 1/2 years 3 years 5 years Balance I 25,311.19 0.00 F III. Solve the following problems. 1. Karina borrowed PhP5,000 for a year 15% . How much will she need to pay for the loan when it matures? How much interest will she have to pay? 2. Manny lent Robby PhP10,000 at 12%. Robby promised to pay Manny in 1 year. Compute and compare the ordinary and exact interest for the said loan. Which interest will Robby choose to pay if given the choice? IV. Prepare an amortization schedule for the 12 monthly payments of a loan worth PhP200000 being charged with 7.5% per annum. Compare your answer with an online calculator or Microsoft Excel.

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The image contains several questions related to solving problems involving simple interest Lets tackle them one by one I To expand his business in sel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started